GOLD Trading Predictions

1 Day Prediction

Target: May 27, 2025$3350

$3340

$3365

$3330

Description

The stock shows a bullish trend with a recent upward movement. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong support at 3330 may hold. Volume is expected to increase as traders react to recent price action.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant upward movements. Key resistance at 3365 and support at 3330 are critical. The MACD indicates bullish momentum, while the ATR suggests moderate volatility. Volume spikes on upward days indicate strong buying interest.

Confidence Level

Potential Risks

Potential for a reversal exists if market sentiment shifts or if macroeconomic news impacts trading.

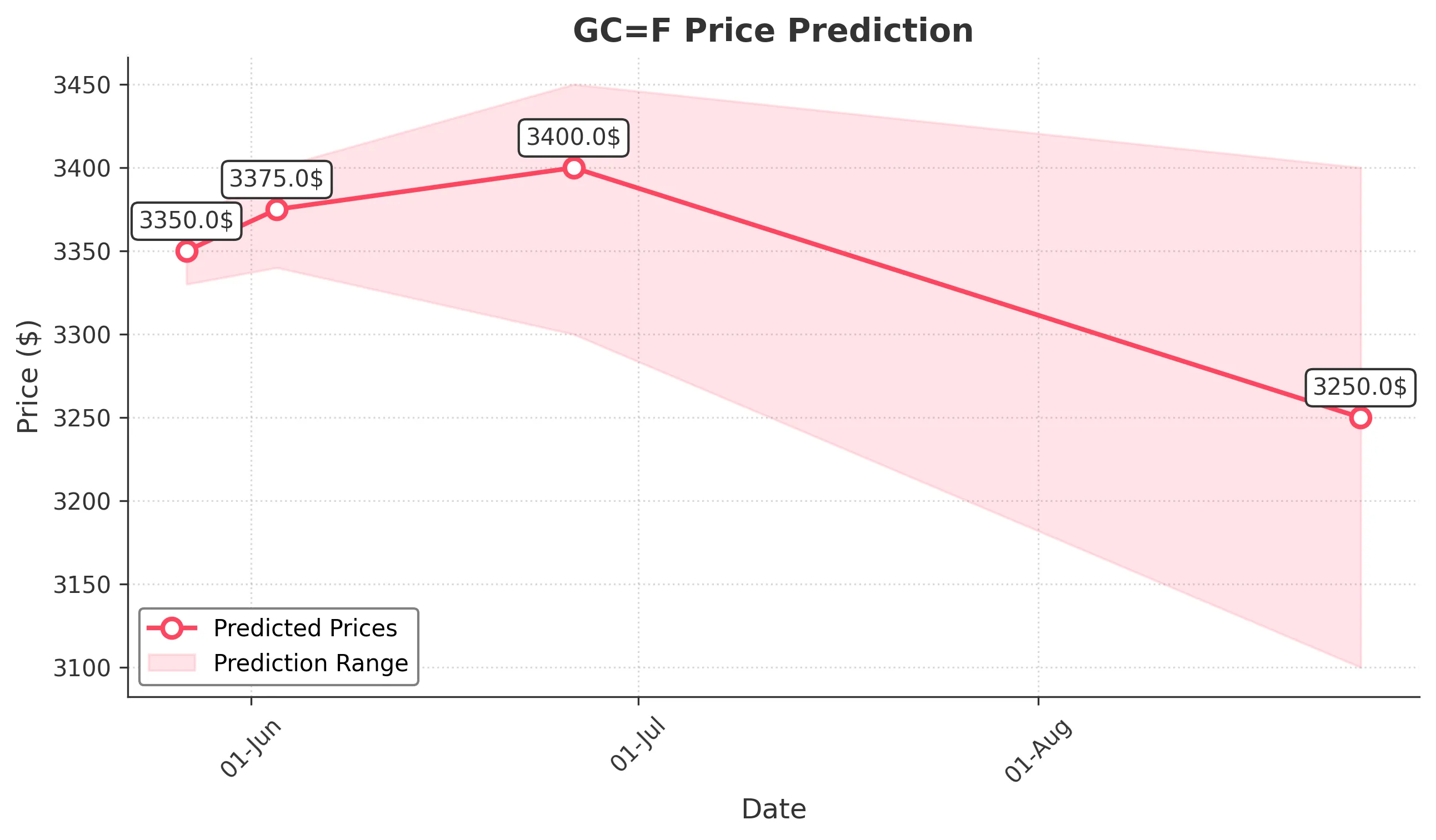

1 Week Prediction

Target: June 3, 2025$3375

$3355

$3400

$3340

Description

The bullish trend is expected to continue, with the stock testing resistance at 3400. The MACD remains positive, and the RSI is stabilizing. However, caution is advised as overbought conditions may lead to profit-taking.

Analysis

GC=F has maintained a bullish trend, with recent highs indicating strong buying pressure. The RSI is nearing overbought territory, suggesting a potential pullback. Key support at 3340 and resistance at 3400 will be crucial in the coming week.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements.

1 Month Prediction

Target: June 26, 2025$3400

$3350

$3450

$3300

Description

The stock is expected to consolidate around 3400, with potential for a breakout. The Bollinger Bands indicate tightening, suggesting a significant move is imminent. Watch for volume spikes as confirmation.

Analysis

GC=F has shown strong upward momentum, but recent price action suggests a potential consolidation phase. Key support at 3300 and resistance at 3450 will be critical. The MACD is bullish, but the RSI indicates potential overbought conditions.

Confidence Level

Potential Risks

Market sentiment and macroeconomic events could lead to volatility, impacting the prediction.

3 Months Prediction

Target: August 26, 2025$3250

$3300

$3400

$3100

Description

A bearish correction is anticipated as the stock may retrace from recent highs. The Fibonacci retracement levels suggest a potential pullback to 3250. Market sentiment may shift due to economic data releases.

Analysis

GC=F has experienced significant volatility, with recent highs followed by potential bearish signals. The stock may face resistance at 3400, and a correction towards 3250 is plausible. Key support levels will be critical in determining future price action.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or shifts in market sentiment could lead to greater volatility and impact the prediction.