GBPUSDX Trading Predictions

1 Day Prediction

Target: June 14, 2025$1.36

$1.359

$1.365

$1.355

Description

The recent bullish trend, supported by a rising MACD and RSI above 50, suggests a continuation. The price is near the upper Bollinger Band, indicating potential resistance. However, a Doji pattern indicates indecision, warranting caution.

Analysis

Over the past 3 months, GBPUSD has shown a bullish trend with significant support at 1.3500 and resistance around 1.3650. The MACD is bullish, and RSI indicates strength. Volume has been stable, but recent spikes suggest increased interest. Overall, the market sentiment remains cautiously optimistic.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the prediction. A reversal is possible if bearish sentiment emerges.

1 Week Prediction

Target: June 21, 2025$1.3625

$1.36

$1.37

$1.355

Description

The bullish momentum is expected to continue, with the price likely to test the resistance at 1.3650. However, the RSI nearing overbought levels suggests a potential pullback. Watch for volume spikes that could indicate trend reversals.

Analysis

The GBPUSD has been in a bullish phase, with key support at 1.3500. The MACD remains positive, and the RSI is approaching overbought territory. Recent candlestick patterns show bullish engulfing signals, but caution is advised as the market may be due for a correction.

Confidence Level

Potential Risks

Potential geopolitical events or economic data releases could lead to unexpected volatility, impacting the forecast.

1 Month Prediction

Target: July 13, 2025$1.355

$1.36

$1.37

$1.34

Description

Expect a potential pullback as the market may correct after recent highs. The RSI indicates overbought conditions, and a bearish divergence in MACD could signal a reversal. Watch for support at 1.3500.

Analysis

The GBPUSD has shown strong bullish trends, but the recent price action suggests a possible correction. Key support at 1.3500 is critical, while resistance remains at 1.3650. The market is influenced by macroeconomic factors, including interest rate expectations.

Confidence Level

Potential Risks

Economic indicators and central bank policies could shift market sentiment rapidly, leading to unexpected price movements.

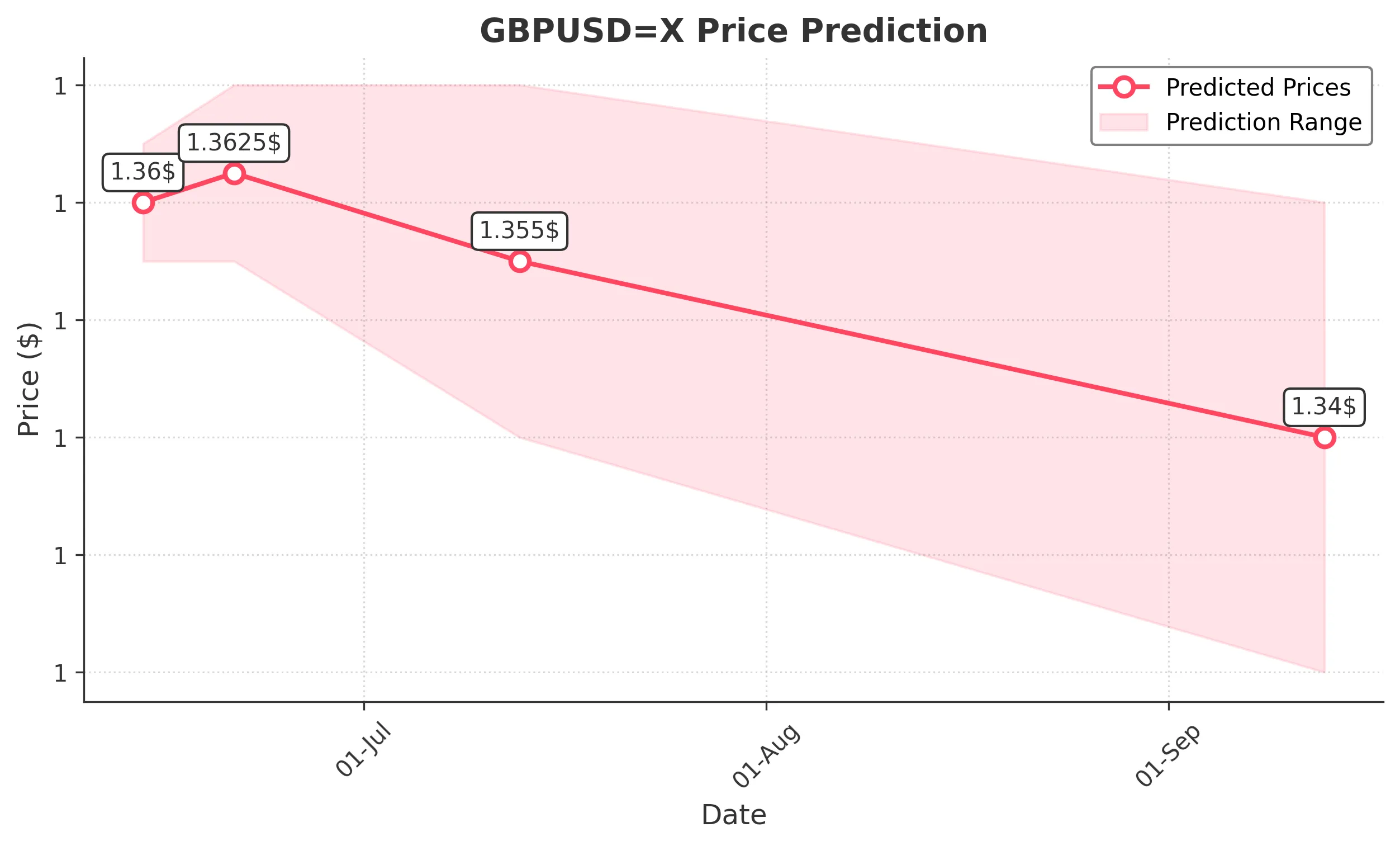

3 Months Prediction

Target: September 13, 2025$1.34

$1.35

$1.36

$1.32

Description

A bearish outlook is anticipated as the market may face headwinds from economic data and potential interest rate changes. The price could test lower support levels, with the RSI indicating weakening momentum.

Analysis

The GBPUSD has been in a bullish trend, but signs of exhaustion are emerging. Key support levels are at 1.3200, while resistance remains at 1.3600. The market is sensitive to macroeconomic developments, and a shift in sentiment could lead to a bearish reversal.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant deviations from this forecast.