GOLD Trading Predictions

1 Day Prediction

Target: April 10, 2025$3020

$3015

$3040

$3000

Description

The stock shows a slight bullish trend with a recent close above the 50-day moving average. RSI indicates overbought conditions, suggesting a potential pullback. Volume spikes on recent days indicate strong interest, but caution is advised due to volatility.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant upward movement, reaching highs around 3132. Key support is at 2950, while resistance is near 3160. RSI is high, indicating overbought conditions, and recent volume spikes suggest strong interest but also potential for profit-taking.

Confidence Level

Potential Risks

Potential for a reversal exists if market sentiment shifts or macroeconomic news impacts trading.

1 Week Prediction

Target: April 17, 2025$2980

$3000

$3025

$2950

Description

Expect a slight pullback as the stock approaches resistance levels. The MACD shows signs of divergence, and the RSI is nearing overbought territory. Volume may decrease as traders take profits, leading to a potential dip.

Analysis

The stock has been on a bullish run, but recent candlestick patterns suggest a potential reversal. Key support at 2950 and resistance at 3160 remain critical. The ATR indicates increasing volatility, and market sentiment is mixed, with some traders cautious about overbought conditions.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements.

1 Month Prediction

Target: May 9, 2025$2900

$2950

$2950

$2850

Description

A bearish trend may develop as profit-taking occurs. The stock is likely to test support levels around 2850. The RSI indicates a potential correction, and the MACD is showing bearish signals.

Analysis

The stock has experienced significant volatility, with recent highs followed by potential profit-taking. Key support at 2850 is critical, and if broken, further declines could occur. The market sentiment is cautious, with mixed signals from technical indicators suggesting a possible correction.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or changes in market sentiment could impact this prediction.

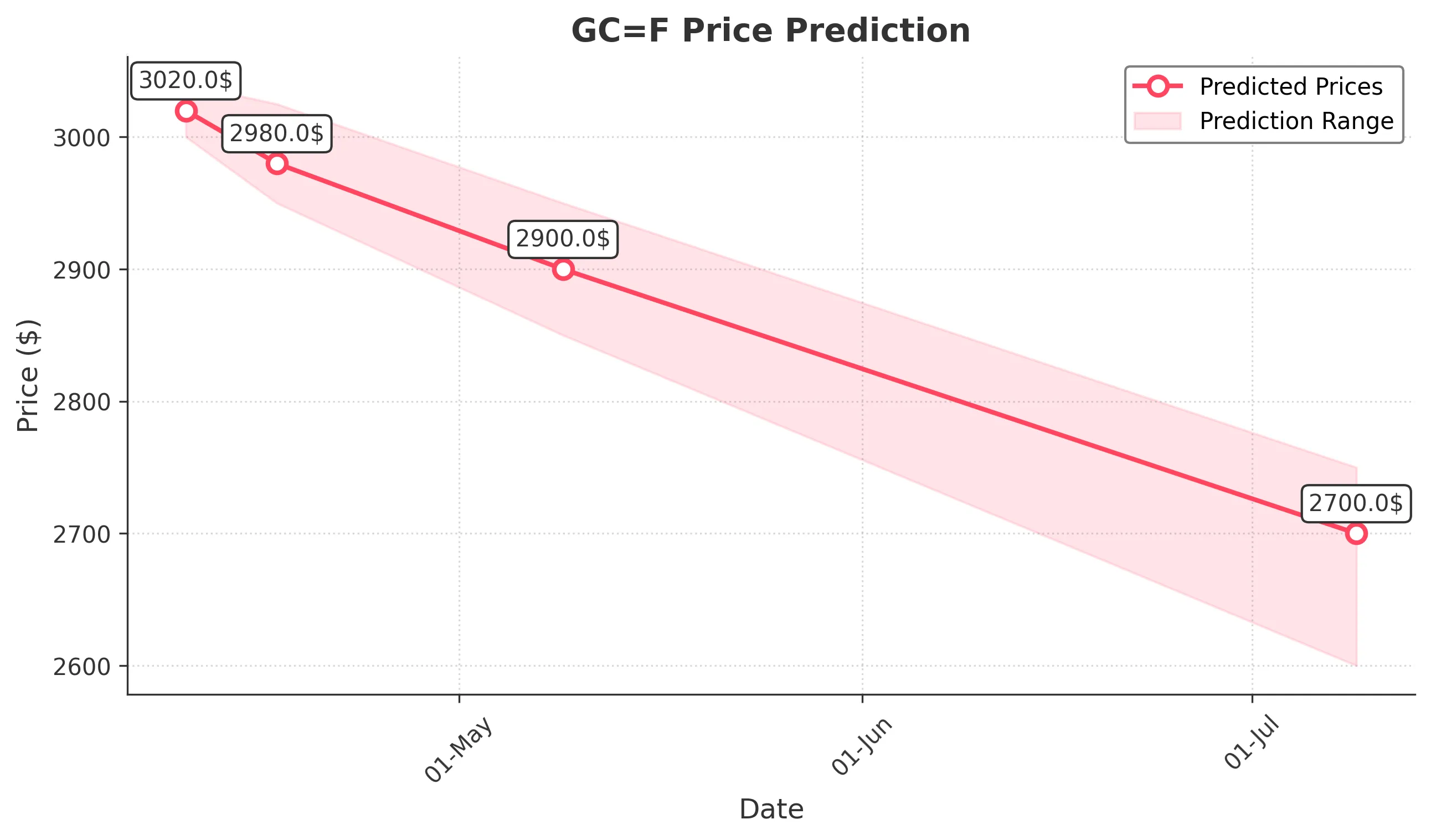

3 Months Prediction

Target: July 9, 2025$2700

$2750

$2750

$2600

Description

Long-term bearish sentiment may prevail as economic conditions shift. The stock could face significant resistance at 2750, with potential declines towards 2600. Technical indicators suggest a bearish trend.

Analysis

The stock has shown a strong bullish trend but is now facing potential headwinds. Key resistance levels are evident, and if the market sentiment shifts negatively, a decline towards 2600 could occur. The overall trend is uncertain, with external factors likely influencing future performance.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could drastically alter market conditions.