GOLD Trading Predictions

1 Day Prediction

Target: April 26, 2025$3340

$3335

$3360

$3320

Description

The stock shows a bullish trend with a recent upward movement. The RSI indicates overbought conditions, suggesting a potential pullback. However, strong support at 3300 may hold. Expect slight fluctuations around the current price.

Analysis

The past 3 months show a bullish trend with significant upward momentum. Key resistance at 3400 and support around 3300. Volume spikes indicate strong buying interest, but overbought conditions may lead to short-term corrections.

Confidence Level

Potential Risks

Potential for a reversal due to overbought RSI and recent volatility.

1 Week Prediction

Target: May 3, 2025$3355

$3340

$3380

$3300

Description

The stock is expected to consolidate around current levels. The MACD shows a potential bearish crossover, indicating weakening momentum. Watch for support at 3300 to hold; otherwise, a deeper correction may occur.

Analysis

The stock has shown strong performance, but recent volatility and potential bearish signals from MACD suggest caution. Key support at 3300 and resistance at 3400. Volume patterns indicate active trading, but market sentiment remains mixed.

Confidence Level

Potential Risks

Market sentiment could shift quickly, impacting the prediction. External economic factors may also play a role.

1 Month Prediction

Target: May 25, 2025$3300

$3350

$3350

$3200

Description

Expect a gradual decline as the market corrects from overbought levels. The Fibonacci retracement suggests a pullback towards 3300. Watch for volume spikes that could indicate a reversal.

Analysis

The stock has been on a bullish run, but signs of exhaustion are emerging. Key support at 3300 and resistance at 3400. The market may face headwinds from economic data releases, impacting investor sentiment.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could significantly alter market dynamics, leading to unexpected price movements.

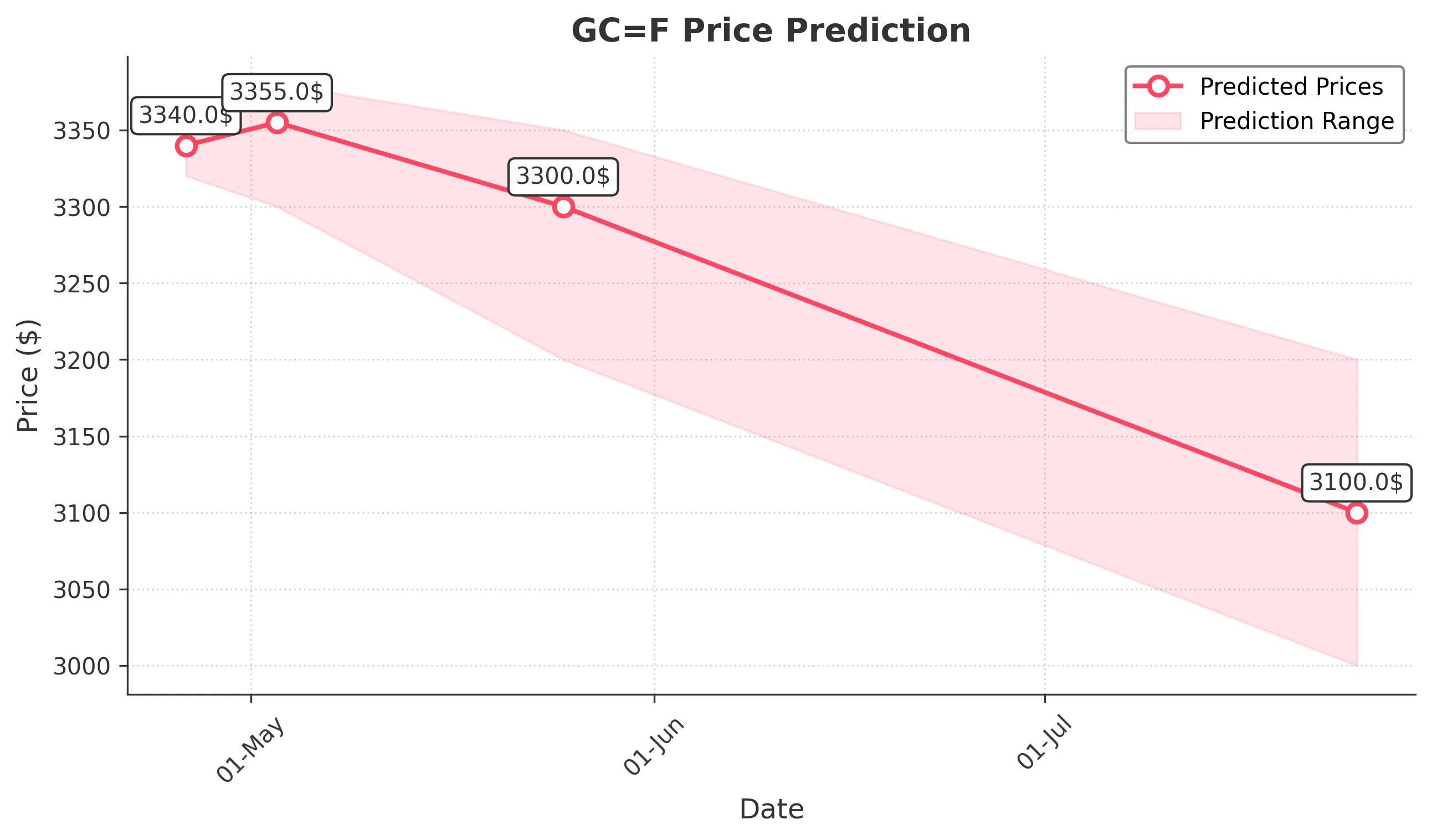

3 Months Prediction

Target: July 25, 2025$3100

$3200

$3200

$3000

Description

A bearish outlook is anticipated as the market corrects further. The ATR indicates increasing volatility, and the stock may test lower support levels. Monitor for any significant news that could impact prices.

Analysis

The stock's performance over the past 3 months has been strong, but signs of a potential downturn are emerging. Key support at 3000 and resistance at 3400. Increased volatility and external economic pressures could lead to a bearish trend.

Confidence Level

Potential Risks

Market conditions are highly unpredictable, and external factors could lead to significant deviations from this prediction.