GBPUSDX Trading Predictions

1 Day Prediction

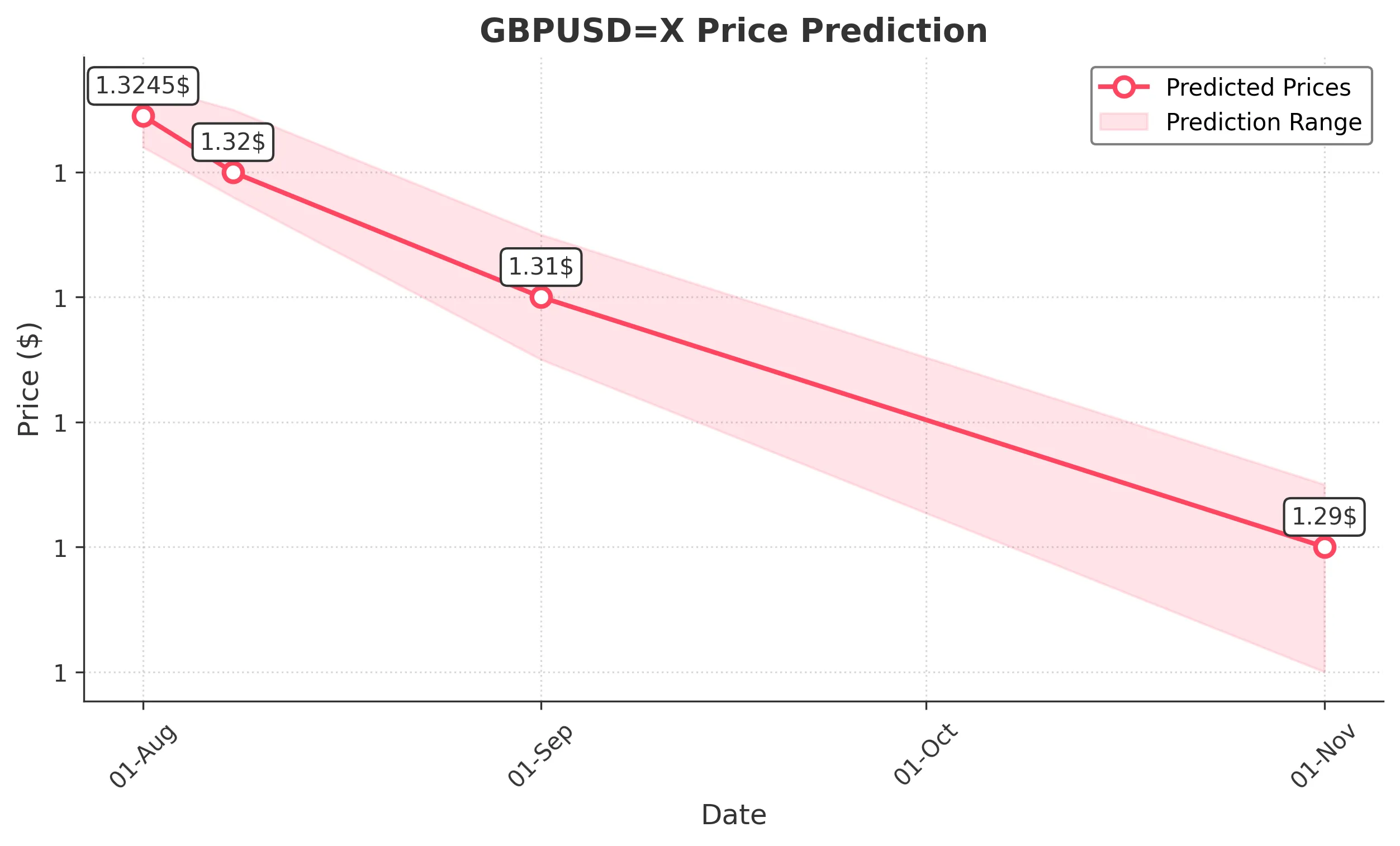

Target: August 1, 2025$1.3245

$1.325

$1.327

$1.322

Description

The recent bearish trend, indicated by lower highs and lower lows, suggests a continuation. RSI is nearing oversold levels, but MACD shows a bearish crossover. Expect a slight decline as market sentiment remains cautious.

Analysis

Over the past 3 months, GBPUSD has shown a bearish trend with significant resistance around 1.35. Technical indicators like the MACD and RSI indicate weakness, while volume has been low, suggesting lack of conviction in upward moves. Recent macroeconomic data has also been mixed, contributing to uncertainty.

Confidence Level

Potential Risks

Potential for a reversal exists if bullish news emerges or if oversold conditions trigger buying.

1 Week Prediction

Target: August 8, 2025$1.32

$1.324

$1.325

$1.318

Description

Continued bearish momentum is expected as the market reacts to recent economic data. The Bollinger Bands indicate potential for further downside, and the ATR suggests increasing volatility. Watch for support at 1.32.

Analysis

The GBPUSD has been in a downtrend, with key support at 1.32. The MACD remains bearish, and the RSI indicates potential oversold conditions. Volume has been low, indicating a lack of strong buying interest. External factors, including geopolitical tensions, may also impact price.

Confidence Level

Potential Risks

Economic announcements could shift sentiment quickly, leading to unexpected volatility.

1 Month Prediction

Target: September 1, 2025$1.31

$1.32

$1.315

$1.305

Description

A bearish outlook persists as the market adjusts to economic conditions. Fibonacci retracement levels suggest a target around 1.31. The overall trend remains downward, with potential for further declines if economic data disappoints.

Analysis

The GBPUSD has been trending downwards, with significant resistance at 1.35 and support around 1.31. Technical indicators show bearish momentum, and recent economic data has not supported a bullish reversal. Volume patterns indicate a lack of strong buying interest, suggesting continued bearish pressure.

Confidence Level

Potential Risks

Market sentiment can shift rapidly based on economic indicators or geopolitical events, which may lead to unexpected price movements.

3 Months Prediction

Target: November 1, 2025$1.29

$1.295

$1.295

$1.28

Description

Long-term bearish trends suggest a potential decline towards 1.29. Economic conditions and market sentiment are likely to remain weak, with the possibility of further downside if key support levels are breached.

Analysis

The GBPUSD has shown a consistent bearish trend over the past three months, with key resistance at 1.35 and support at 1.31. Technical indicators suggest continued weakness, and external economic factors may further influence price. The market sentiment remains cautious, with potential for further declines.

Confidence Level

Potential Risks

Unforeseen economic developments or policy changes could alter the trajectory significantly, leading to volatility.