GOLD Trading Predictions

1 Day Prediction

Target: April 24, 2025$3355

$3350

$3370

$3340

Description

The stock shows a bullish trend with a recent breakout above resistance at 3350. The RSI indicates overbought conditions, suggesting a potential pullback. However, strong buying volume supports upward momentum.

Analysis

Over the past 3 months, GC=F has shown a bullish trend, breaking key resistance levels. The MACD is positive, and the ATR indicates increasing volatility. Volume spikes on up days suggest strong buying interest, but the RSI indicates overbought conditions.

Confidence Level

Potential Risks

Potential profit-taking could lead to volatility. Market sentiment may shift due to macroeconomic news.

1 Week Prediction

Target: May 1, 2025$3300

$3340

$3350

$3280

Description

A slight bearish correction is expected as the stock approaches resistance. The RSI is high, indicating potential overbought conditions. A pullback to support levels around 3300 is likely.

Analysis

The stock has been in a strong uptrend, but recent candlestick patterns suggest exhaustion. Key support is at 3300, and the MACD shows signs of divergence, indicating potential weakness ahead.

Confidence Level

Potential Risks

Market sentiment could shift rapidly based on economic data releases, impacting the prediction.

1 Month Prediction

Target: May 23, 2025$3250

$3300

$3300

$3200

Description

Expect a continued bearish trend as profit-taking and macroeconomic factors weigh on prices. The stock may test lower support levels around 3200.

Analysis

The stock has shown signs of weakening momentum. The Bollinger Bands are tightening, indicating potential volatility. Volume has decreased, suggesting waning interest. A bearish divergence in the MACD supports the outlook.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could alter the trajectory significantly.

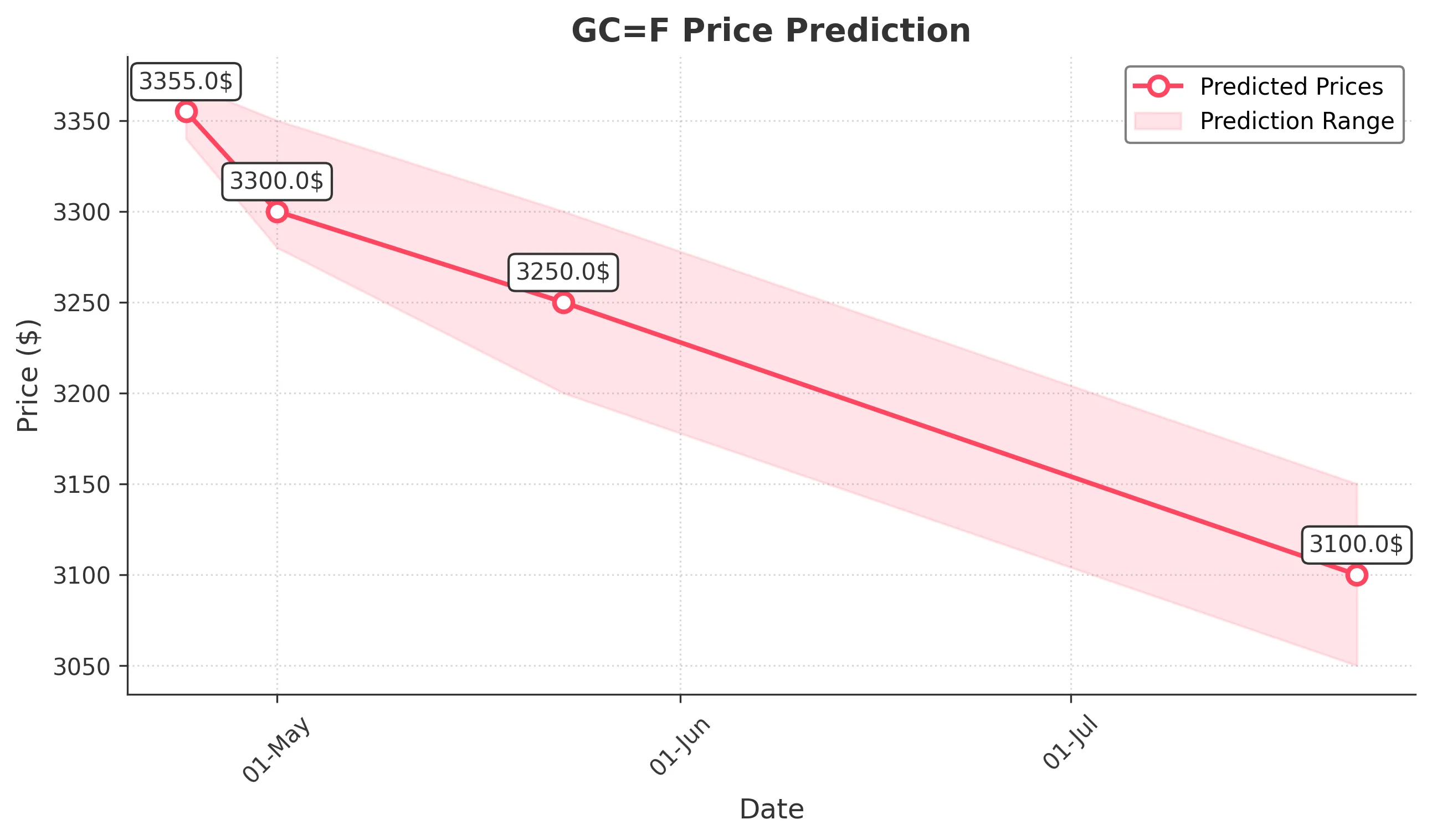

3 Months Prediction

Target: July 23, 2025$3100

$3150

$3150

$3050

Description

A bearish outlook is anticipated as the stock may continue to decline towards key support levels. Economic conditions and market sentiment will play a crucial role.

Analysis

The stock has been in a corrective phase, with significant resistance at 3200. The ATR indicates increasing volatility, and the RSI is trending downwards. Volume patterns suggest a lack of buying interest, indicating potential further declines.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements.