GBPUSDX Trading Predictions

1 Day Prediction

Target: July 11, 2025$1.3575

$1.3585

$1.359

$1.356

Description

The market shows signs of bearish momentum with a recent Doji candlestick pattern indicating indecision. The RSI is approaching overbought levels, suggesting a potential pullback. MACD is also showing a bearish crossover, supporting a downward move.

Analysis

Over the past 3 months, GBPUSD has shown a bullish trend with significant resistance around 1.375. Recent price action indicates a potential reversal as the price approaches this level. The RSI is nearing overbought territory, and volume has been low, indicating a lack of strong buying interest.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction. A sudden bullish sentiment could reverse the trend.

1 Week Prediction

Target: July 18, 2025$1.355

$1.356

$1.358

$1.353

Description

The bearish trend is expected to continue as the price approaches key support levels. The MACD indicates a bearish divergence, and the Bollinger Bands suggest a squeeze, indicating potential volatility. A break below support could lead to further declines.

Analysis

The GBPUSD has been fluctuating around the 1.36 level, with significant resistance at 1.375. The recent bearish candlestick patterns and declining volume suggest a weakening bullish trend. The ATR indicates increasing volatility, which could lead to sharp price movements.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or changes in market sentiment could lead to unexpected price movements.

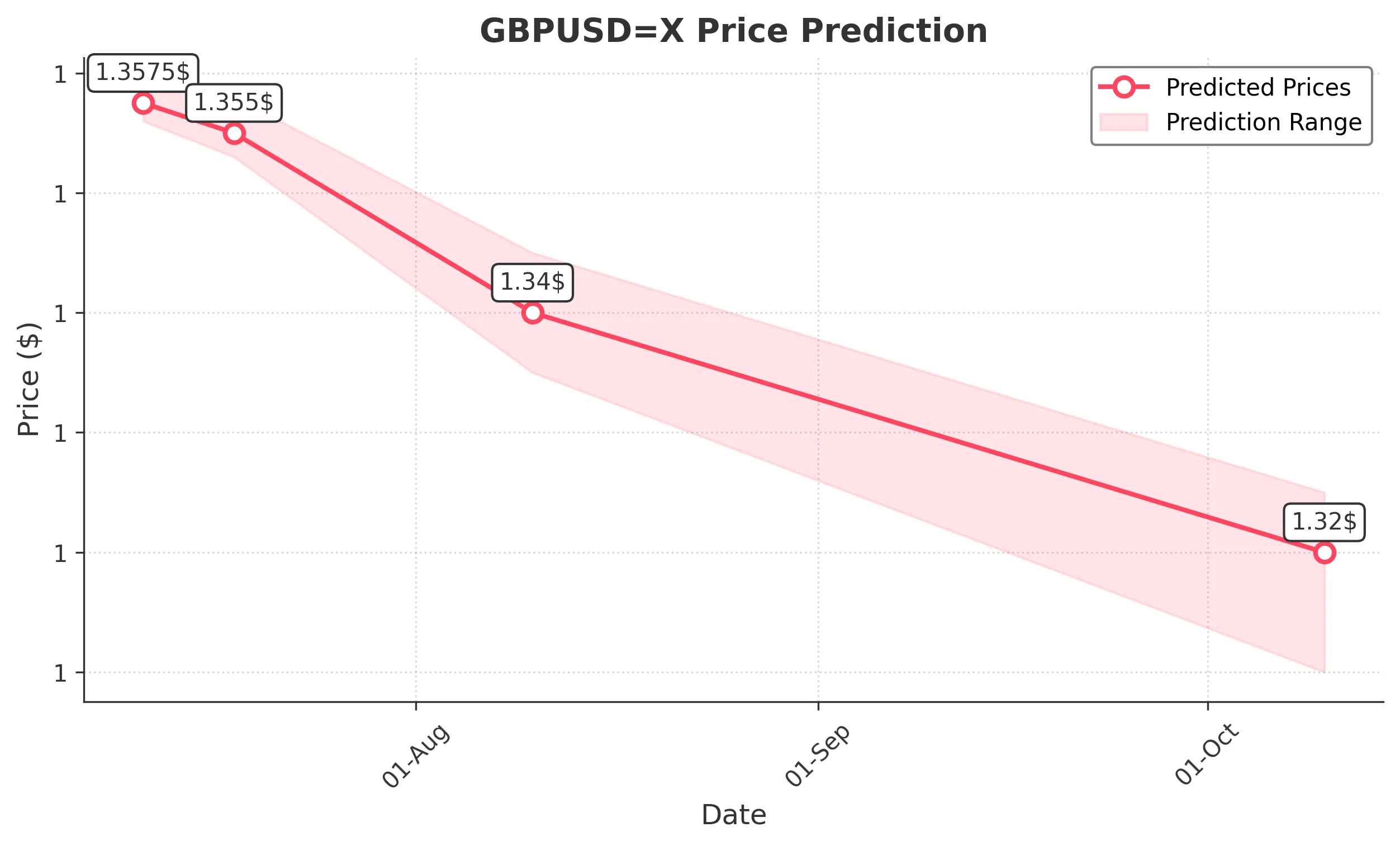

1 Month Prediction

Target: August 10, 2025$1.34

$1.342

$1.345

$1.335

Description

A continuation of the bearish trend is anticipated as the price approaches the Fibonacci retracement level at 1.340. The RSI indicates a potential oversold condition, but the overall trend remains bearish. A break below this level could lead to further declines.

Analysis

The past three months have shown a bearish trend with significant support at 1.340. The MACD is trending downwards, and the RSI is approaching oversold levels. Volume has been decreasing, indicating a lack of strong buying interest, which could lead to further declines.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and any positive economic news could reverse the bearish outlook.

3 Months Prediction

Target: October 10, 2025$1.32

$1.322

$1.325

$1.31

Description

The bearish trend is expected to persist, with potential for further declines as the market reacts to macroeconomic factors. The support level at 1.320 is critical; a break below could lead to a more significant downturn. The overall sentiment remains cautious.

Analysis

The GBPUSD has been in a bearish trend, with key support at 1.320. The MACD shows a bearish signal, and the RSI indicates potential oversold conditions. Volume patterns suggest a lack of strong buying interest, and external economic factors could further influence the price.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could significantly impact the GBPUSD, leading to unexpected price movements.