GBPUSDX Trading Predictions

1 Day Prediction

Target: April 19, 2025$1.327

$1.3265

$1.33

$1.325

Description

The price is expected to rise slightly due to bullish momentum indicated by recent candlestick patterns and a positive MACD crossover. However, resistance at 1.3300 may limit gains.

Analysis

The past 3 months show a bullish trend with significant support at 1.2900 and resistance around 1.3300. The RSI indicates overbought conditions, suggesting caution. Volume has been stable, but spikes could indicate reversals.

Confidence Level

Potential Risks

Potential volatility from macroeconomic news could impact the prediction.

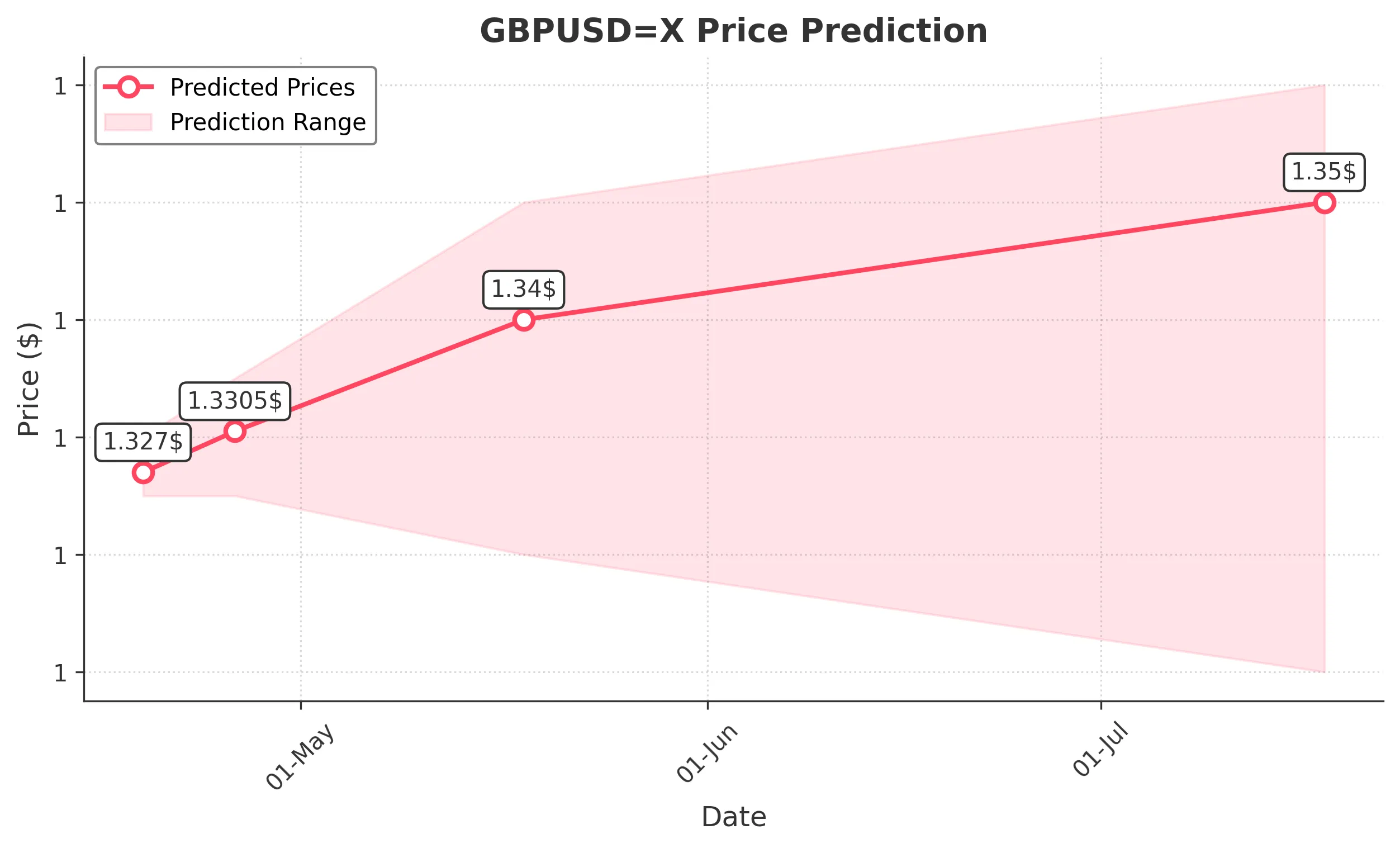

1 Week Prediction

Target: April 26, 2025$1.3305

$1.328

$1.335

$1.325

Description

A continued bullish trend is anticipated, supported by a strong MACD and RSI. However, the market may face resistance at 1.3350, which could lead to a pullback.

Analysis

The stock has shown resilience with a bullish trend. Key support at 1.2900 remains intact, while resistance at 1.3350 is a critical level to watch. The ATR indicates moderate volatility, suggesting potential price swings.

Confidence Level

Potential Risks

Market sentiment could shift due to geopolitical events or economic data releases.

1 Month Prediction

Target: May 18, 2025$1.34

$1.33

$1.35

$1.32

Description

The bullish trend is expected to continue, with potential for a breakout above 1.3350. However, overbought conditions may lead to corrections.

Analysis

The overall trend remains bullish, with significant support at 1.2900. The RSI is approaching overbought territory, indicating a possible correction. Volume patterns suggest healthy buying interest, but caution is warranted.

Confidence Level

Potential Risks

Economic indicators and central bank policies could introduce volatility.

3 Months Prediction

Target: July 18, 2025$1.35

$1.34

$1.36

$1.31

Description

Long-term bullish sentiment is expected, but potential resistance at 1.3600 may lead to a consolidation phase. Market sentiment and macroeconomic factors will play a crucial role.

Analysis

The stock has shown a strong upward trend, with key support at 1.2900 and resistance at 1.3600. The MACD indicates bullish momentum, but the RSI suggests caution due to overbought conditions. Volume trends are stable, but external factors could introduce volatility.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could impact the forecast.