GOLD Trading Predictions

1 Day Prediction

Target: April 30, 2025$3310

$3315

$3325

$3300

Description

The stock shows a slight bullish trend with a recent upward movement. The RSI is approaching overbought levels, indicating potential resistance. A Doji pattern suggests indecision, but overall momentum remains positive.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant upward movements. Key resistance is around 3400, while support is at 3200. Volume has been increasing, indicating strong interest. However, recent volatility and external market factors could impact future performance.

Confidence Level

Potential Risks

Potential reversal due to overbought conditions and market sentiment could shift quickly.

1 Week Prediction

Target: May 7, 2025$3290

$3300

$3310

$3280

Description

The stock may experience a slight pullback as it approaches resistance levels. The MACD shows signs of divergence, indicating potential weakening momentum. Volume spikes could suggest profit-taking.

Analysis

GC=F has been on a bullish run, but recent candlestick patterns indicate potential exhaustion. Key support at 3200 remains critical. The RSI is high, suggesting a possible correction. Overall, while bullish, caution is warranted.

Confidence Level

Potential Risks

Market volatility and external economic news could lead to unexpected price movements.

1 Month Prediction

Target: May 29, 2025$3250

$3280

$3300

$3200

Description

A bearish trend may develop as the stock approaches key resistance. The Bollinger Bands indicate tightening, suggesting a potential breakout or breakdown. Market sentiment is mixed, with external factors influencing price.

Analysis

The past three months show a strong bullish trend, but signs of potential reversal are emerging. Key resistance at 3400 and support at 3200 are critical. The market's reaction to economic data will be pivotal in determining future direction.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could significantly impact the stock's trajectory.

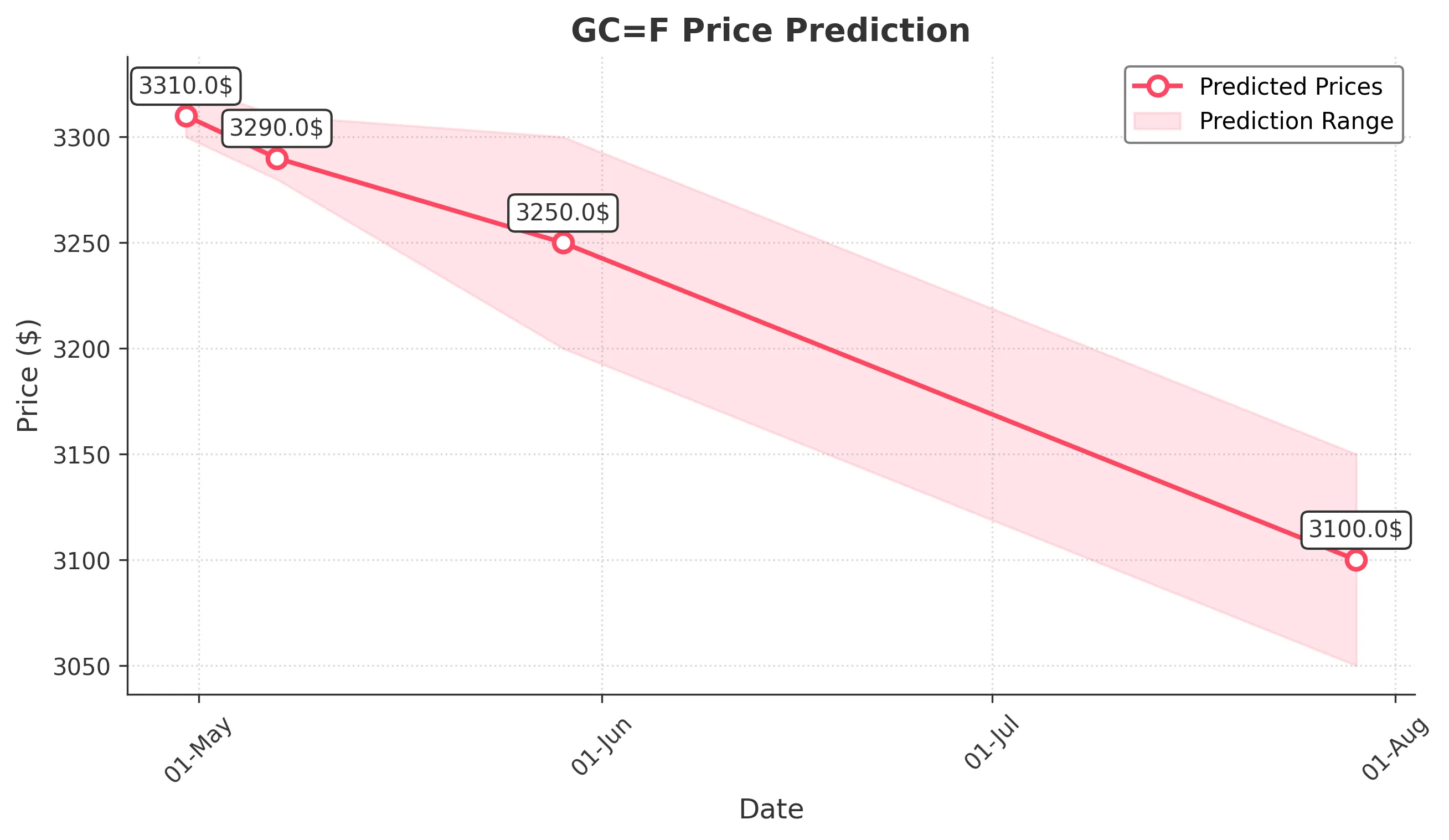

3 Months Prediction

Target: July 29, 2025$3100

$3120

$3150

$3050

Description

A bearish outlook is anticipated as the stock may face significant resistance. The MACD indicates a potential downtrend, and the RSI suggests overbought conditions. Market sentiment could shift negatively due to economic pressures.

Analysis

GC=F has shown strong performance, but the last few weeks indicate a potential shift. Key support at 3000 is crucial. The market's response to economic indicators will be vital, and bearish signals are emerging, suggesting caution.

Confidence Level

Potential Risks

Economic downturns or geopolitical tensions could exacerbate price declines.