GBPUSDX Trading Predictions

1 Day Prediction

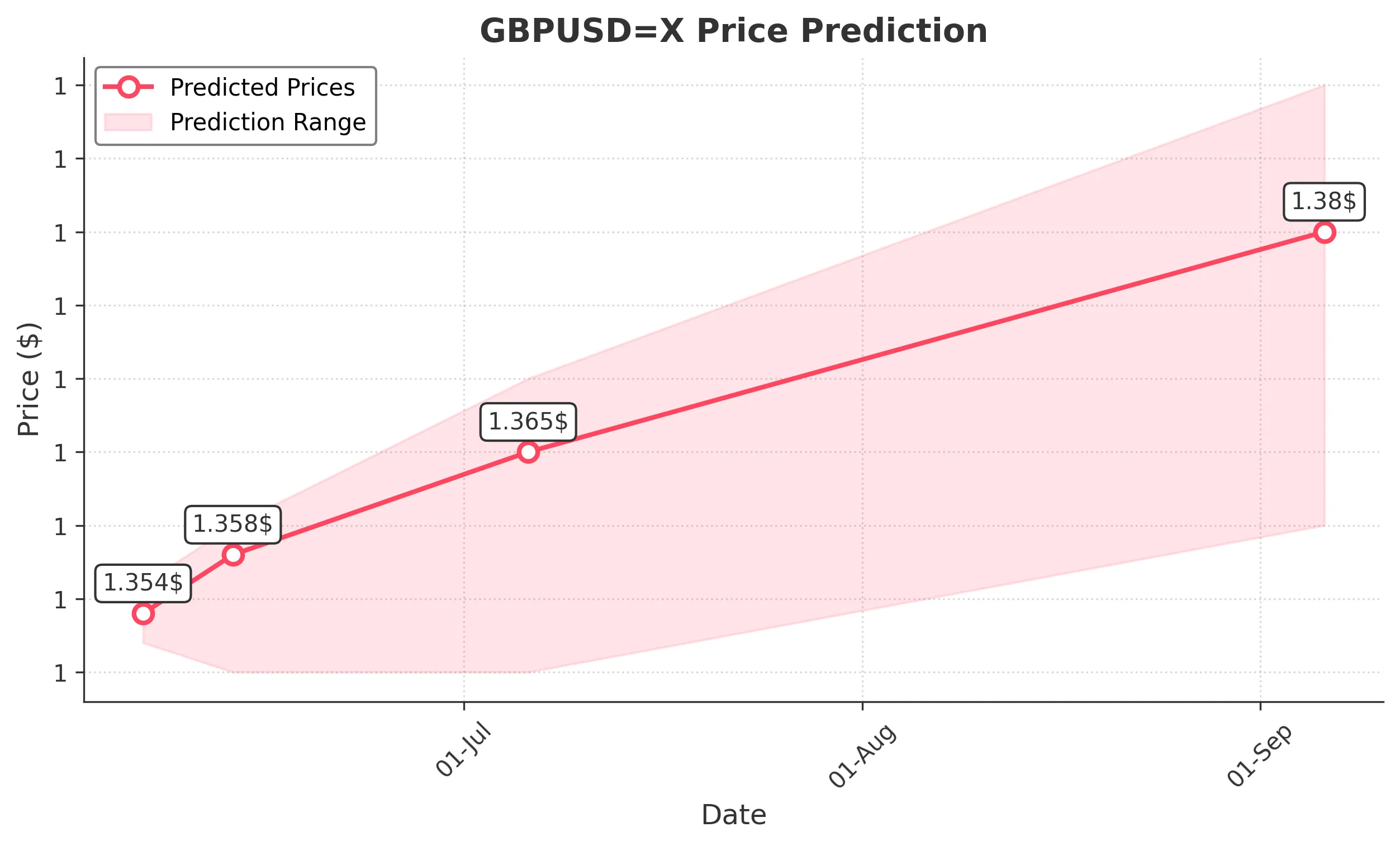

Target: June 6, 2025$1.354

$1.3545

$1.356

$1.352

Description

The price is expected to stabilize around 1.354 due to recent consolidation patterns. RSI indicates neutrality, while MACD shows a slight bullish divergence. However, recent volatility suggests caution.

Analysis

The past three months show a bullish trend with significant resistance around 1.360. Recent price action has been volatile, with a mix of bullish and bearish candlestick patterns. Volume has been low, indicating a lack of strong conviction.

Confidence Level

Potential Risks

Potential for sudden market shifts due to external news or economic data releases.

1 Week Prediction

Target: June 13, 2025$1.358

$1.354

$1.36

$1.35

Description

Expect a slight upward movement as the market reacts to potential positive macroeconomic data. The 50-day moving average supports this bullish outlook, but caution is advised due to potential resistance at 1.360.

Analysis

The market has shown a bullish trend with recent higher lows. However, resistance at 1.360 remains a concern. Technical indicators suggest a potential pullback if the price fails to break this level.

Confidence Level

Potential Risks

Economic indicators could shift sentiment quickly, leading to unexpected price movements.

1 Month Prediction

Target: July 6, 2025$1.365

$1.36

$1.37

$1.35

Description

A bullish trend is anticipated as the market digests recent economic data. The MACD indicates upward momentum, and the RSI is approaching overbought territory, suggesting a potential price rally.

Analysis

The overall trend remains bullish, with significant support at 1.350. Recent price action has shown strong buying interest, but caution is warranted as the RSI approaches overbought levels.

Confidence Level

Potential Risks

Market sentiment could shift due to geopolitical events or unexpected economic data.

3 Months Prediction

Target: September 6, 2025$1.38

$1.375

$1.39

$1.36

Description

Long-term bullish sentiment is expected as economic recovery continues. Fibonacci retracement levels support upward movement, but potential resistance at 1.390 could limit gains.

Analysis

The stock has shown a strong upward trend over the past three months, with key support at 1.360. Technical indicators suggest continued bullish momentum, but external factors could introduce volatility.

Confidence Level

Potential Risks

Unforeseen economic events or changes in monetary policy could impact the forecast.