GBPUSDX Trading Predictions

1 Day Prediction

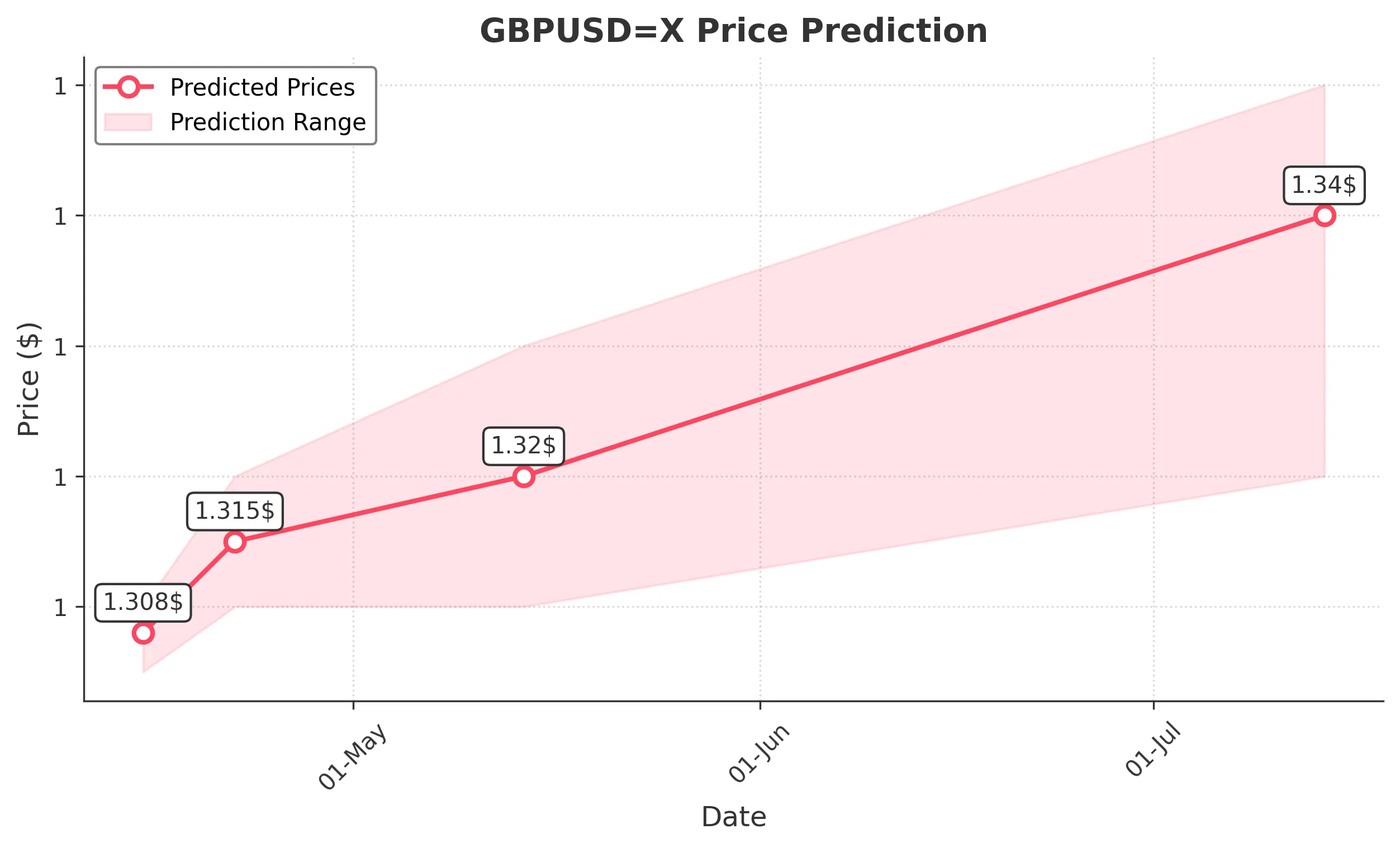

Target: April 15, 2025$1.308

$1.307

$1.31

$1.305

Description

The price is expected to stabilize around 1.308 due to recent bullish momentum. The RSI is neutral, and MACD shows a slight bullish crossover. However, the market sentiment is cautious, which may limit upside potential.

Analysis

The GBPUSD has shown a bullish trend recently, with key support at 1.2900 and resistance around 1.3100. The moving averages indicate a bullish crossover, but the RSI is approaching overbought territory, suggesting caution.

Confidence Level

Potential Risks

Potential for volatility due to macroeconomic news or geopolitical events could impact the prediction.

1 Week Prediction

Target: April 22, 2025$1.315

$1.312

$1.32

$1.31

Description

Expecting a gradual rise to 1.315 as bullish sentiment persists. The MACD remains positive, and the price is above the 50-day moving average, indicating strength. However, watch for potential pullbacks.

Analysis

The GBPUSD has been trending upward, with strong support at 1.3000. The recent price action shows bullish candlestick patterns, but the market remains sensitive to external economic factors, which could introduce volatility.

Confidence Level

Potential Risks

Market reactions to economic data releases could lead to unexpected volatility.

1 Month Prediction

Target: May 14, 2025$1.32

$1.315

$1.33

$1.31

Description

The price is projected to reach 1.320 as the bullish trend continues. The Fibonacci retracement levels support this upward movement, but overbought conditions may lead to corrections.

Analysis

The GBPUSD has shown a bullish trend with significant resistance at 1.3300. The market is currently in a bullish phase, but the RSI indicates potential overbought conditions, suggesting a risk of pullbacks.

Confidence Level

Potential Risks

Economic indicators and geopolitical tensions could reverse the trend unexpectedly.

3 Months Prediction

Target: July 14, 2025$1.34

$1.335

$1.35

$1.32

Description

Long-term outlook suggests a rise to 1.340, supported by bullish fundamentals. However, external economic pressures could create volatility.

Analysis

The GBPUSD has been on a bullish trajectory, with key support at 1.3100. The market sentiment is cautiously optimistic, but potential economic disruptions could impact the upward trend. The ATR indicates increasing volatility.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant deviations from this prediction.