GBPUSDX Trading Predictions

1 Day Prediction

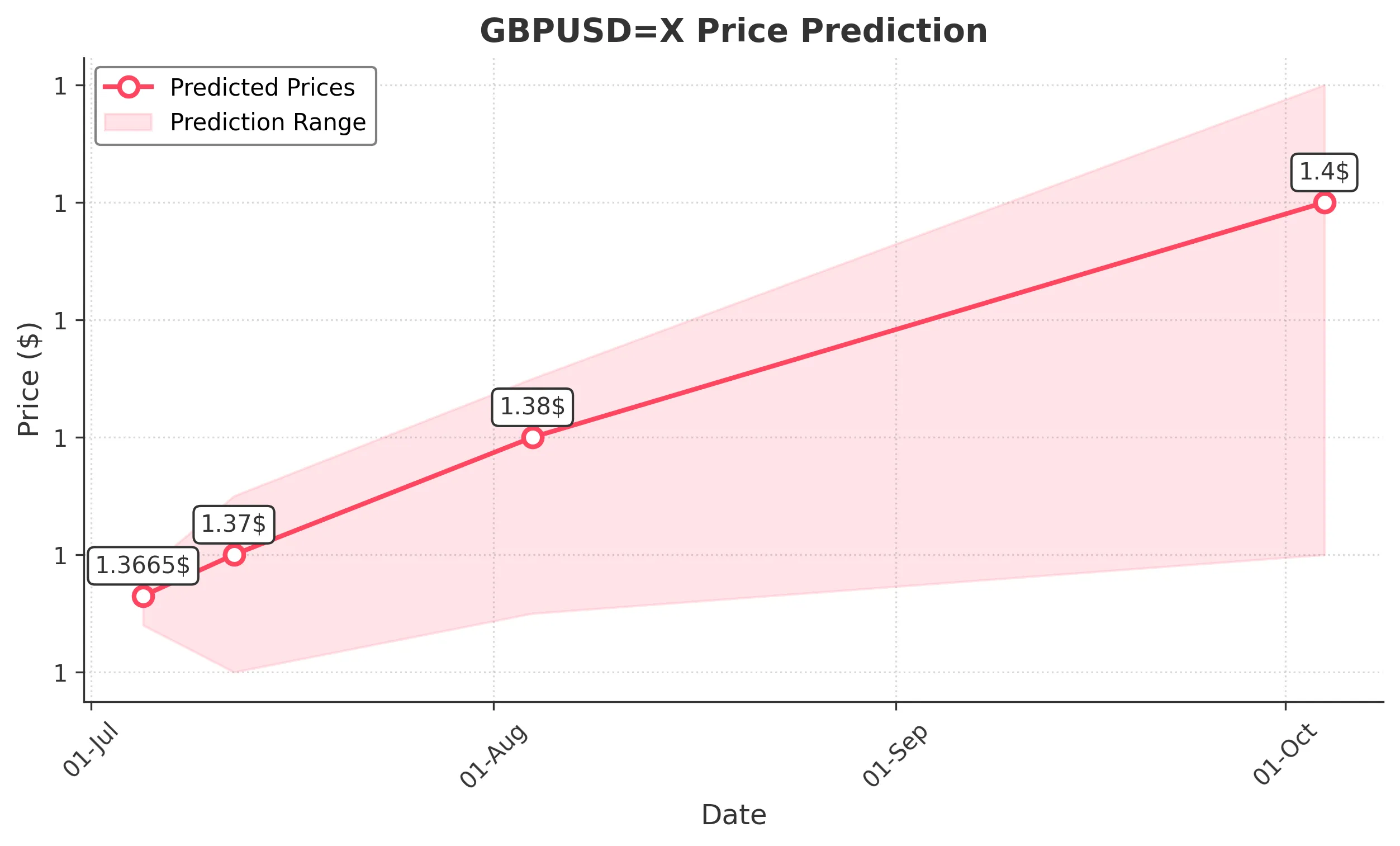

Target: July 5, 2025$1.3665

$1.3655

$1.3685

$1.364

Description

The price is expected to stabilize around 1.3665, supported by recent bullish momentum. The RSI indicates neutrality, while MACD shows a slight bullish crossover. However, volatility remains a concern.

Analysis

The past three months show a bullish trend with significant resistance at 1.375. Recent price action indicates consolidation around 1.365-1.370. Volume has been low, suggesting a lack of strong conviction in the current trend.

Confidence Level

Potential Risks

Potential for sudden market shifts due to external news or economic data releases could impact accuracy.

1 Week Prediction

Target: July 12, 2025$1.37

$1.3665

$1.375

$1.36

Description

Expect a slight upward movement to 1.3700 as the market digests recent gains. The Bollinger Bands indicate potential for a breakout, but caution is advised due to mixed signals from the MACD.

Analysis

The GBP/USD has shown resilience, bouncing off support at 1.360. The MACD is flattening, indicating potential indecision. Key resistance remains at 1.375, which could limit upside potential.

Confidence Level

Potential Risks

Market sentiment could shift quickly, especially with upcoming economic reports that may influence currency strength.

1 Month Prediction

Target: August 4, 2025$1.38

$1.37

$1.385

$1.365

Description

A bullish outlook for the month ahead, targeting 1.3800 as the market may react positively to economic data. The RSI is approaching overbought territory, suggesting caution.

Analysis

The trend has been bullish, with a clear upward trajectory. Support at 1.365 is strong, while resistance at 1.375 may be tested. Volume patterns indicate increasing interest, but caution is warranted as the market approaches overbought conditions.

Confidence Level

Potential Risks

Economic data releases could lead to volatility, and geopolitical events may also impact currency strength.

3 Months Prediction

Target: October 4, 2025$1.4

$1.38

$1.41

$1.37

Description

Long-term bullish sentiment suggests a target of 1.4000, driven by potential economic recovery and favorable monetary policy. However, overbought conditions may lead to corrections.

Analysis

The overall trend remains bullish, with significant support at 1.370. The market sentiment is cautiously optimistic, but potential resistance at 1.400 could trigger profit-taking. The MACD indicates a strong upward momentum, but caution is advised as the market approaches overbought levels.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in monetary policy could derail this bullish outlook, leading to increased volatility.