GBPUSDX Trading Predictions

1 Day Prediction

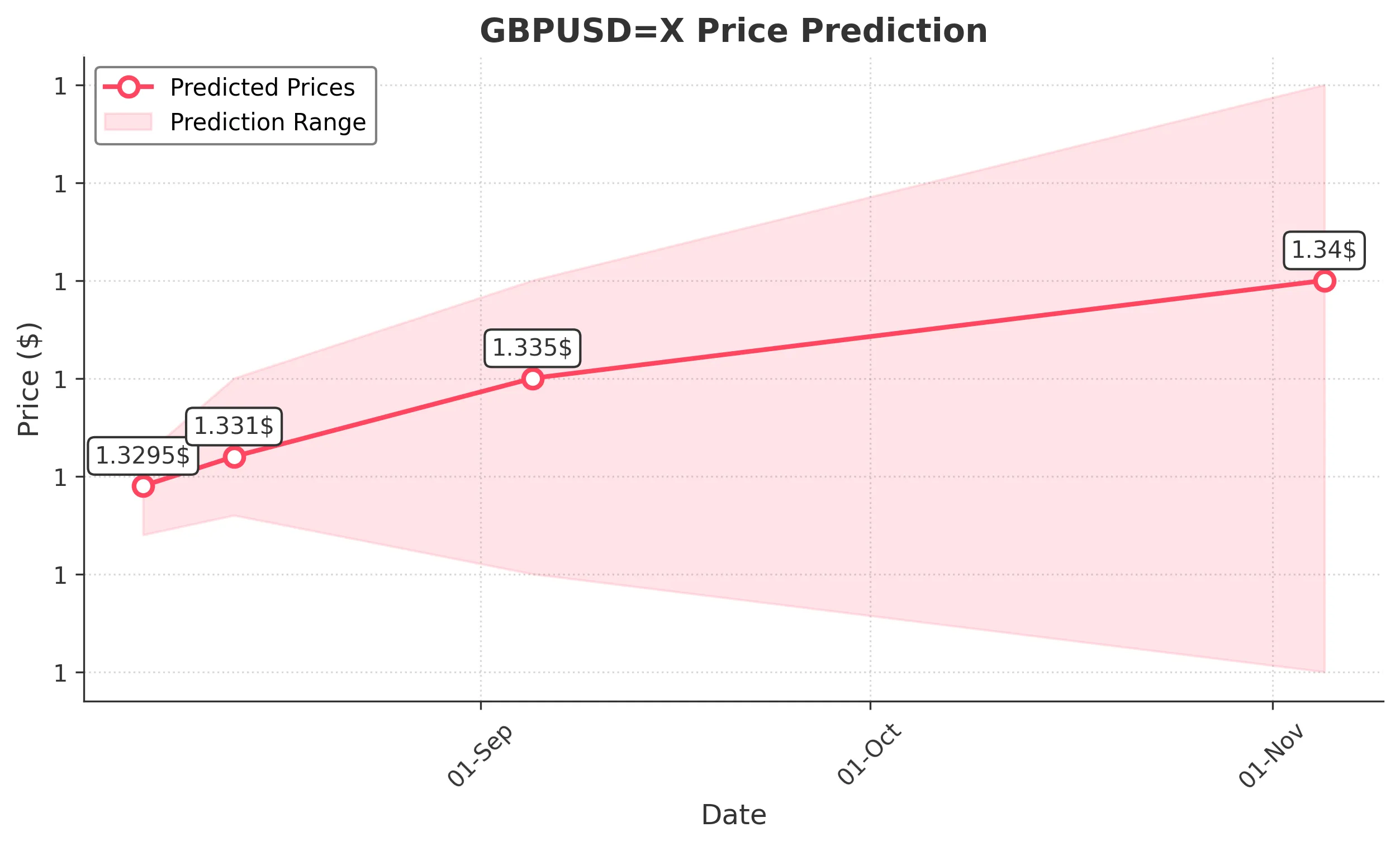

Target: August 6, 2025$1.3295

$1.3285

$1.331

$1.327

Description

The price is expected to stabilize around 1.3295, supported by recent bullish momentum. RSI indicates neutrality, while MACD shows a slight bullish crossover. However, recent volatility suggests caution.

Analysis

The past three months show a bearish trend with significant support around 1.3200. Recent price action indicates a potential reversal, but the overall sentiment remains cautious. Volume has been low, indicating a lack of strong conviction.

Confidence Level

Potential Risks

Potential for sudden market shifts due to external news or economic data releases could impact accuracy.

1 Week Prediction

Target: August 13, 2025$1.331

$1.3295

$1.335

$1.328

Description

Expect a slight upward movement as the market digests recent data. The 50-day moving average is providing support, while the Bollinger Bands suggest a potential breakout. However, caution is warranted due to mixed signals.

Analysis

The stock has shown a sideways trend recently, with resistance at 1.3400. Technical indicators are mixed, with some bullish signals from MACD but bearish pressure from recent lows. Volume remains low, indicating uncertainty.

Confidence Level

Potential Risks

Market sentiment could shift quickly based on geopolitical events or economic indicators, leading to unexpected volatility.

1 Month Prediction

Target: September 5, 2025$1.335

$1.33

$1.34

$1.325

Description

A gradual increase is anticipated as the market stabilizes. Fibonacci retracement levels suggest 1.3350 as a target. However, the RSI indicates potential overbought conditions, which could lead to pullbacks.

Analysis

The last three months have seen a bearish trend with a recent attempt to recover. Key resistance at 1.3400 remains, while support is around 1.3200. Mixed signals from indicators suggest a cautious approach.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could significantly impact market direction, introducing uncertainty.

3 Months Prediction

Target: November 5, 2025$1.34

$1.335

$1.35

$1.32

Description

Expect a gradual recovery towards 1.3400 as market sentiment improves. The MACD shows potential bullish divergence, but external factors could introduce volatility.

Analysis

The overall trend has been bearish, with significant resistance at 1.3400. Recent price action suggests a potential reversal, but external factors and low volume indicate caution. The market remains sensitive to macroeconomic developments.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential economic shifts and geopolitical tensions that could affect currency markets.