GBPUSDX Trading Predictions

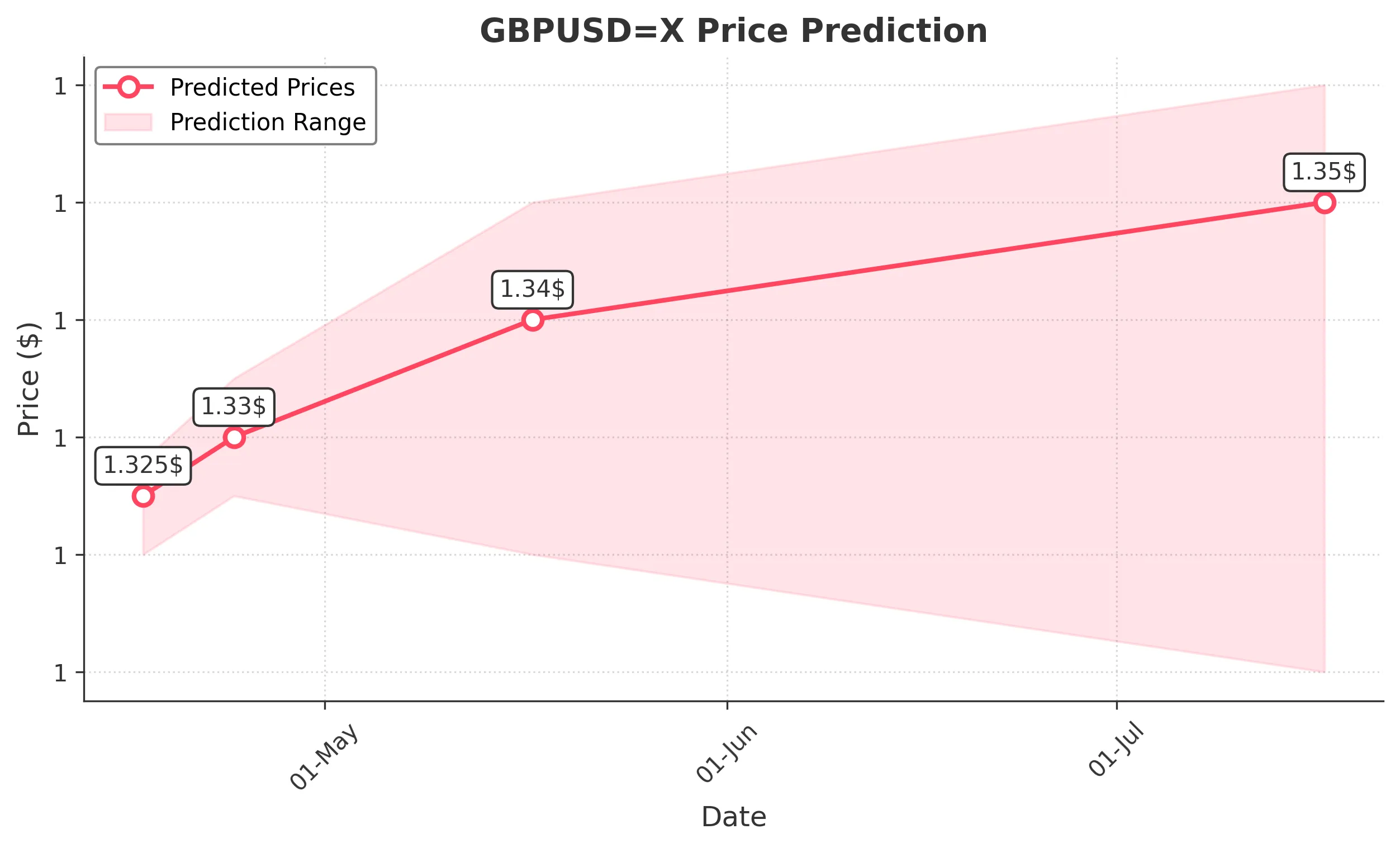

1 Day Prediction

Target: April 17, 2025$1.325

$1.324

$1.328

$1.32

Description

The recent bullish trend, supported by a strong MACD crossover and RSI indicating upward momentum, suggests a potential rise. However, resistance at 1.328 may limit gains.

Analysis

The GBPUSD has shown a bullish trend over the past three months, with significant support at 1.2900 and resistance around 1.3300. The MACD is bullish, and RSI is approaching overbought levels, indicating potential for a pullback.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the prediction.

1 Week Prediction

Target: April 24, 2025$1.33

$1.326

$1.335

$1.325

Description

Continued bullish sentiment and a potential breakout above 1.328 could drive prices higher. However, overbought conditions may lead to a correction.

Analysis

The GBPUSD has maintained a bullish trend, with key support at 1.2900. The recent price action suggests a possible breakout above resistance levels, but caution is warranted due to high RSI readings.

Confidence Level

Potential Risks

Potential geopolitical events or economic data releases could create volatility.

1 Month Prediction

Target: May 17, 2025$1.34

$1.33

$1.35

$1.32

Description

If the bullish trend continues, we may see prices reaching 1.3400. However, the market's overbought condition could lead to a pullback.

Analysis

The GBPUSD has shown resilience, with a bullish trend supported by strong economic data. However, the potential for a correction exists, especially if resistance levels hold.

Confidence Level

Potential Risks

Economic indicators and central bank policies could shift market sentiment.

3 Months Prediction

Target: July 17, 2025$1.35

$1.34

$1.36

$1.31

Description

Long-term bullish sentiment may push prices to 1.3500, but significant resistance and potential economic shifts could lead to volatility.

Analysis

The GBPUSD has been in a bullish phase, but with increasing volatility and potential resistance at higher levels, the outlook remains uncertain. Economic data and geopolitical factors will play a crucial role.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could drastically alter the outlook.