GBPUSDX Trading Predictions

1 Day Prediction

Target: August 2, 2025$1.3215

$1.32083

$1.324

$1.319

Description

The market shows a slight bearish trend with recent lower closes. RSI indicates oversold conditions, suggesting a potential bounce. However, resistance at 1.3250 may limit upward movement.

Analysis

The past three months show a bearish trend with significant resistance around 1.3250. The recent price action indicates a struggle to maintain higher levels, with support at 1.3200. Volume has been low, indicating lack of conviction.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden shift in sentiment may lead to unexpected price movements.

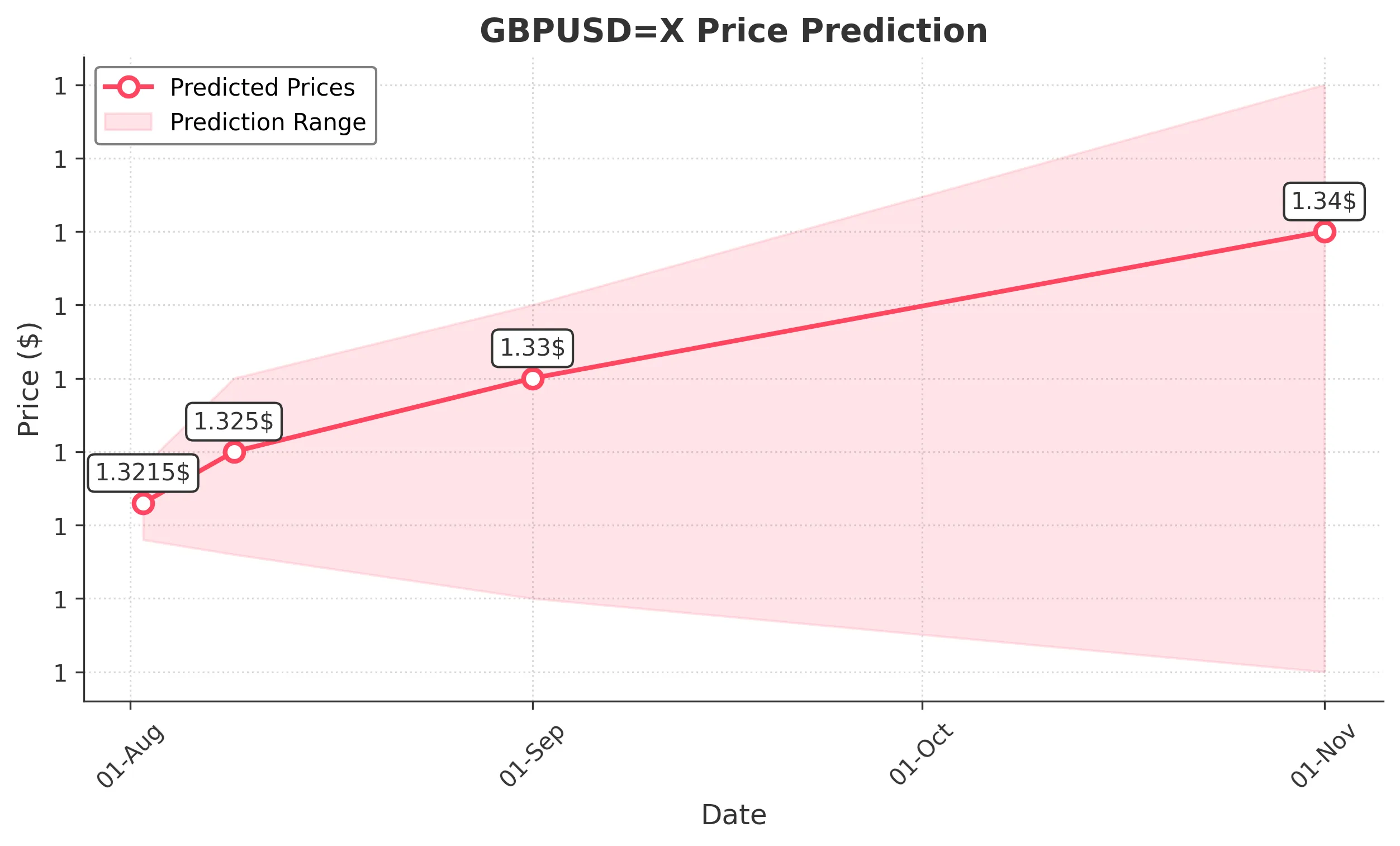

1 Week Prediction

Target: August 9, 2025$1.325

$1.3215

$1.33

$1.318

Description

Expect a slight recovery as the market may test the resistance at 1.3250. However, bearish sentiment persists, and any failure to break above could lead to further declines.

Analysis

The stock has been in a bearish phase, with recent lows indicating weakness. The RSI is approaching neutral, suggesting a possible consolidation phase. Key resistance remains at 1.3250, while support is at 1.3180.

Confidence Level

Potential Risks

Potential geopolitical events or economic data releases could shift market sentiment unexpectedly, impacting the forecast.

1 Month Prediction

Target: September 1, 2025$1.33

$1.325

$1.335

$1.315

Description

A gradual recovery is anticipated as the market may stabilize around 1.3300. However, bearish pressures remain, and any negative news could reverse this trend.

Analysis

The overall trend remains bearish, but a potential reversal could occur if the price holds above 1.3200. The market is currently in a consolidation phase, with key levels to watch at 1.3300 and 1.3150.

Confidence Level

Potential Risks

Economic indicators and central bank policies could significantly influence the market direction, leading to unexpected volatility.

3 Months Prediction

Target: November 1, 2025$1.34

$1.33

$1.35

$1.31

Description

Longer-term outlook suggests a potential bullish reversal if the price can break above 1.3400. However, macroeconomic factors could pose risks to this prediction.

Analysis

The market has shown signs of weakness, but a recovery could be on the horizon if key resistance levels are breached. The overall sentiment remains cautious, with significant external factors likely to influence future price movements.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant price fluctuations, impacting the accuracy of this forecast.