GBPUSDX Trading Predictions

1 Day Prediction

Target: July 30, 2025$1.335

$1.3355

$1.337

$1.334

Description

The market shows bearish momentum with a recent downtrend. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, and the price is near support levels, indicating possible consolidation.

Analysis

Over the past 3 months, GBPUSD has shown a bearish trend with significant resistance around 1.36. Recent candlestick patterns indicate indecision, and volume has been low, suggesting a lack of strong conviction. Key support is around 1.33.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish reversal is possible if sentiment shifts.

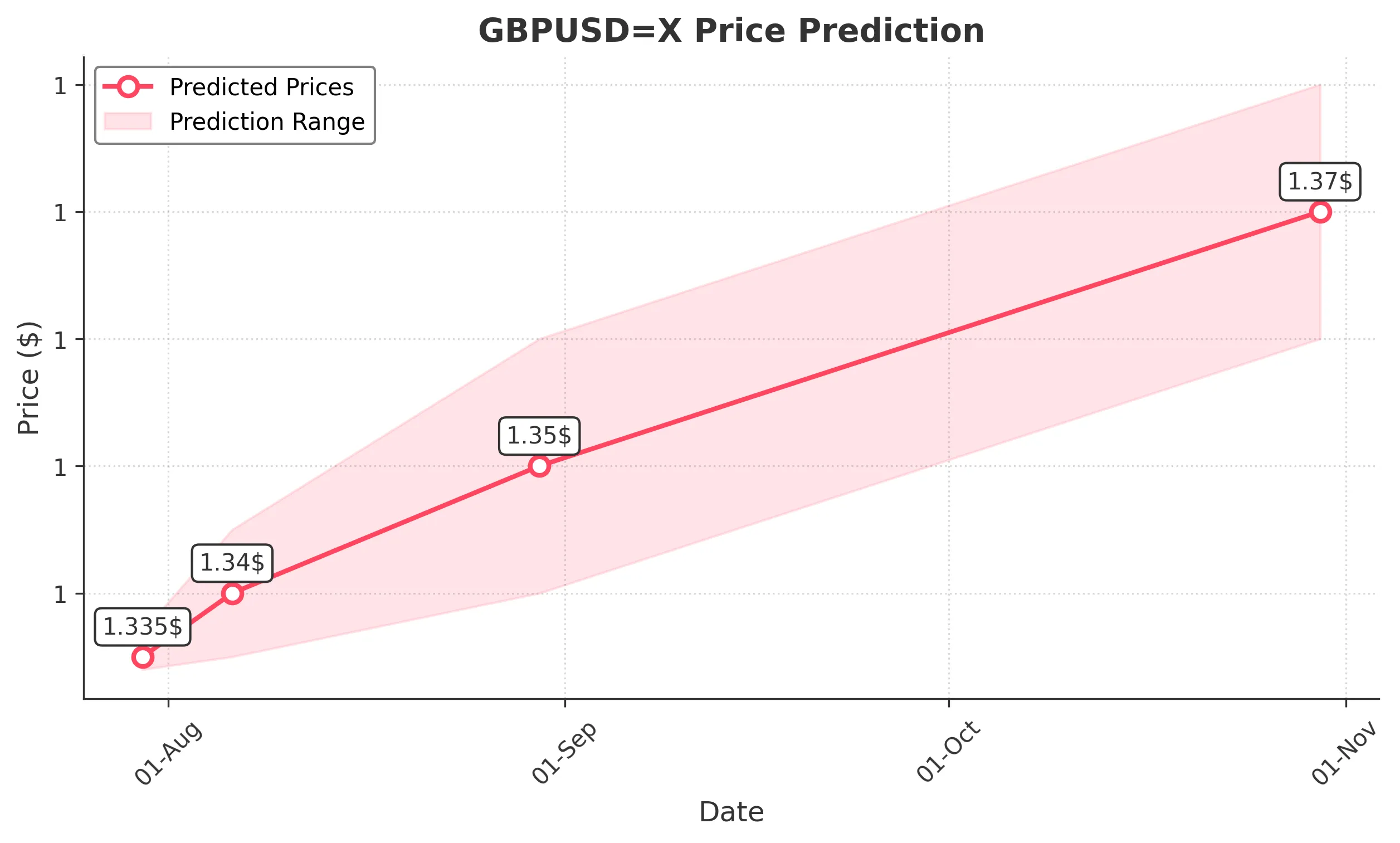

1 Week Prediction

Target: August 6, 2025$1.34

$1.336

$1.345

$1.335

Description

Expect a slight recovery as the market may find support at 1.33. The RSI is improving, and a bullish divergence is forming. However, MACD remains bearish, indicating potential resistance at 1.34.

Analysis

The past 3 months have seen a bearish trend with key support at 1.33. Recent price action shows a struggle to maintain higher levels, and volume spikes have been minimal, indicating weak buying interest.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to volatility. The bearish trend may resume if resistance levels hold.

1 Month Prediction

Target: August 30, 2025$1.35

$1.345

$1.36

$1.34

Description

A potential recovery towards 1.35 is anticipated as the market stabilizes. The RSI may approach neutral levels, and if bullish momentum builds, we could see a test of resistance at 1.36.

Analysis

The overall trend has been bearish, with significant resistance at 1.36. Recent price action shows attempts to stabilize, but volume remains low, indicating uncertainty. Key support at 1.33 is critical.

Confidence Level

Potential Risks

Market sentiment is fragile, and any negative news could reverse the trend. The potential for a bearish continuation remains.

3 Months Prediction

Target: October 30, 2025$1.37

$1.365

$1.38

$1.36

Description

If the bullish momentum continues, we may see a gradual rise towards 1.37. However, the market remains sensitive to macroeconomic factors, and resistance at 1.38 could pose challenges.

Analysis

The past 3 months have shown a bearish trend with key resistance at 1.36. The market is currently in a consolidation phase, and any bullish breakout will depend on external economic conditions and market sentiment.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic shifts and geopolitical events that could impact currency strength.