GBPUSDX Trading Predictions

1 Day Prediction

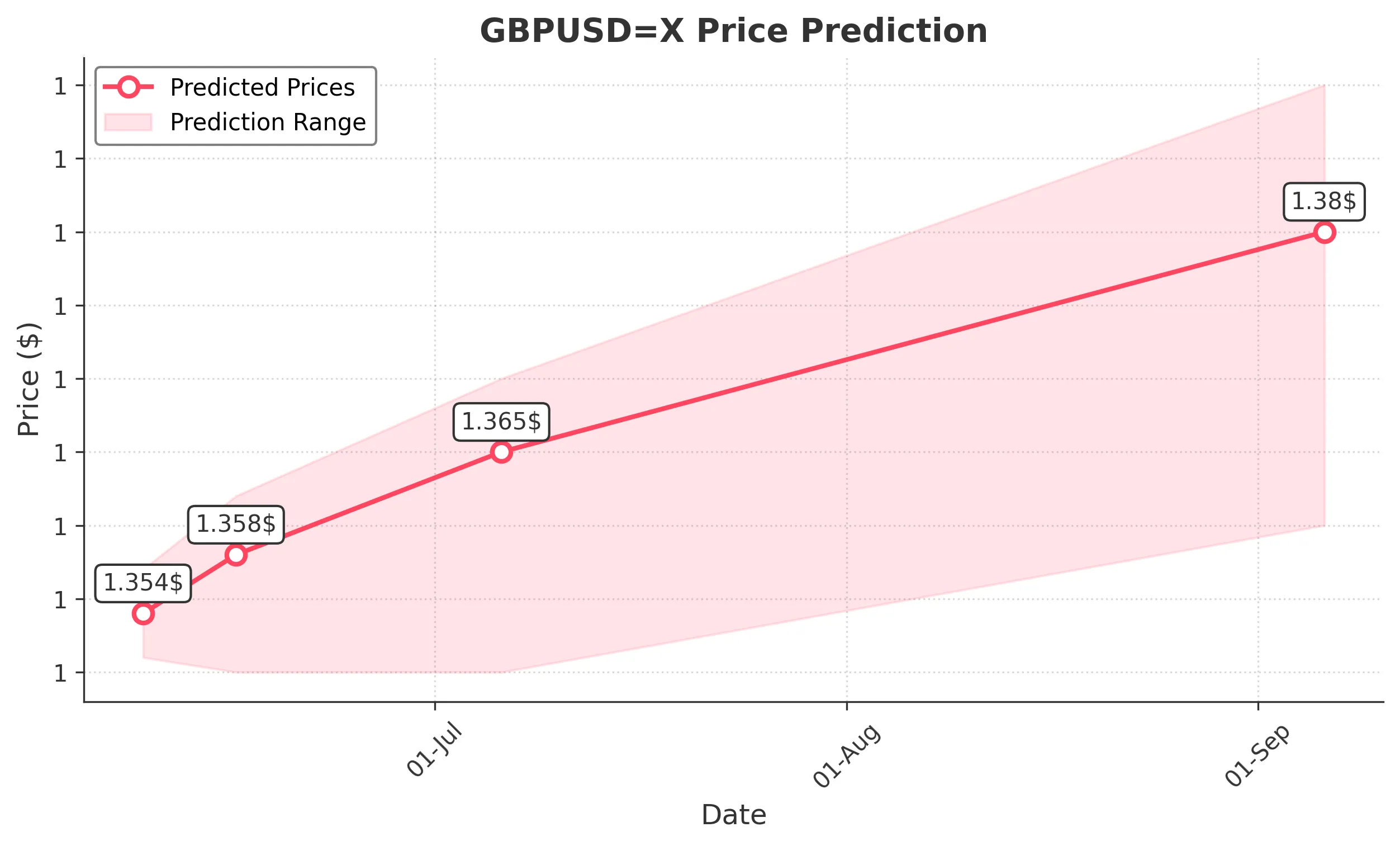

Target: June 9, 2025$1.354

$1.353

$1.357

$1.351

Description

The price is expected to stabilize around 1.354 due to recent consolidation patterns. RSI indicates neutrality, while MACD shows a slight bullish divergence. However, recent volatility suggests caution.

Analysis

The past three months show a bullish trend with significant resistance around 1.360. Recent price action has been volatile, with a mix of bullish and bearish candlestick patterns. Volume has been low, indicating a lack of strong conviction.

Confidence Level

Potential Risks

Potential for sudden market shifts due to external news or economic data releases.

1 Week Prediction

Target: June 16, 2025$1.358

$1.354

$1.362

$1.35

Description

Expect a slight upward movement as the market reacts to potential positive macroeconomic data. The 50-day moving average supports this bullish outlook, but caution is advised due to potential resistance at 1.360.

Analysis

The stock has shown a bullish trend with recent higher lows. However, the market is sensitive to external factors, and the RSI is approaching overbought territory, indicating a possible pullback.

Confidence Level

Potential Risks

Market sentiment could shift quickly based on geopolitical events or economic indicators.

1 Month Prediction

Target: July 6, 2025$1.365

$1.36

$1.37

$1.35

Description

A bullish trend is anticipated as the market digests recent economic data. The MACD indicates upward momentum, and Fibonacci retracement levels suggest support at 1.350. However, watch for resistance at 1.370.

Analysis

The last three months have shown a clear upward trend, with significant support at 1.350. The market sentiment is cautiously optimistic, but external economic factors could introduce volatility.

Confidence Level

Potential Risks

Economic data releases could lead to volatility, impacting the predicted trend.

3 Months Prediction

Target: September 6, 2025$1.38

$1.375

$1.39

$1.36

Description

Long-term bullish sentiment is expected as economic recovery continues. The 200-day moving average supports this outlook, but potential geopolitical tensions could create volatility.

Analysis

The overall trend remains bullish, with key support at 1.360 and resistance at 1.390. The market has shown resilience, but external factors could lead to fluctuations in the coming months.

Confidence Level

Potential Risks

Unforeseen geopolitical events or economic downturns could impact the forecast.