GBPUSDX Trading Predictions

1 Day Prediction

Target: August 15, 2025$1.357

$1.356

$1.36

$1.354

Description

The price is expected to stabilize around 1.357, supported by recent bullish candlestick patterns. RSI indicates neutrality, while MACD shows a slight bullish divergence. However, market sentiment remains cautious due to potential geopolitical tensions.

Analysis

Over the past 3 months, GBPUSD has shown a bearish trend with significant support around 1.3400. Recent price action indicates a potential reversal, but the overall sentiment remains mixed. Key resistance is at 1.3600, while the RSI is hovering around 50, indicating indecision.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction, especially if economic data releases are unfavorable.

1 Week Prediction

Target: August 22, 2025$1.36

$1.358

$1.365

$1.355

Description

A slight upward trend is anticipated as the market reacts positively to recent economic data. The MACD is showing bullish momentum, and the price is approaching the upper Bollinger Band, suggesting potential resistance at 1.365.

Analysis

The last three months have seen GBPUSD fluctuating between 1.3400 and 1.3600. The recent bullish candlestick patterns suggest a potential upward movement, but the market remains sensitive to external factors. Volume has been low, indicating a lack of strong conviction.

Confidence Level

Potential Risks

Unexpected economic reports or geopolitical events could lead to volatility, impacting the accuracy of this prediction.

1 Month Prediction

Target: September 14, 2025$1.37

$1.365

$1.375

$1.355

Description

Expect a gradual increase in price as bullish sentiment builds. The Fibonacci retracement levels suggest a target around 1.370, supported by a potential breakout above recent resistance levels. However, caution is advised due to possible market corrections.

Analysis

The GBPUSD has been in a consolidation phase, with key support at 1.3400 and resistance at 1.3600. The RSI indicates a potential bullish trend, but the market remains cautious. Volume patterns suggest a lack of strong buying interest, which could limit upward movement.

Confidence Level

Potential Risks

The prediction is subject to changes in economic indicators and potential market corrections that could reverse the trend.

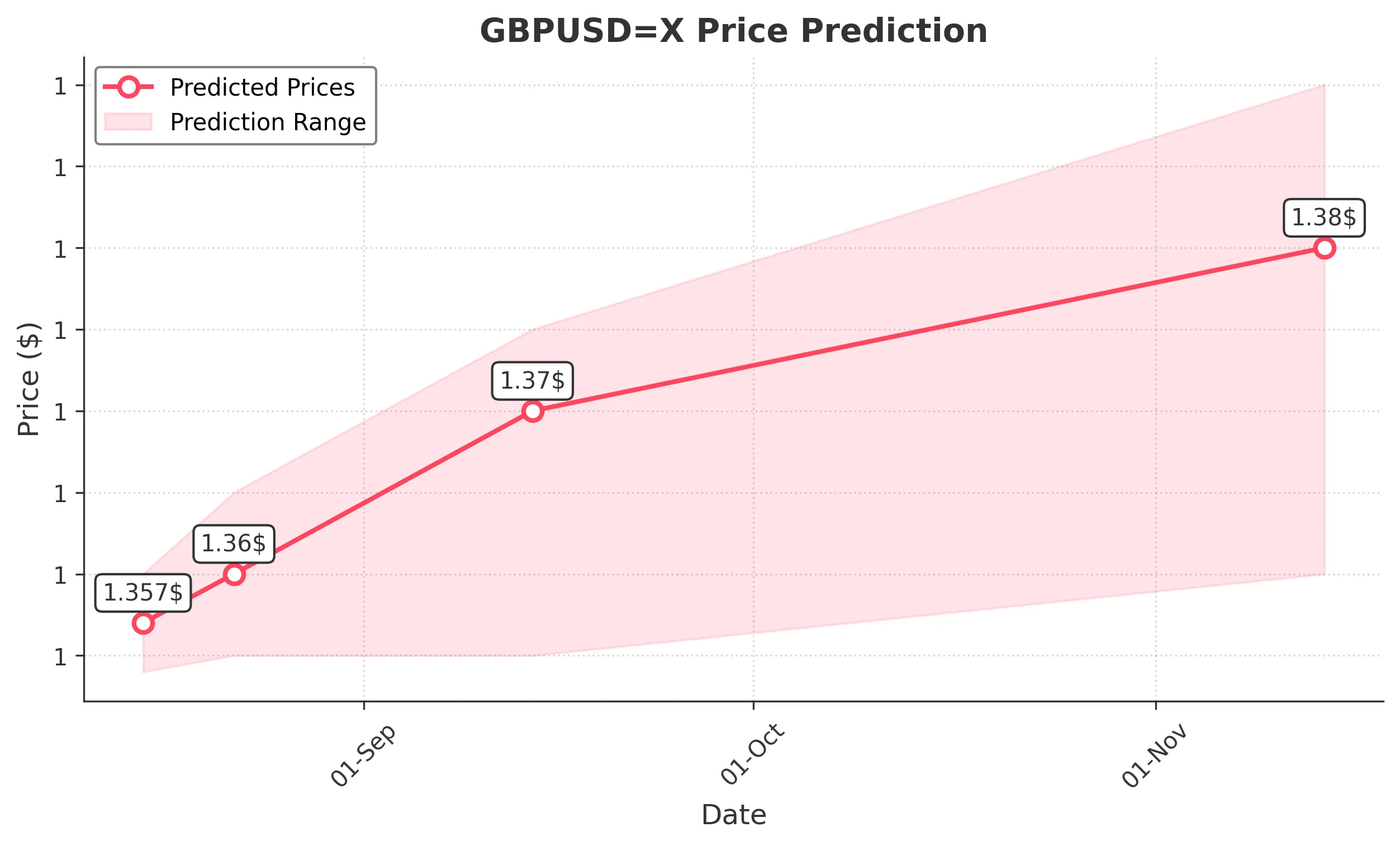

3 Months Prediction

Target: November 14, 2025$1.38

$1.375

$1.39

$1.36

Description

Long-term bullish sentiment is expected as economic recovery signals strengthen. The MACD indicates a strong upward trend, and the price may test the 1.390 resistance level. However, external economic shocks could pose risks.

Analysis

The overall trend for GBPUSD has been bearish, but recent patterns suggest a potential reversal. Key resistance levels are at 1.3900, while support remains at 1.3400. The market is influenced by macroeconomic factors, including interest rate changes and inflation data.

Confidence Level

Potential Risks

Long-term predictions are inherently uncertain, especially with potential economic shifts and geopolitical tensions that could impact currency strength.