GBPUSDX Trading Predictions

1 Day Prediction

Target: April 13, 2025$1.305

$1.304

$1.31

$1.3

Description

The price is expected to stabilize around 1.305 due to recent bullish momentum. The RSI indicates overbought conditions, suggesting a potential pullback. However, support at 1.300 may hold, limiting downside risk.

Analysis

The past 3 months show a bullish trend with significant resistance around 1.310. Recent price action indicates a consolidation phase. The MACD is bullish, but the RSI suggests caution due to overbought conditions.

Confidence Level

Potential Risks

Potential volatility due to macroeconomic news could impact the prediction.

1 Week Prediction

Target: April 20, 2025$1.31

$1.305

$1.315

$1.295

Description

Expecting a slight upward trend as the market digests recent gains. The Bollinger Bands indicate potential for a breakout, but the RSI suggests a correction could occur. Watch for support at 1.295.

Analysis

The stock has shown resilience with a bullish trend. Key support at 1.295 and resistance at 1.310. Volume has been low, indicating a lack of conviction in the current price levels.

Confidence Level

Potential Risks

Market sentiment could shift rapidly based on economic data releases.

1 Month Prediction

Target: May 12, 2025$1.32

$1.31

$1.325

$1.3

Description

A bullish outlook for the month ahead, driven by positive market sentiment and potential economic recovery signals. However, the RSI indicates overbought conditions, suggesting a possible pullback.

Analysis

The trend remains bullish, with a strong upward movement observed. Key resistance at 1.320 and support at 1.300. The MACD is bullish, but caution is advised due to potential overextension.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could lead to unexpected volatility.

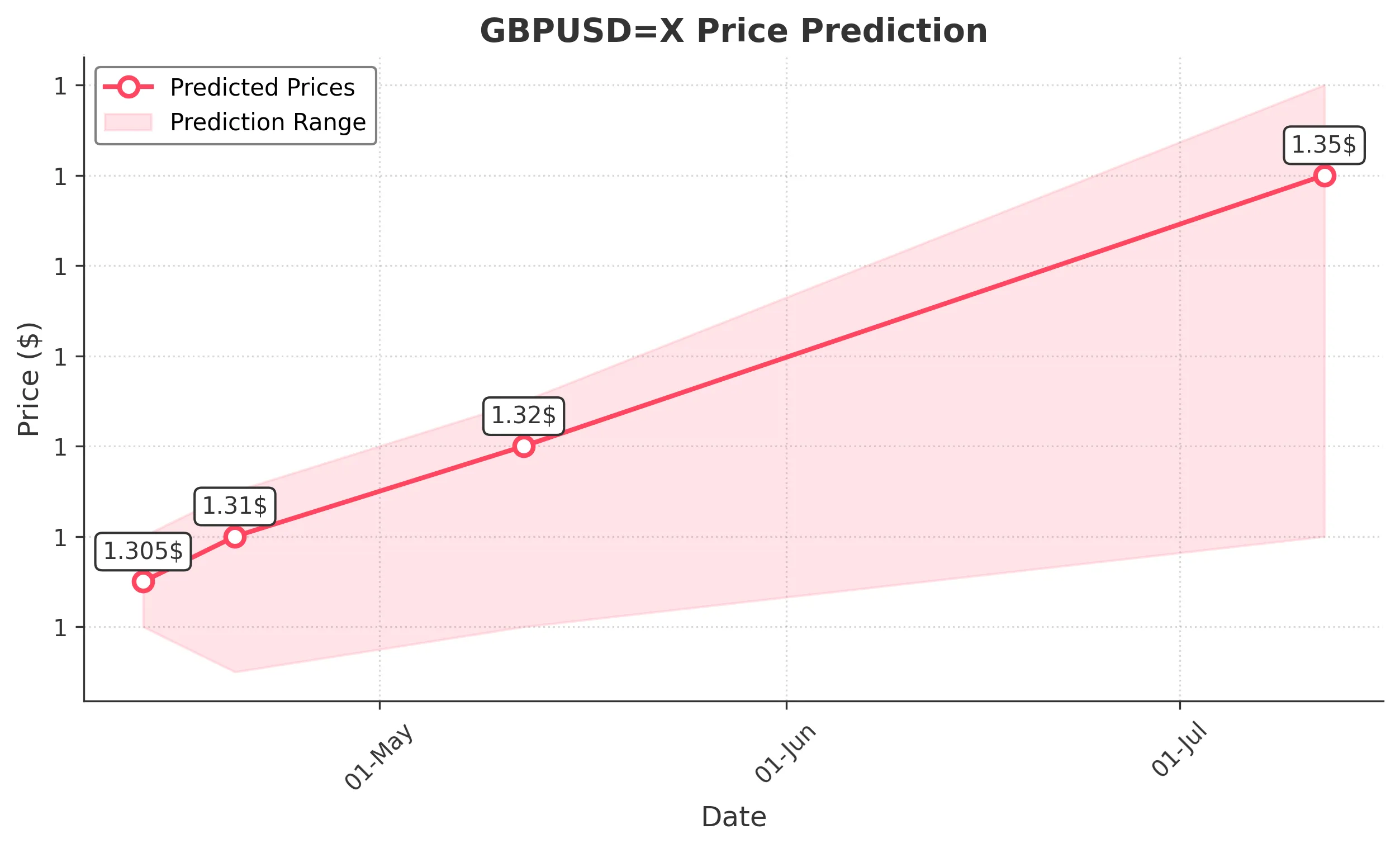

3 Months Prediction

Target: July 12, 2025$1.35

$1.32

$1.36

$1.31

Description

Long-term bullish sentiment expected as economic recovery continues. However, potential resistance at 1.350 may lead to volatility. Watch for macroeconomic developments that could impact the trend.

Analysis

The overall trend is bullish, but the market may face headwinds from economic data and geopolitical tensions. Key support at 1.310 and resistance at 1.350. The ATR indicates increasing volatility.

Confidence Level

Potential Risks

Long-term predictions are subject to significant uncertainty due to external factors.