GBPUSDX Trading Predictions

1 Day Prediction

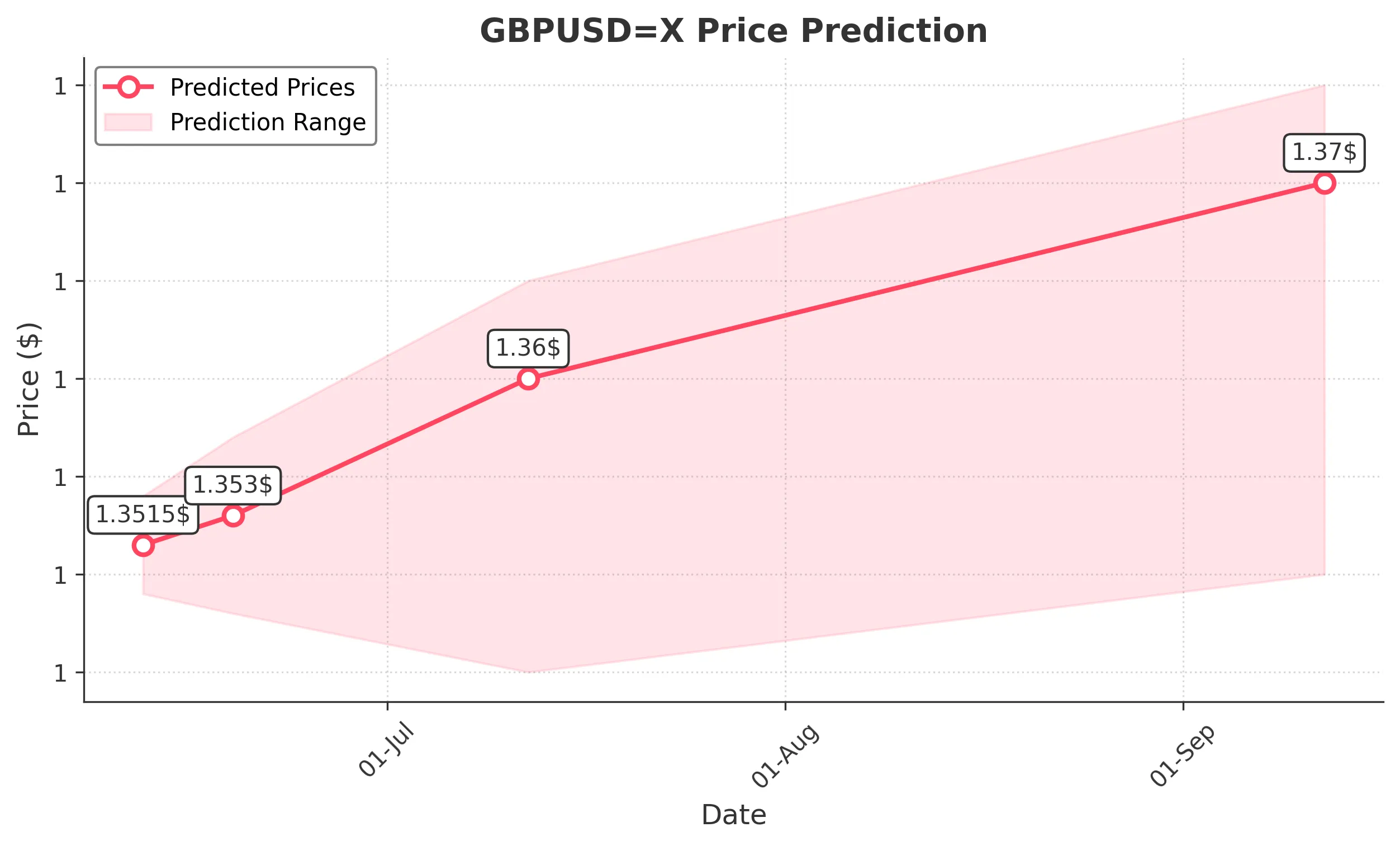

Target: June 12, 2025$1.3515

$1.35

$1.354

$1.349

Description

The recent price action shows a slight bullish trend with the last close at 1.350111. The RSI is neutral, indicating no overbought or oversold conditions. A potential breakout above 1.355 could lead to further gains.

Analysis

The past 3 months show a bullish trend with significant support around 1.3400 and resistance near 1.3600. The MACD is showing a bullish crossover, while the ATR indicates moderate volatility. Volume has been stable, suggesting steady interest.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the prediction.

1 Week Prediction

Target: June 19, 2025$1.353

$1.3515

$1.357

$1.348

Description

With the current upward momentum, the price is expected to test the resistance at 1.3600. The Bollinger Bands are widening, indicating potential volatility. A close above 1.355 would confirm bullish sentiment.

Analysis

The stock has shown a bullish trend with higher highs and higher lows. The RSI is approaching overbought territory, suggesting caution. Key support is at 1.3400, while resistance is at 1.3600. Volume patterns indicate healthy trading activity.

Confidence Level

Potential Risks

Potential market corrections or geopolitical events could reverse the trend.

1 Month Prediction

Target: July 12, 2025$1.36

$1.353

$1.365

$1.345

Description

The bullish trend is expected to continue, with a target of 1.3600. The Fibonacci retracement levels suggest strong support at 1.3400. However, a failure to break above 1.3600 could lead to a pullback.

Analysis

The overall trend remains bullish, but the RSI indicates potential overbought conditions. The MACD is positive, but divergence could signal a reversal. Key levels to watch are 1.3400 for support and 1.3600 for resistance.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could significantly impact the price.

3 Months Prediction

Target: September 12, 2025$1.37

$1.36

$1.375

$1.35

Description

If the bullish momentum persists, the price could reach 1.3700. However, macroeconomic factors and potential interest rate changes could introduce volatility. A break below 1.3400 would invalidate this bullish outlook.

Analysis

The long-term outlook appears bullish, but the market is sensitive to economic indicators. The ATR suggests increasing volatility, and the RSI may indicate overbought conditions. Key support at 1.3400 and resistance at 1.3700 are critical.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant price fluctuations.