GBPUSDX Trading Predictions

1 Day Prediction

Target: July 4, 2025$1.3665

$1.3653

$1.37

$1.363

Description

The recent price action shows a slight bearish trend with a Doji pattern indicating indecision. The RSI is approaching oversold levels, suggesting a potential bounce. However, MACD is bearish, indicating caution.

Analysis

Over the past 3 months, GBPUSD has shown a bearish trend with significant support around 1.3600. The RSI indicates potential oversold conditions, while MACD suggests bearish momentum. Volume has been low, indicating lack of strong conviction.

Confidence Level

Potential Risks

Market volatility and external news could impact the price direction unexpectedly.

1 Week Prediction

Target: July 11, 2025$1.37

$1.3665

$1.375

$1.365

Description

Expect a slight recovery as the market may react to oversold conditions. The Bollinger Bands are tightening, indicating potential volatility. However, bearish sentiment remains prevalent.

Analysis

The stock has been trading sideways with resistance at 1.3750. The recent candlestick patterns suggest indecision, and the ATR indicates low volatility. Market sentiment remains cautious, influenced by economic data releases.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to sudden price movements.

1 Month Prediction

Target: August 4, 2025$1.38

$1.37

$1.385

$1.37

Description

A potential bullish reversal is anticipated as the market may react positively to upcoming economic data. The Fibonacci retracement levels suggest support at 1.3700, which could lead to upward momentum.

Analysis

The past three months have shown a bearish trend, but recent patterns indicate a possible reversal. Key support at 1.3700 and resistance at 1.3850 are critical. The market is sensitive to macroeconomic news, which could sway sentiment.

Confidence Level

Potential Risks

Economic indicators may not align with market expectations, leading to volatility.

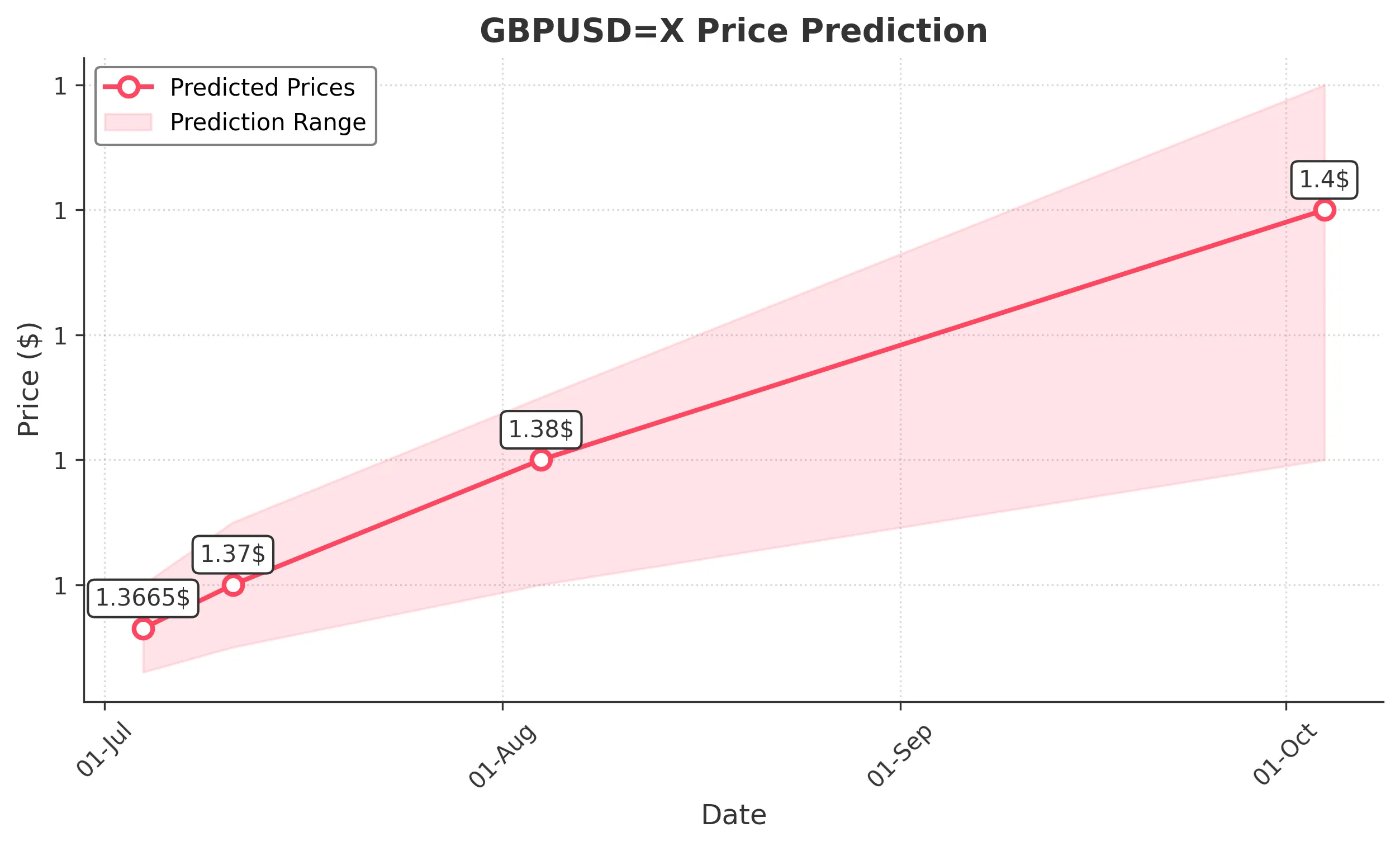

3 Months Prediction

Target: October 4, 2025$1.4

$1.38

$1.41

$1.38

Description

Long-term bullish sentiment may develop if economic conditions improve. The MACD could turn bullish, and if the price breaks above 1.3850, it may signal a stronger upward trend.

Analysis

The overall trend has been bearish, but signs of recovery are emerging. Key resistance levels at 1.3850 and support at 1.3700 will be crucial. Market sentiment is influenced by economic data, and any negative news could reverse the trend.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential geopolitical events and economic shifts.