GBPUSDX Trading Predictions

1 Day Prediction

Target: August 8, 2025$1.3365

$1.3358

$1.339

$1.334

Description

The recent bullish momentum, indicated by the last few candlesticks and a slight upward trend in the moving averages, suggests a potential increase in price. However, resistance at 1.339 may limit gains.

Analysis

Over the past 3 months, GBPUSD has shown a bearish trend with significant support around 1.3200. The RSI indicates oversold conditions, while MACD shows a potential bullish crossover. Volume has been low, indicating a lack of strong conviction in price movements.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the prediction.

1 Week Prediction

Target: August 15, 2025$1.34

$1.3365

$1.345

$1.335

Description

A continuation of the upward trend is expected as the market reacts positively to recent economic data. The Bollinger Bands suggest potential upward movement, but resistance at 1.345 could pose challenges.

Analysis

The market has been fluctuating around the 1.3300 level, with recent bullish candlestick patterns indicating a possible reversal. The ATR suggests increasing volatility, and the market sentiment remains cautious.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could reverse the trend.

1 Month Prediction

Target: September 8, 2025$1.35

$1.34

$1.36

$1.34

Description

If the bullish trend continues, we may see a rise towards 1.3500, supported by positive economic indicators. However, resistance levels at 1.3600 could limit further gains.

Analysis

The GBPUSD has been in a sideways trend with key resistance at 1.3600. The RSI is approaching neutral territory, indicating indecision. Volume patterns suggest a lack of strong buying or selling pressure.

Confidence Level

Potential Risks

Potential geopolitical tensions and economic data releases could lead to volatility.

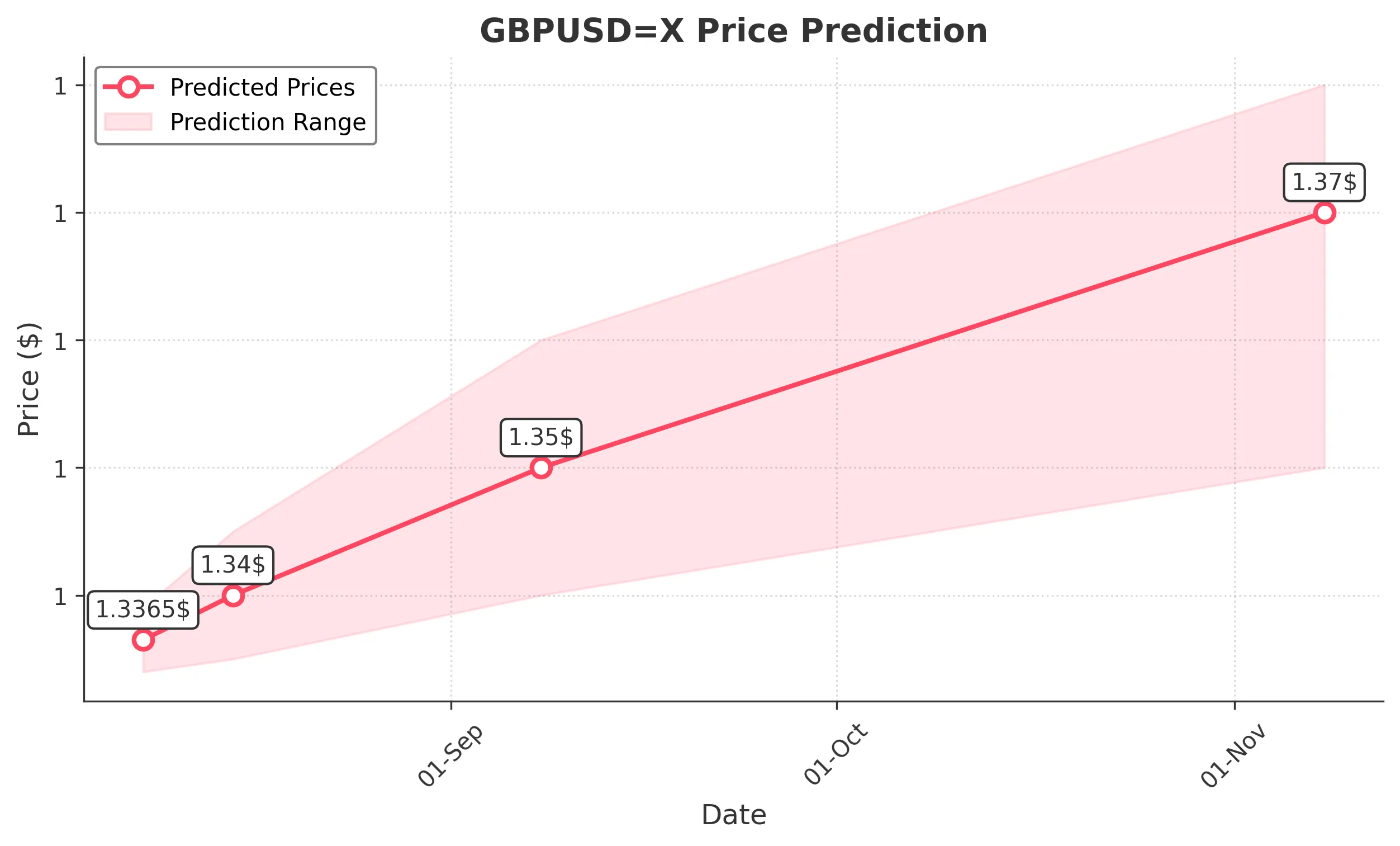

3 Months Prediction

Target: November 8, 2025$1.37

$1.36

$1.38

$1.35

Description

If the current bullish momentum persists, we could see prices reaching 1.3700. However, macroeconomic factors and potential resistance at 1.3800 may hinder this growth.

Analysis

The overall trend has been bearish, but recent price action shows signs of recovery. Key support at 1.3400 and resistance at 1.3800 are critical levels to watch. The market remains sensitive to economic data and geopolitical developments.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic shifts and market sentiment changes.