GBPUSDX Trading Predictions

1 Day Prediction

Target: June 25, 2025$1.352

$1.35

$1.355

$1.34

Description

The market shows a slight bearish trend with recent lower closes. RSI indicates oversold conditions, suggesting a potential bounce. However, resistance at 1.355 may limit upward movement.

Analysis

Over the past 3 months, GBPUSD has shown a bearish trend with significant support around 1.340. Technical indicators like MACD are bearish, while volume has been low, indicating lack of strong conviction. Recent candlestick patterns suggest indecision.

Confidence Level

Potential Risks

Market volatility and external news could impact price movements significantly.

1 Week Prediction

Target: July 2, 2025$1.355

$1.352

$1.36

$1.34

Description

A potential recovery is indicated as the market may test resistance at 1.360. The RSI is approaching neutral, suggesting a possible upward correction. However, bearish sentiment remains prevalent.

Analysis

The past 3 months have seen fluctuating prices with a bearish bias. Key resistance at 1.360 and support at 1.340 are critical. Volume patterns indicate low participation, and recent candlestick formations show uncertainty.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could reverse the trend, impacting the prediction.

1 Month Prediction

Target: July 24, 2025$1.36

$1.355

$1.37

$1.345

Description

Expecting a gradual recovery towards 1.360 as market sentiment may shift positively. However, resistance at 1.370 could pose challenges. The overall trend remains cautious.

Analysis

The GBPUSD has been in a bearish phase, with significant resistance at 1.370. Technical indicators suggest potential for a rebound, but overall market sentiment remains cautious. Volume has been low, indicating weak conviction.

Confidence Level

Potential Risks

Market sentiment can shift rapidly due to economic data releases or geopolitical events.

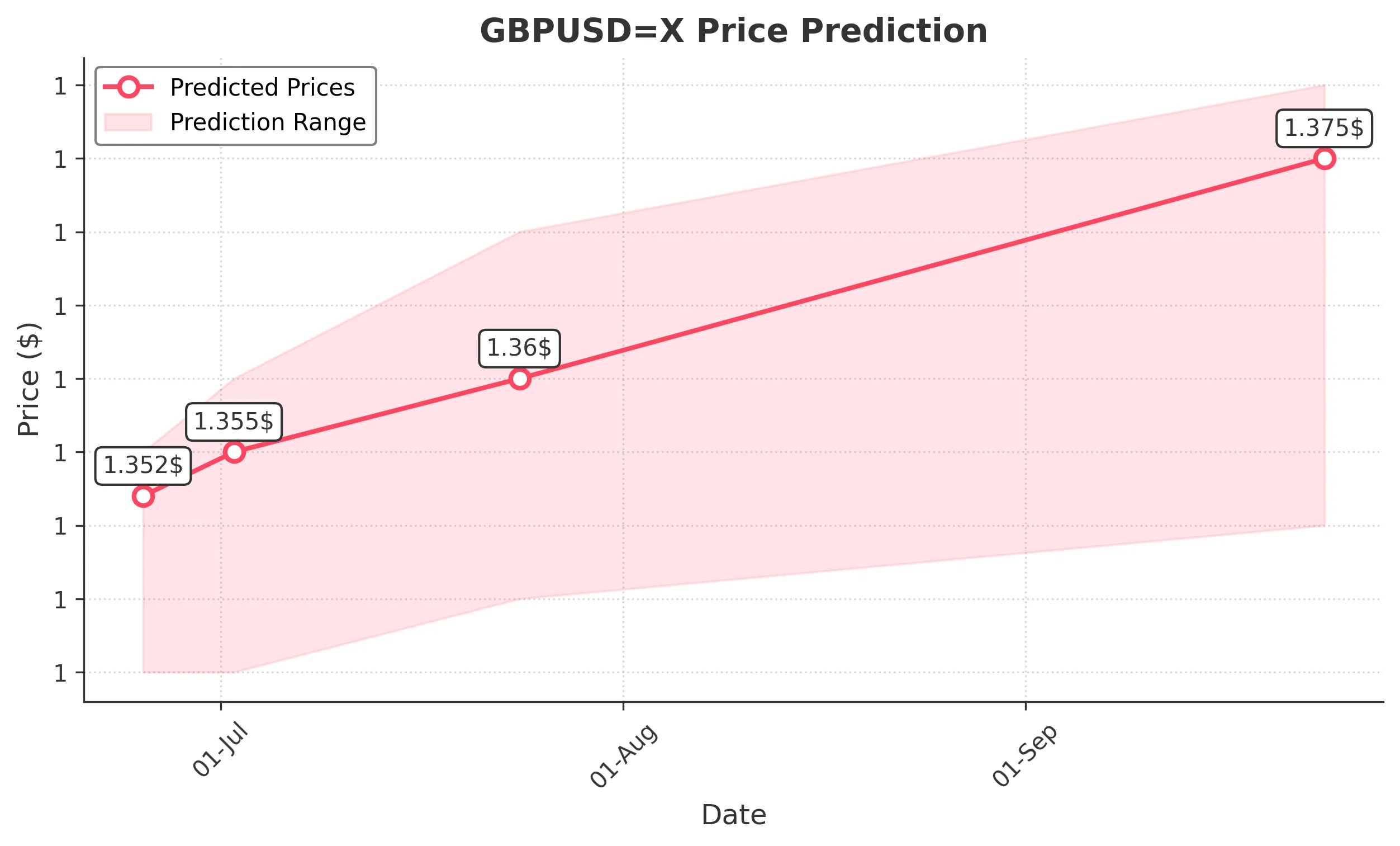

3 Months Prediction

Target: September 24, 2025$1.375

$1.37

$1.38

$1.35

Description

Longer-term outlook suggests a potential recovery towards 1.375, driven by improving economic indicators. However, resistance levels will need to be monitored closely.

Analysis

The GBPUSD has faced downward pressure, but potential for recovery exists if economic conditions improve. Key resistance at 1.380 and support at 1.350 are critical. Technical indicators show mixed signals, indicating uncertainty.

Confidence Level

Potential Risks

Economic conditions and central bank policies could significantly alter the trajectory.