GOLD Trading Predictions

1 Day Prediction

Target: April 9, 2025$3020

$3015

$3040

$3000

Description

The stock shows a slight bullish trend with a potential close around 3020. The RSI is neutral, and MACD indicates a possible upward momentum. However, recent volatility suggests caution.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant resistance around 3100. Recent price action indicates volatility, with support at 2950. Technical indicators suggest a potential pullback, but overall sentiment remains cautiously optimistic.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the price.

1 Week Prediction

Target: April 16, 2025$2980

$2990

$3000

$2950

Description

A bearish reversal pattern is forming, suggesting a potential decline to 2980. The MACD is showing divergence, and volume has decreased, indicating weakening momentum.

Analysis

The stock has experienced fluctuations, with a recent peak at 3122. The RSI indicates overbought conditions, and a correction may be imminent. Key support at 2950 will be critical in the coming week.

Confidence Level

Potential Risks

Unexpected market news or changes in economic indicators could lead to a different outcome.

1 Month Prediction

Target: May 8, 2025$2900

$2920

$2950

$2850

Description

The stock is expected to trend lower due to bearish signals from the MACD and RSI. A potential test of support at 2900 is likely, with increased volatility anticipated.

Analysis

GC=F has shown a strong upward trend but is now facing resistance. The recent price action suggests a possible correction. Key support levels will be tested, and macroeconomic factors could play a significant role in future performance.

Confidence Level

Potential Risks

Market conditions can change rapidly, and external factors may influence the price significantly.

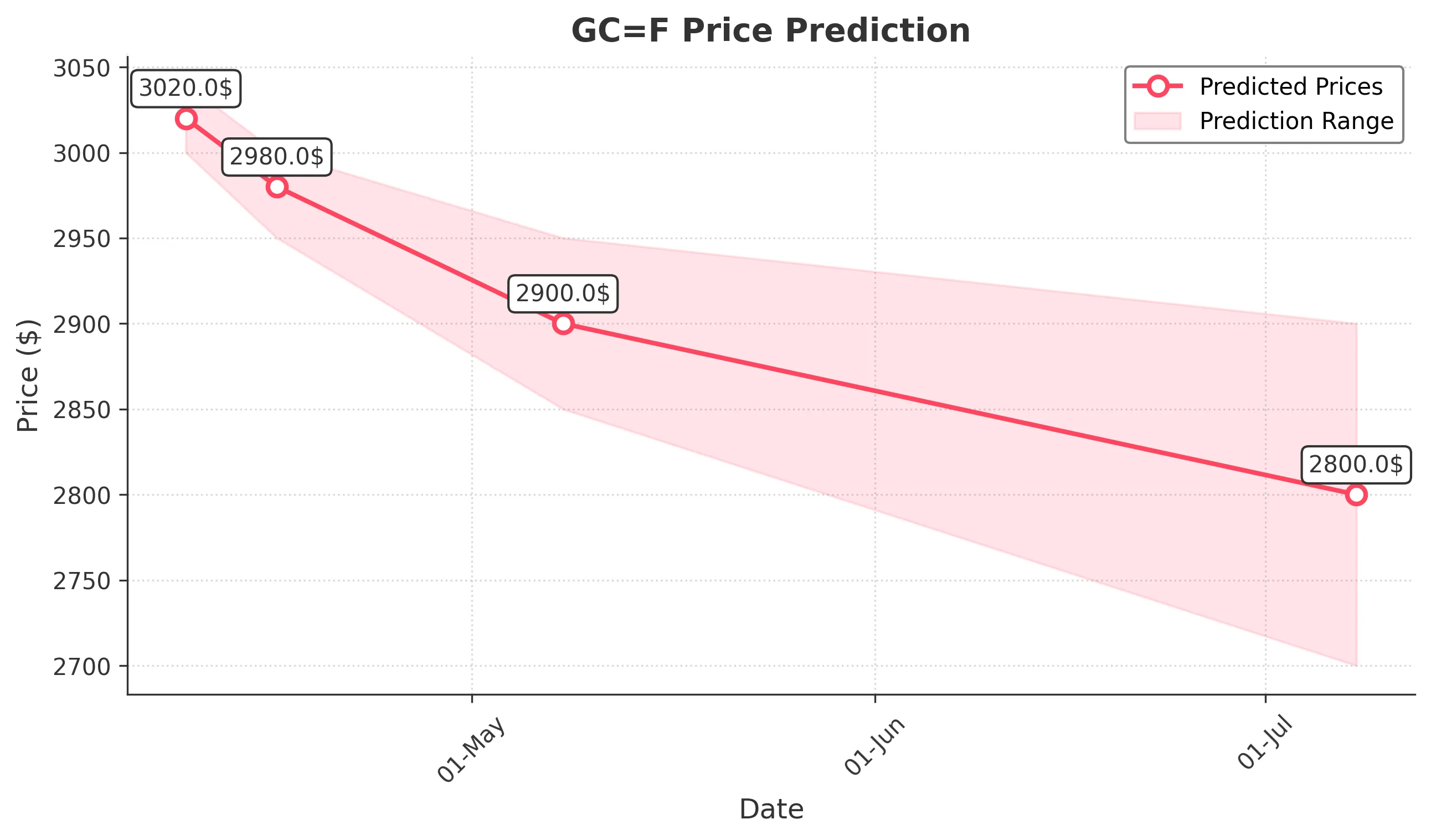

3 Months Prediction

Target: July 8, 2025$2800

$2850

$2900

$2700

Description

Long-term indicators suggest a bearish trend, with potential declines towards 2800. The market may react to economic data releases, impacting investor sentiment.

Analysis

The stock has been on a bullish run but is showing signs of exhaustion. Key resistance levels are being tested, and a bearish trend may develop if support levels fail. Market sentiment is mixed, with potential external influences looming.

Confidence Level

Potential Risks

Long-term predictions are inherently uncertain, and unexpected geopolitical or economic events could alter the trajectory.