GBPUSDX Trading Predictions

1 Day Prediction

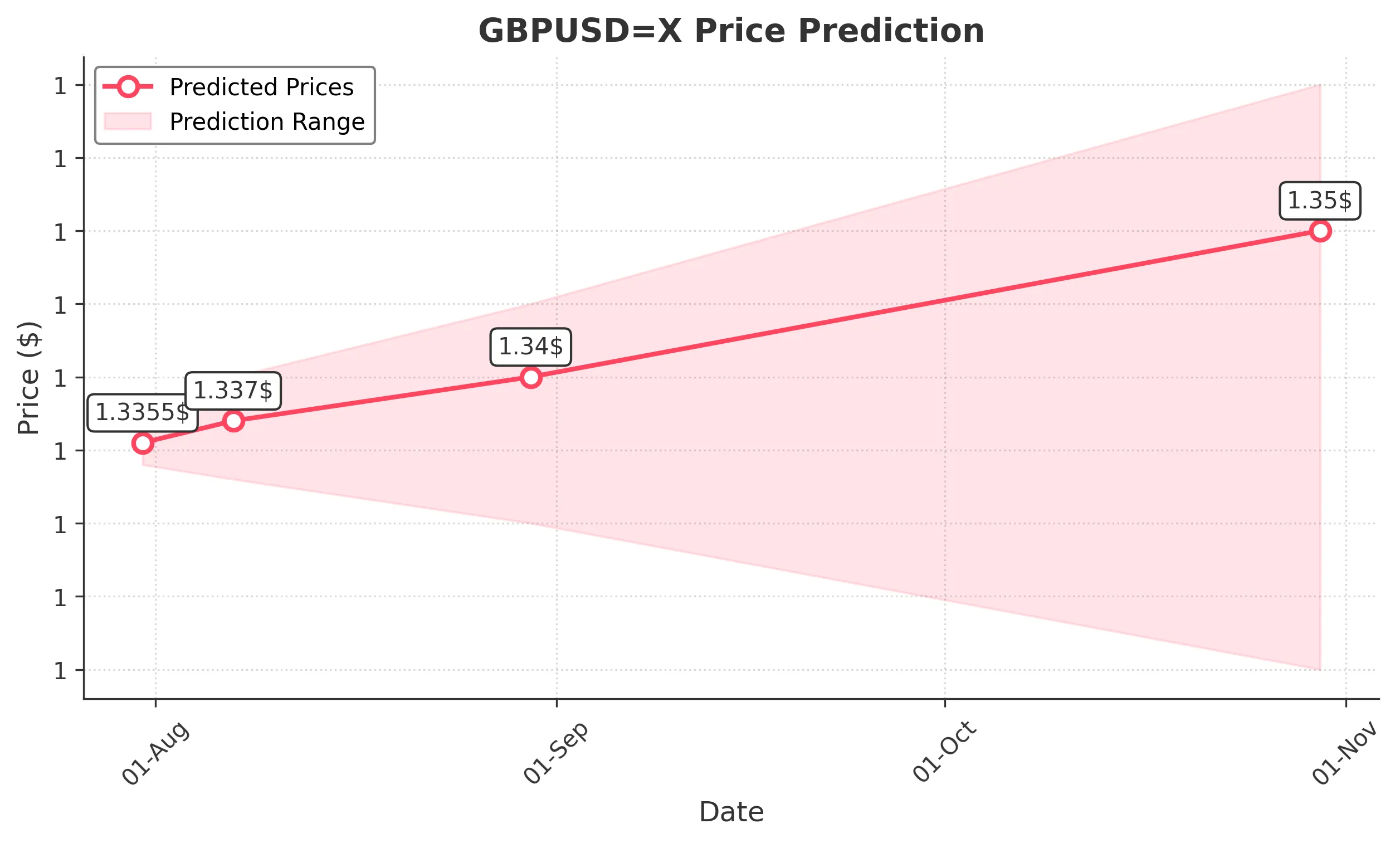

Target: July 31, 2025$1.3355

$1.335292

$1.337

$1.334

Description

The market shows signs of consolidation with a slight bearish trend. The RSI is approaching oversold levels, indicating potential for a bounce. However, recent candlestick patterns suggest indecision, which may lead to a minor pullback.

Analysis

Over the past 3 months, GBPUSD has shown a bearish trend with significant support around 1.3350. The recent price action indicates a potential reversal, but the overall sentiment remains cautious. Technical indicators like MACD are showing bearish divergence, while volume has been low, indicating a lack of strong conviction.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden shift in sentiment may lead to unexpected price movements.

1 Week Prediction

Target: August 7, 2025$1.337

$1.3355

$1.34

$1.333

Description

A slight recovery is expected as the market may find support at 1.3350. The RSI is showing signs of recovery, and if the price breaks above 1.3400, it could signal a bullish reversal. However, caution is advised due to potential resistance levels.

Analysis

The past three months have seen GBPUSD fluctuating around key support levels. The recent bearish trend has been met with some buying interest, but overall market sentiment remains mixed. Technical indicators suggest a possible short-term recovery, but the risk of further declines persists.

Confidence Level

Potential Risks

The potential for a bearish reversal remains if the price fails to break key resistance levels. Economic data releases could also influence market sentiment.

1 Month Prediction

Target: August 30, 2025$1.34

$1.337

$1.345

$1.33

Description

Expect a gradual recovery as the market stabilizes. If the price can hold above 1.3350, it may attract more buyers. However, macroeconomic factors and geopolitical events could introduce volatility.

Analysis

The GBPUSD has been in a bearish phase, but recent price action suggests a potential bottoming out. Key support at 1.3350 has held, and if bullish momentum builds, we could see a return to previous highs. However, the overall trend remains uncertain.

Confidence Level

Potential Risks

Unforeseen economic data or geopolitical tensions could lead to significant price swings. The market remains sensitive to external influences.

3 Months Prediction

Target: October 30, 2025$1.35

$1.34

$1.36

$1.32

Description

A longer-term bullish outlook is anticipated if the market can break above 1.3500. The potential for a recovery exists, but external economic conditions will play a crucial role in sustaining upward momentum.

Analysis

The GBPUSD has experienced significant fluctuations over the past three months, with key support and resistance levels shaping the price action. While there are signs of potential recovery, the overall market sentiment remains cautious, and external factors could heavily influence future performance.

Confidence Level

Potential Risks

Long-term predictions are highly susceptible to macroeconomic changes and geopolitical events. The risk of a bearish trend remains if economic indicators disappoint.