GBPUSDX Trading Predictions

1 Day Prediction

Target: June 18, 2025$1.3585

$1.357

$1.36

$1.355

Description

The price is expected to stabilize around 1.3585, supported by recent bullish momentum and a slight upward trend in the RSI. However, resistance at 1.3600 may limit gains.

Analysis

The past three months show a bullish trend with key support at 1.3500 and resistance at 1.3600. The RSI indicates overbought conditions, suggesting a possible pullback. Volume has been stable, indicating steady interest.

Confidence Level

Potential Risks

Potential volatility due to external economic news could impact the prediction.

1 Week Prediction

Target: June 25, 2025$1.36

$1.358

$1.365

$1.355

Description

Expect a gradual rise to 1.3600 as bullish sentiment persists. The MACD shows a bullish crossover, indicating potential upward momentum, but watch for resistance at 1.3650.

Analysis

The market has shown a bullish trend with a recent breakout above 1.3550. The MACD and RSI support further gains, but caution is warranted as the price approaches resistance levels.

Confidence Level

Potential Risks

Market sentiment could shift due to geopolitical events or economic data releases.

1 Month Prediction

Target: July 18, 2025$1.37

$1.36

$1.375

$1.355

Description

A target of 1.3700 is anticipated as the bullish trend continues, supported by Fibonacci retracement levels. However, overbought conditions may lead to corrections.

Analysis

The overall trend remains bullish, with significant support at 1.3550. The price has been fluctuating within a range, and while upward momentum is present, external factors could influence market direction.

Confidence Level

Potential Risks

Economic indicators and central bank policies could introduce volatility.

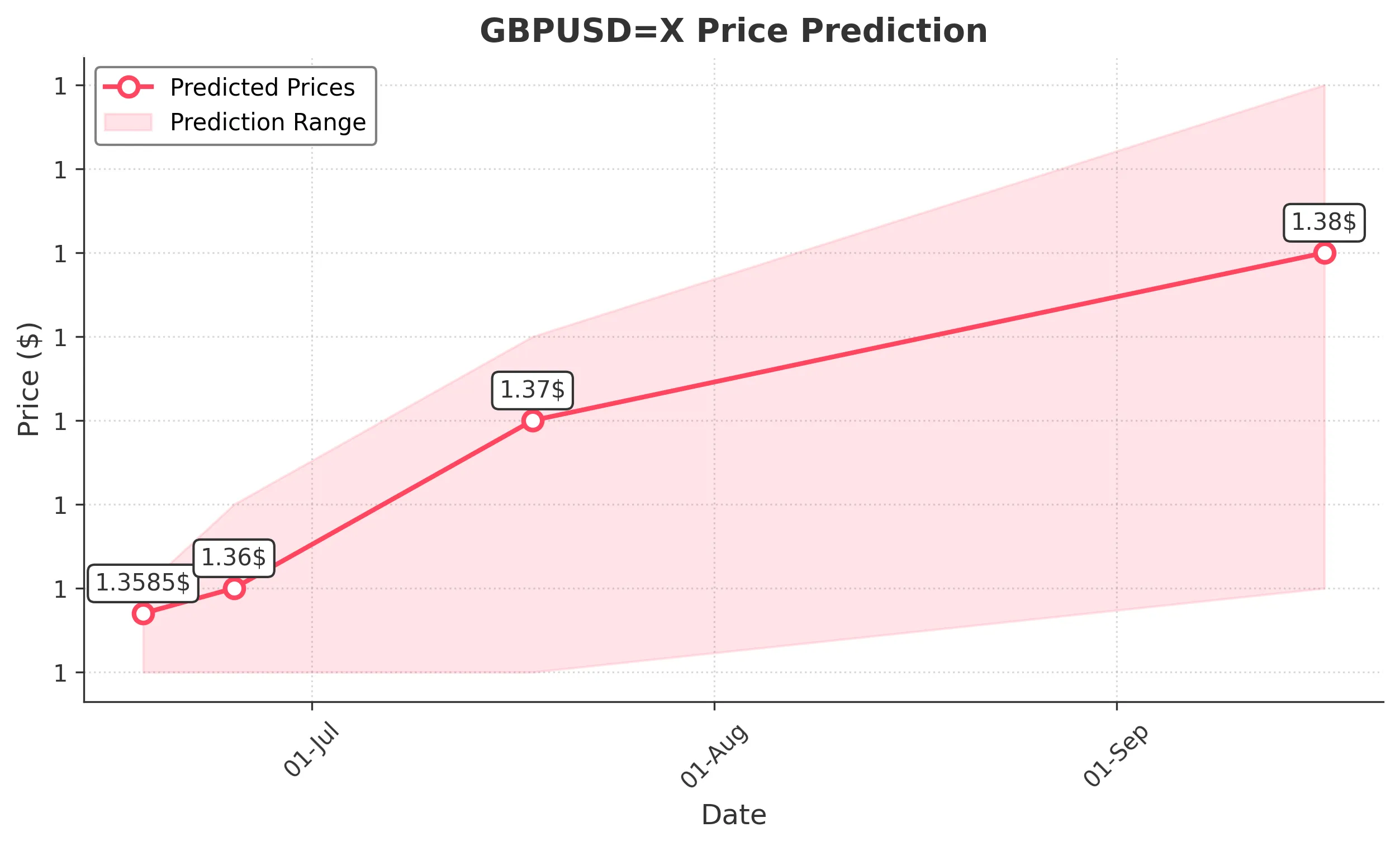

3 Months Prediction

Target: September 17, 2025$1.38

$1.37

$1.39

$1.36

Description

Long-term outlook suggests a rise to 1.3800, driven by sustained bullish sentiment and potential economic recovery. However, resistance at 1.3900 may pose challenges.

Analysis

The market has shown a consistent upward trend, but the potential for corrections exists. Key resistance levels at 1.3900 could hinder progress, and external economic factors will be crucial in determining the trajectory.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant volatility.