GBPUSDX Trading Predictions

1 Day Prediction

Target: July 15, 2025$1.35

$1.349

$1.353

$1.347

Description

The market shows signs of a potential rebound after recent declines. The RSI is approaching oversold levels, suggesting a possible upward correction. However, bearish candlestick patterns indicate caution. Volume remains low, indicating weak conviction.

Analysis

Over the past 3 months, GBPUSD has shown a bearish trend with significant support around 1.3480. The recent price action indicates a potential reversal, but the overall sentiment remains cautious. Technical indicators like MACD are showing bearish divergence, while Bollinger Bands suggest low volatility.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden shift in sentiment may lead to unexpected price movements.

1 Week Prediction

Target: July 22, 2025$1.355

$1.352

$1.36

$1.35

Description

A slight bullish trend is anticipated as the market may react positively to potential macroeconomic news. The RSI is recovering, and a bullish engulfing pattern has formed, indicating a possible upward momentum. However, resistance at 1.3600 may limit gains.

Analysis

The past three months have seen GBPUSD fluctuating within a range, with key resistance at 1.3600. The recent price action suggests a potential recovery, but the overall trend remains bearish. Volume patterns indicate a lack of strong buying interest, which could hinder upward movement.

Confidence Level

Potential Risks

Unforeseen economic data releases or geopolitical events could reverse the trend. The market remains sensitive to external factors.

1 Month Prediction

Target: August 14, 2025$1.365

$1.362

$1.37

$1.36

Description

Expect a gradual recovery as the market stabilizes. The MACD shows signs of a bullish crossover, and the RSI is moving towards neutral territory. However, resistance levels may cap gains, and market sentiment remains mixed.

Analysis

GBPUSD has been in a bearish phase, with significant resistance at 1.3700. The market is currently at a crossroads, with mixed signals from technical indicators. Volume analysis shows low participation, indicating uncertainty among traders.

Confidence Level

Potential Risks

Economic indicators and central bank policies could significantly influence the market. A lack of strong bullish signals may lead to further declines.

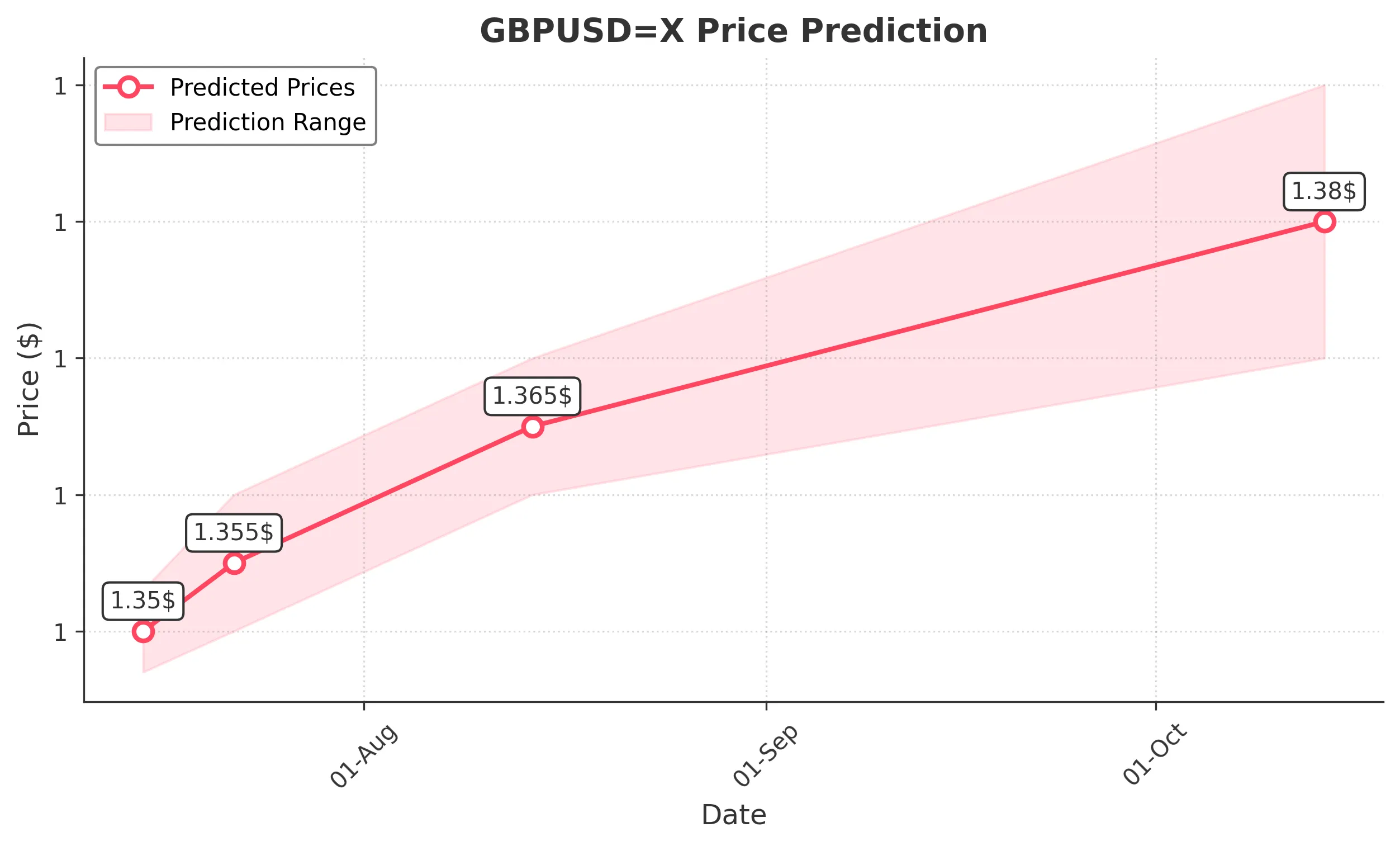

3 Months Prediction

Target: October 14, 2025$1.38

$1.375

$1.39

$1.37

Description

A bullish outlook is projected as the market may respond positively to economic recovery signals. The long-term trend suggests a potential breakout above resistance levels. However, macroeconomic uncertainties could pose risks.

Analysis

The overall trend for GBPUSD has been bearish, but signs of recovery are emerging. Key resistance levels are critical, and the market's response to economic data will be pivotal. Technical indicators suggest potential upward movement, but caution is warranted.

Confidence Level

Potential Risks

Global economic conditions and potential geopolitical tensions could derail the bullish scenario. The market remains susceptible to volatility.