GOLD Trading Predictions

1 Day Prediction

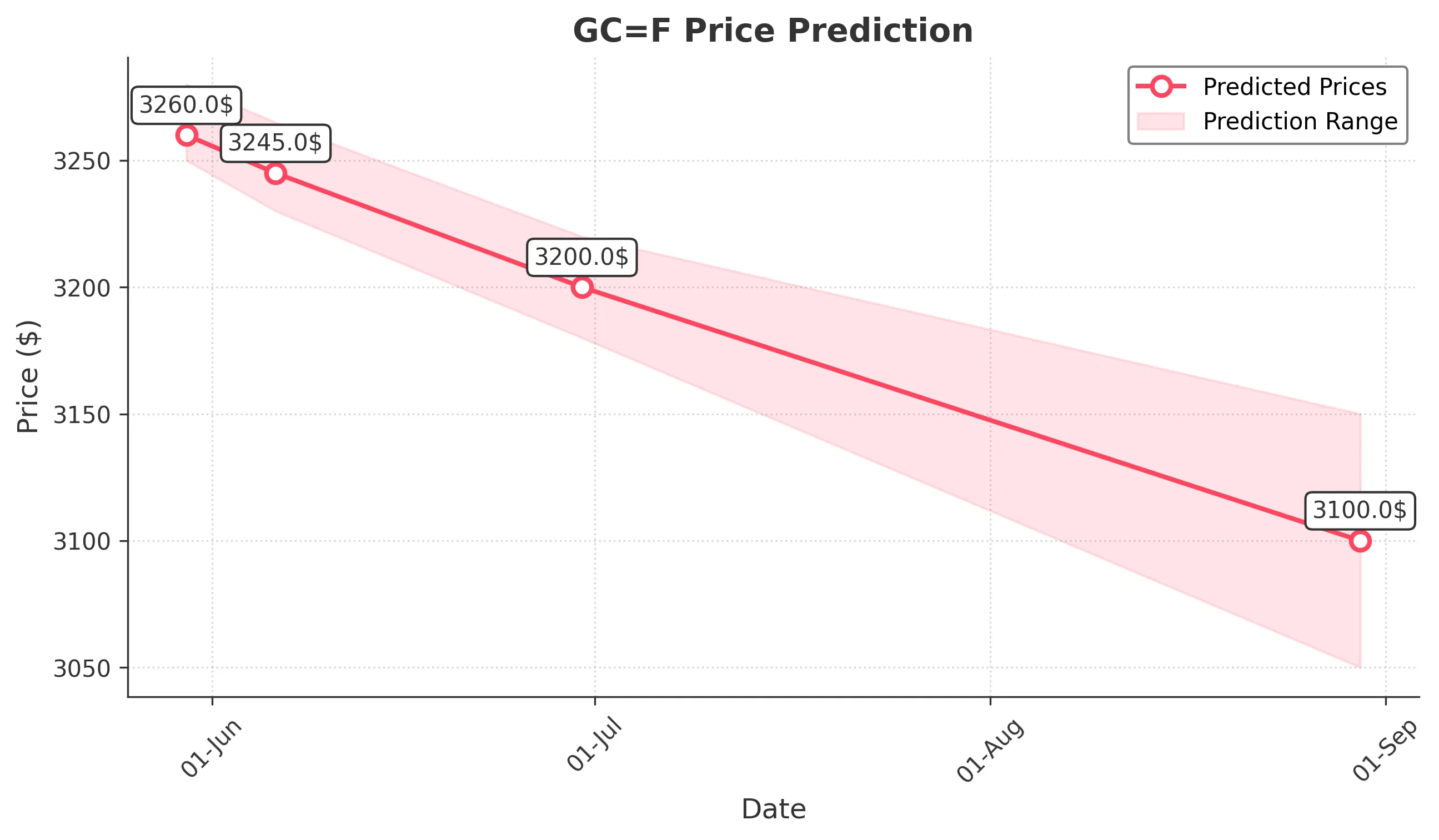

Target: May 30, 2025$3260

$3265

$3280

$3250

Description

The stock shows a slight bearish trend with recent lower highs and lower lows. RSI indicates overbought conditions, suggesting a pullback. Volume has decreased, indicating weakening momentum. Expect a close around 3260.

Analysis

Over the past 3 months, GC=F has shown volatility with a recent bearish trend. Key support at 3250 and resistance at 3300. RSI indicates overbought conditions, while MACD shows a bearish crossover. Volume patterns suggest weakening interest.

Confidence Level

Potential Risks

Potential for a reversal if market sentiment shifts or if macroeconomic news impacts trading.

1 Week Prediction

Target: June 6, 2025$3245

$3250

$3265

$3230

Description

The bearish trend is expected to continue as the stock faces resistance at 3300. The MACD remains negative, and RSI is approaching oversold territory. Anticipate a close around 3245 as selling pressure persists.

Analysis

GC=F has been in a bearish phase with significant resistance at 3300. Recent candlestick patterns indicate indecision, and volume has been declining. The ATR suggests increased volatility, which could lead to further price fluctuations.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements.

1 Month Prediction

Target: June 30, 2025$3200

$3210

$3220

$3180

Description

Expect continued bearish pressure with a potential test of support at 3200. The market sentiment is cautious, and macroeconomic factors may weigh on prices. A close around 3200 is likely as selling persists.

Analysis

The stock has shown a bearish trend with key support at 3200. Technical indicators suggest a potential continuation of this trend. Volume analysis indicates reduced buying interest, and external economic factors may further impact performance.

Confidence Level

Potential Risks

Unforeseen economic news or changes in market sentiment could alter this outlook significantly.

3 Months Prediction

Target: August 30, 2025$3100

$3120

$3150

$3050

Description

Long-term bearish sentiment may lead to a gradual decline towards 3100. The market is likely to remain volatile, and macroeconomic conditions could further influence prices. Expect a close around 3100.

Analysis

GC=F has been trending downwards with significant resistance levels. The overall market sentiment is bearish, and technical indicators suggest further declines. Volume patterns indicate a lack of strong buying interest, which may continue.

Confidence Level

Potential Risks

Market conditions are unpredictable, and any significant news could lead to sharp price movements contrary to this prediction.