GBPUSDX Trading Predictions

1 Day Prediction

Target: August 14, 2025$1.351

$1.35

$1.3535

$1.348

Description

The price is expected to rise slightly due to bullish momentum indicated by recent candlestick patterns and a positive MACD crossover. However, resistance at 1.3535 may limit gains.

Analysis

The past 3 months show a bearish trend with significant support around 1.3400. Recent price action indicates a potential reversal, but the overall sentiment remains cautious. RSI is neutral, suggesting indecision.

Confidence Level

Potential Risks

Potential volatility due to external market news could impact the prediction.

1 Week Prediction

Target: August 21, 2025$1.355

$1.352

$1.36

$1.35

Description

A gradual increase is anticipated as the market may react positively to upcoming economic data. The RSI shows signs of recovery, indicating potential upward momentum.

Analysis

The stock has shown a sideways trend recently, with resistance at 1.3600. Volume has been low, indicating a lack of strong conviction. The MACD is showing a bullish divergence, which could support upward movement.

Confidence Level

Potential Risks

Market sentiment could shift quickly based on geopolitical events or economic reports.

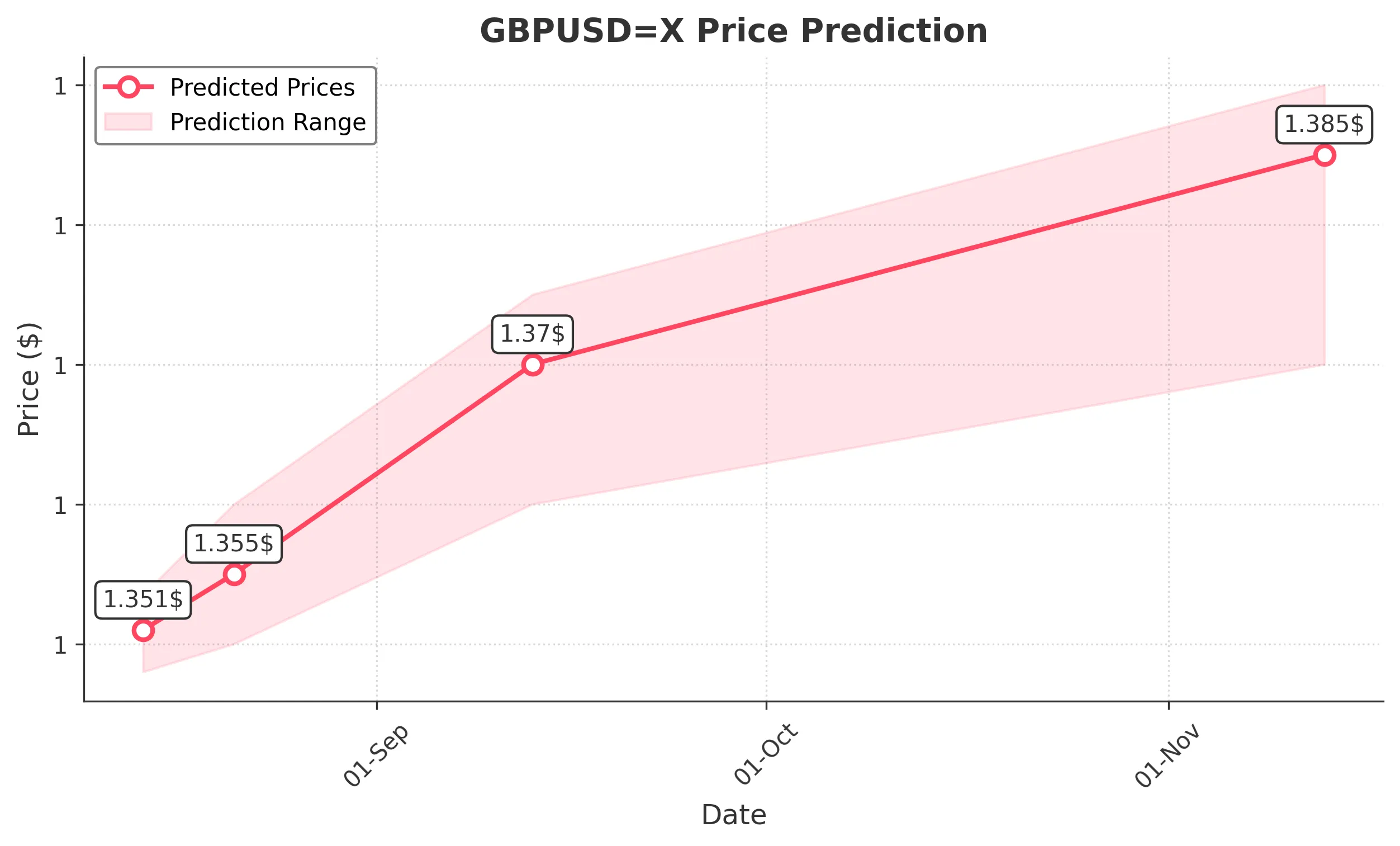

1 Month Prediction

Target: September 13, 2025$1.37

$1.365

$1.375

$1.36

Description

Expect a bullish trend as the market stabilizes and economic indicators improve. Fibonacci retracement levels suggest a target around 1.3700, supported by a bullish MACD.

Analysis

The last three months have shown a bearish trend, but recent price action indicates a potential reversal. Key support at 1.3400 and resistance at 1.3750 are critical levels to watch.

Confidence Level

Potential Risks

Unexpected economic data releases could alter the trajectory.

3 Months Prediction

Target: November 13, 2025$1.385

$1.38

$1.39

$1.37

Description

Long-term bullish sentiment is expected as economic recovery takes hold. The price may test the 1.3900 resistance level, supported by positive macroeconomic indicators.

Analysis

The overall trend has been bearish, but signs of recovery are emerging. Key resistance levels at 1.3900 and support at 1.3600 will be crucial in determining the future direction.

Confidence Level

Potential Risks

Long-term predictions are subject to significant uncertainty due to potential economic shifts.