GBPUSDX Trading Predictions

1 Day Prediction

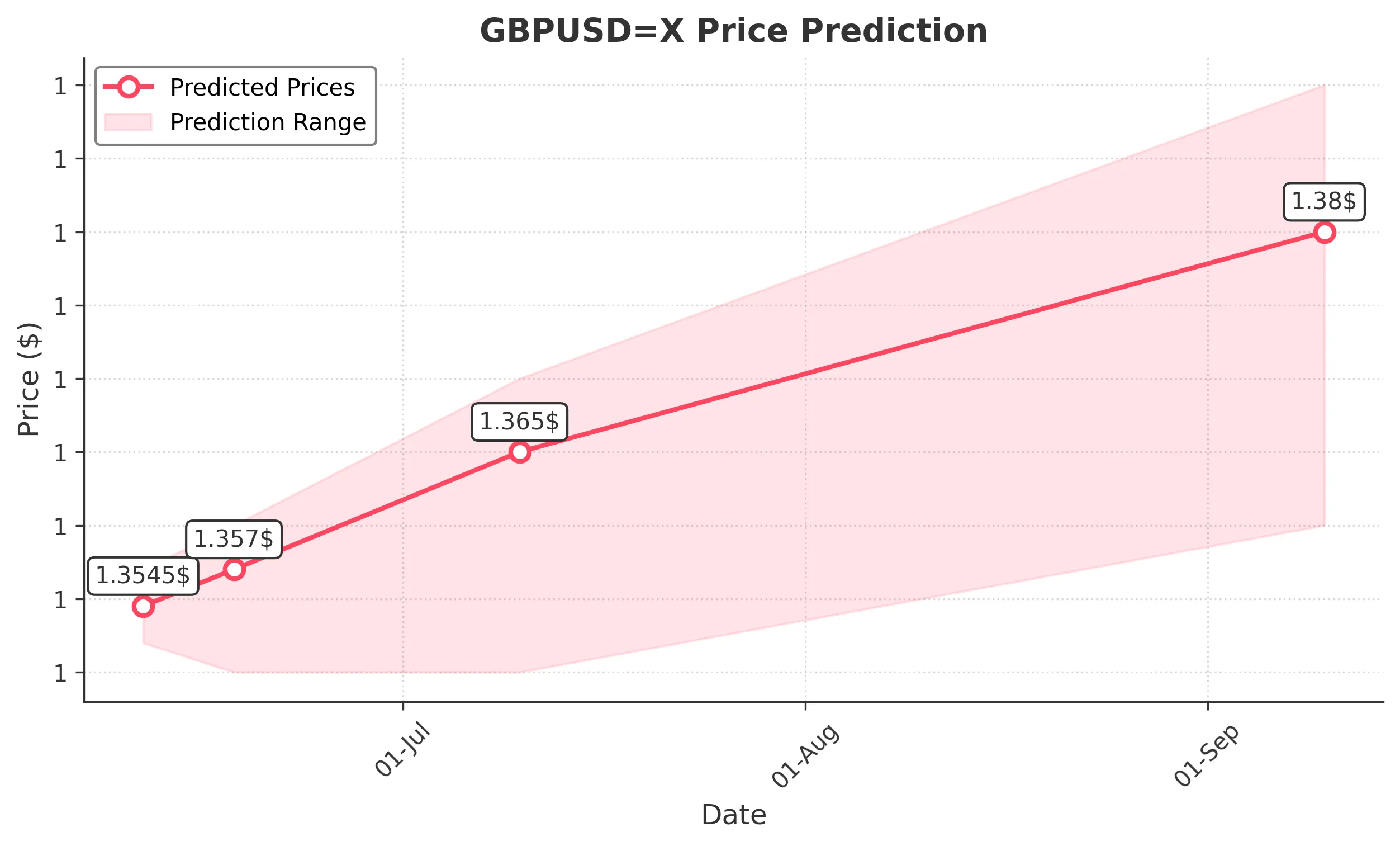

Target: June 11, 2025$1.3545

$1.354

$1.357

$1.352

Description

The price is expected to stabilize around 1.3545, supported by recent bullish momentum. RSI indicates neutrality, while MACD shows a slight bullish crossover. However, volatility remains a concern with potential for a pullback.

Analysis

The past three months show a bullish trend with significant resistance around 1.3600. Recent price action indicates consolidation, with RSI hovering around 50. Volume has been low, suggesting a lack of strong conviction in the current trend.

Confidence Level

Potential Risks

Market sentiment could shift due to external economic news, impacting the predicted stability.

1 Week Prediction

Target: June 18, 2025$1.357

$1.3545

$1.36

$1.35

Description

Expect a slight upward movement to 1.3570 as bullish sentiment persists. The MACD remains positive, and the price is approaching the upper Bollinger Band, indicating potential resistance. Watch for volume spikes for confirmation.

Analysis

The market has shown a bullish trend with key support at 1.3500. The recent price action indicates a struggle to break above 1.3600, with RSI nearing overbought territory. Volume patterns suggest caution as traders await clearer signals.

Confidence Level

Potential Risks

Potential for bearish reversal if economic data releases are unfavorable, which could impact the upward trend.

1 Month Prediction

Target: July 10, 2025$1.365

$1.357

$1.37

$1.35

Description

A bullish outlook with a target of 1.3650, supported by Fibonacci retracement levels. The MACD indicates continued upward momentum, but watch for potential resistance at 1.3700. Market sentiment remains cautiously optimistic.

Analysis

The overall trend is bullish, with significant support at 1.3500 and resistance at 1.3700. The RSI is approaching overbought levels, suggesting a potential pullback. Volume has been low, indicating a lack of strong buying pressure.

Confidence Level

Potential Risks

Economic indicators could shift sentiment, leading to unexpected volatility.

3 Months Prediction

Target: September 10, 2025$1.38

$1.365

$1.39

$1.36

Description

Long-term bullish trend expected to push prices to 1.3800, driven by macroeconomic factors and potential interest rate changes. However, watch for resistance at 1.3900. The market sentiment is optimistic but could be volatile.

Analysis

The three-month outlook shows a bullish trend with key support at 1.3600. The MACD indicates strong momentum, while the RSI suggests potential overbought conditions. Volume patterns indicate a lack of strong conviction, warranting caution.

Confidence Level

Potential Risks

Unforeseen geopolitical events or economic data could lead to significant market shifts.