GBPUSDX Trading Predictions

1 Day Prediction

Target: April 11, 2025$1.28

$1.28

$1.285

$1.275

Description

The recent bullish momentum suggests a potential continuation, with the last close at 1.281788. The MACD is showing a bullish crossover, and RSI is near 60, indicating strength. However, volatility remains high, which could lead to fluctuations.

Analysis

Over the past 3 months, GBPUSD has shown a bearish trend with significant support around 0.764100 and resistance near 1.282117. Recent bullish movements indicate a potential reversal, but the market remains volatile. Technical indicators like MACD and RSI suggest upward momentum, while volume patterns show low activity.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or geopolitical events, which may impact the predicted price.

1 Week Prediction

Target: April 18, 2025$1.275

$1.278

$1.28

$1.27

Description

Expect a slight pullback as the market consolidates after recent gains. The RSI is approaching overbought levels, suggesting a potential correction. Support at 1.270000 may hold, but bearish sentiment could emerge if economic data disappoints.

Analysis

The past 3 months have seen fluctuating prices with a recent bullish spike. Key resistance levels are being tested, and while the trend is upward, the potential for a pullback exists. Volume has been low, indicating a lack of strong conviction in the current trend.

Confidence Level

Potential Risks

Economic indicators and geopolitical tensions could lead to unexpected volatility, impacting the price direction.

1 Month Prediction

Target: May 10, 2025$1.26

$1.265

$1.27

$1.25

Description

A bearish outlook is anticipated as the market may face resistance at higher levels. The recent highs may not be sustainable, and economic data could trigger a downward trend. Watch for support at 1.250000.

Analysis

The overall trend has been bearish with recent fluctuations. Key support levels are being tested, and the market sentiment is mixed. Technical indicators suggest potential weakness ahead, with the possibility of a downward trend if economic conditions worsen.

Confidence Level

Potential Risks

Unforeseen economic events or changes in market sentiment could lead to significant deviations from this prediction.

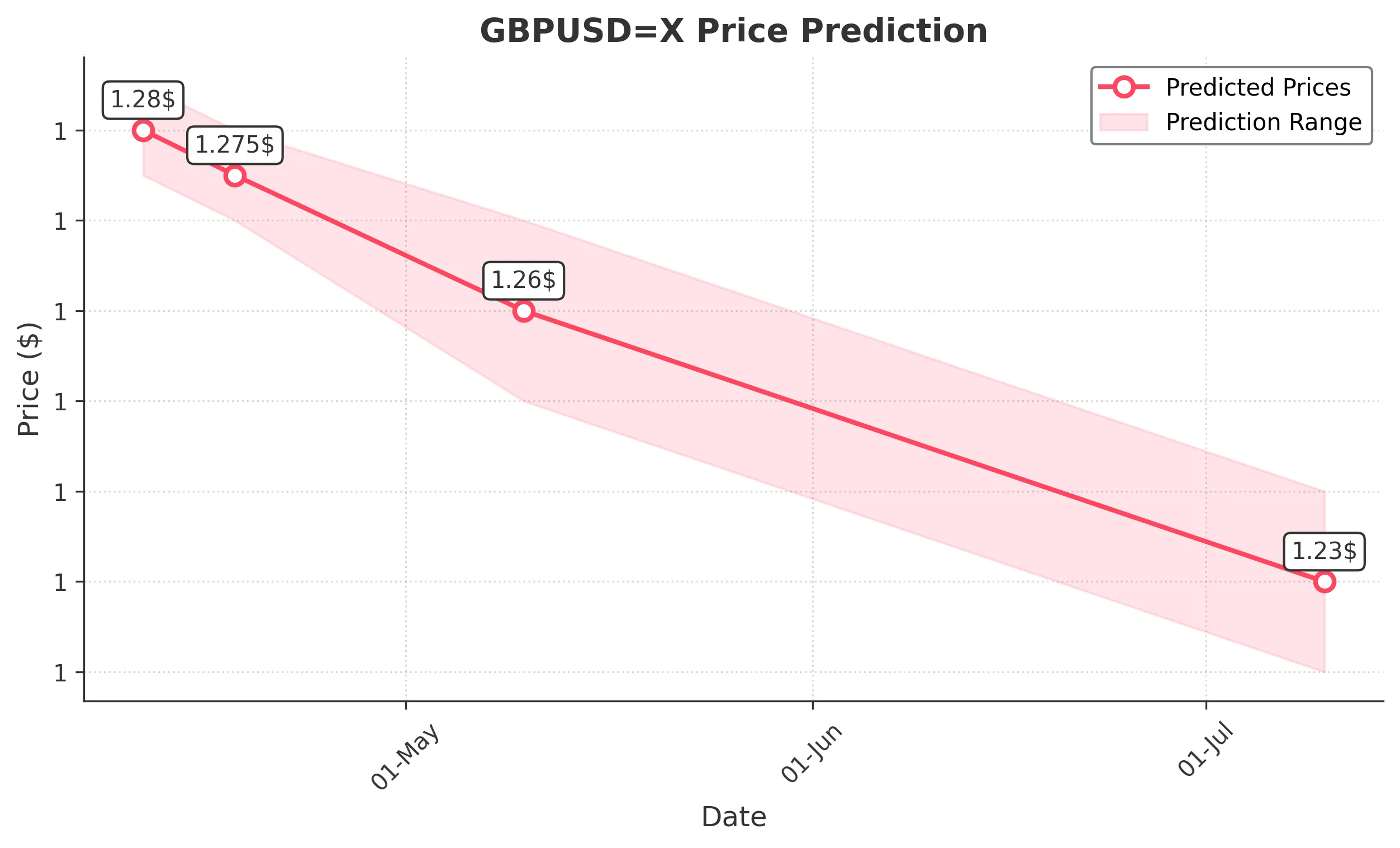

3 Months Prediction

Target: July 10, 2025$1.23

$1.235

$1.24

$1.22

Description

Long-term bearish sentiment is expected as economic pressures may weigh on the GBP. The market could test lower support levels, with potential for further declines if macroeconomic indicators remain unfavorable.

Analysis

The past 3 months have shown a bearish trend with significant resistance levels. The market is influenced by macroeconomic factors, and while there are short-term bullish signals, the long-term outlook remains cautious. Key support levels will be critical in determining future price action.

Confidence Level

Potential Risks

Market volatility and external economic factors could significantly alter this prediction, leading to unexpected price movements.