GBPUSDX Trading Predictions

1 Day Prediction

Target: April 24, 2025$1.325

$1.324

$1.33

$1.32

Description

The recent price action shows a slight bearish trend with a potential reversal. The RSI is approaching overbought levels, indicating a possible pullback. The MACD is showing signs of divergence, suggesting weakening momentum. Expect a close around 1.325.

Analysis

Over the past three months, GBPUSD has shown a bullish trend with significant resistance around 1.3400. Recent candlestick patterns indicate indecision, and the ATR suggests increasing volatility. The market sentiment is mixed, influenced by macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction. A sudden shift in sentiment may lead to unexpected price movements.

1 Week Prediction

Target: May 1, 2025$1.32

$1.315

$1.325

$1.31

Description

Expect a slight decline as the market consolidates. The Bollinger Bands are tightening, indicating reduced volatility. The recent bearish candlestick patterns suggest a potential downward move. A close around 1.320 is likely.

Analysis

The past three months have seen a bullish trend, but recent price action indicates a potential reversal. Key support is at 1.3100, while resistance remains at 1.3400. Volume has been decreasing, suggesting a lack of conviction in the current trend.

Confidence Level

Potential Risks

Unforeseen economic data releases or geopolitical events could lead to significant price fluctuations.

1 Month Prediction

Target: June 1, 2025$1.31

$1.315

$1.32

$1.3

Description

A bearish outlook is anticipated as the market may continue to correct. The Fibonacci retracement levels indicate potential support at 1.3000. The RSI is trending downwards, suggesting further weakness. Expect a close around 1.310.

Analysis

The overall trend has shifted to bearish in the last month, with significant resistance at 1.3400. The MACD shows a bearish crossover, and volume patterns indicate a lack of buying interest. Market sentiment is cautious amid economic uncertainties.

Confidence Level

Potential Risks

Economic indicators and central bank policies could significantly alter market dynamics, leading to unexpected outcomes.

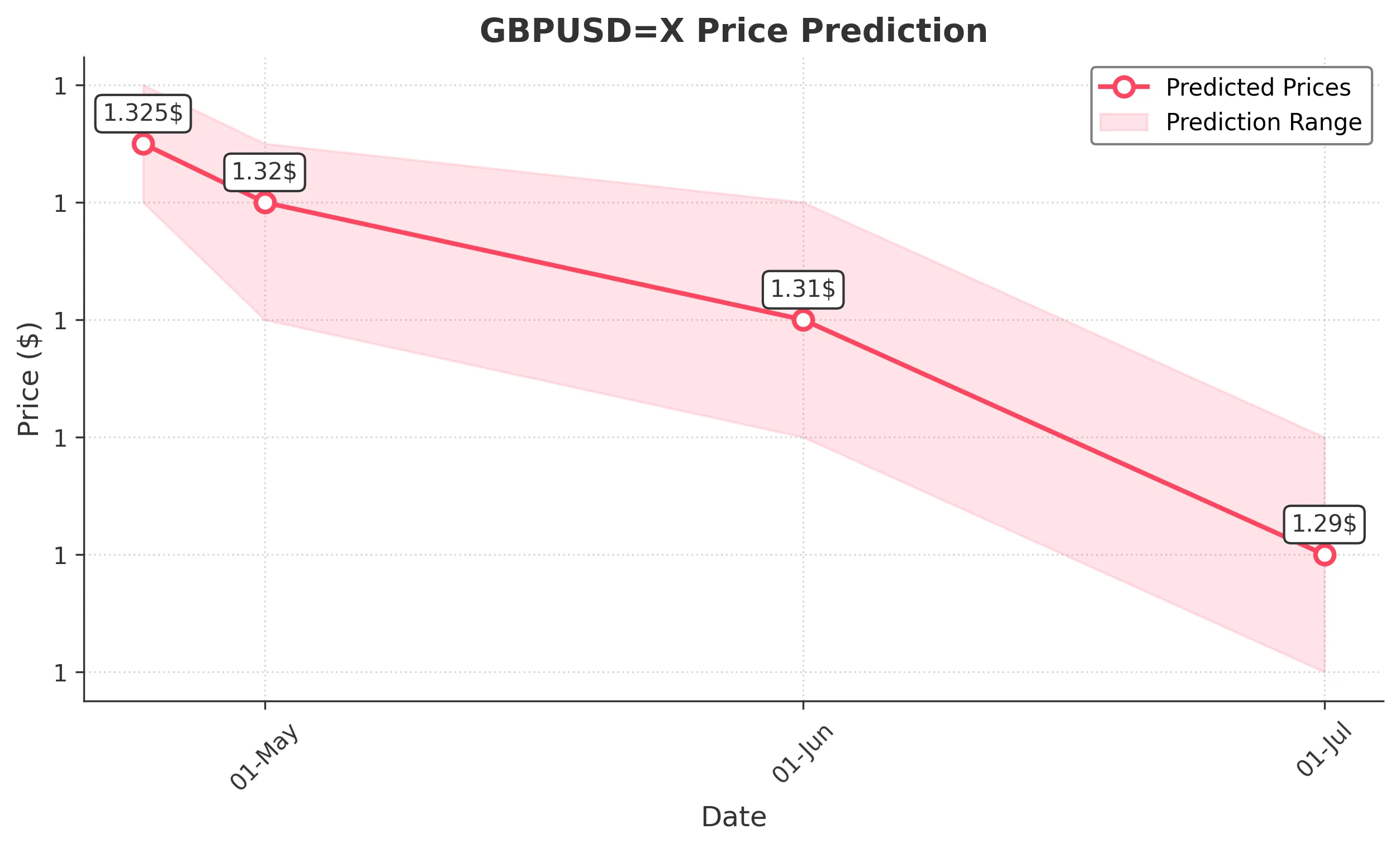

3 Months Prediction

Target: July 1, 2025$1.29

$1.295

$1.3

$1.28

Description

A continued bearish trend is expected as the market reacts to macroeconomic pressures. The ATR indicates increasing volatility, and the RSI suggests oversold conditions. A close around 1.290 is likely as sellers dominate.

Analysis

The GBPUSD has shown a bearish trend over the past three months, with key support at 1.2800. The market is reacting to economic data and central bank policies, leading to increased volatility. The sentiment remains cautious, with traders awaiting clearer signals.

Confidence Level

Potential Risks

Potential geopolitical events or unexpected economic data could lead to sharp reversals, impacting the accuracy of this prediction.