GBPUSDX Trading Predictions

1 Day Prediction

Target: June 30, 2025$1.37

$1.37

$1.372

$1.368

Description

The price is expected to stabilize around 1.3700, supported by recent bullish momentum. The RSI is neutral, indicating no overbought conditions, while MACD shows a slight bullish crossover. However, volatility remains a concern.

Analysis

Over the past 3 months, GBPUSD has shown a bullish trend with significant resistance around 1.3750. Recent candlestick patterns indicate indecision, and volume has been low, suggesting caution. The market sentiment is mixed, influenced by macroeconomic factors.

Confidence Level

Potential Risks

Potential market volatility and external economic news could impact the prediction.

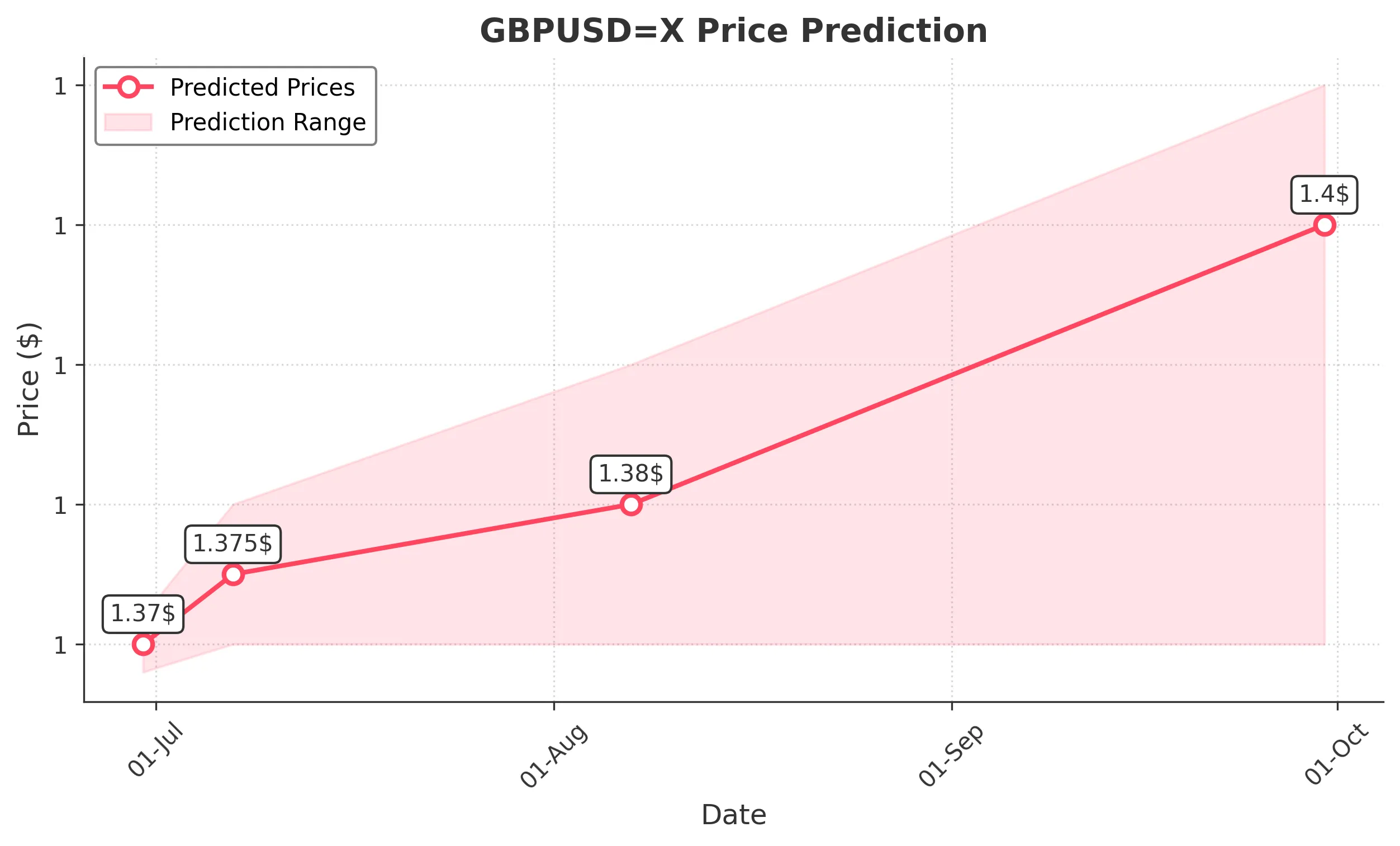

1 Week Prediction

Target: July 7, 2025$1.375

$1.372

$1.38

$1.37

Description

Expect a gradual rise to 1.3750 as bullish momentum builds. The 50-day moving average supports this upward trend, while the RSI remains below overbought levels. However, external factors could introduce volatility.

Analysis

The last three months have seen a bullish trend with key support at 1.3600. The MACD indicates potential upward momentum, but recent candlestick patterns show some indecision. Volume spikes on upward moves suggest strong buying interest.

Confidence Level

Potential Risks

Economic data releases could lead to unexpected price movements.

1 Month Prediction

Target: August 7, 2025$1.38

$1.375

$1.39

$1.37

Description

A target of 1.3800 is anticipated as the market continues to trend upward. The Fibonacci retracement levels indicate strong support at 1.3700, while the MACD suggests bullish momentum. However, geopolitical events could pose risks.

Analysis

The GBPUSD has been in a bullish phase, with resistance at 1.3900. The ATR indicates increasing volatility, and recent candlestick patterns show bullish engulfing signals. Market sentiment is cautiously optimistic, but external factors remain a concern.

Confidence Level

Potential Risks

Unforeseen geopolitical tensions or economic data could reverse the trend.

3 Months Prediction

Target: September 30, 2025$1.4

$1.385

$1.41

$1.37

Description

A longer-term target of 1.4000 is projected as the market may continue its upward trajectory. The 200-day moving average supports this bullish outlook, but potential economic downturns could impact the forecast.

Analysis

The overall trend has been bullish, with key resistance at 1.4000. The market has shown strong buying interest, but recent volatility raises concerns. The RSI is approaching overbought territory, indicating a potential pullback.

Confidence Level

Potential Risks

Economic instability or policy changes could lead to significant price corrections.