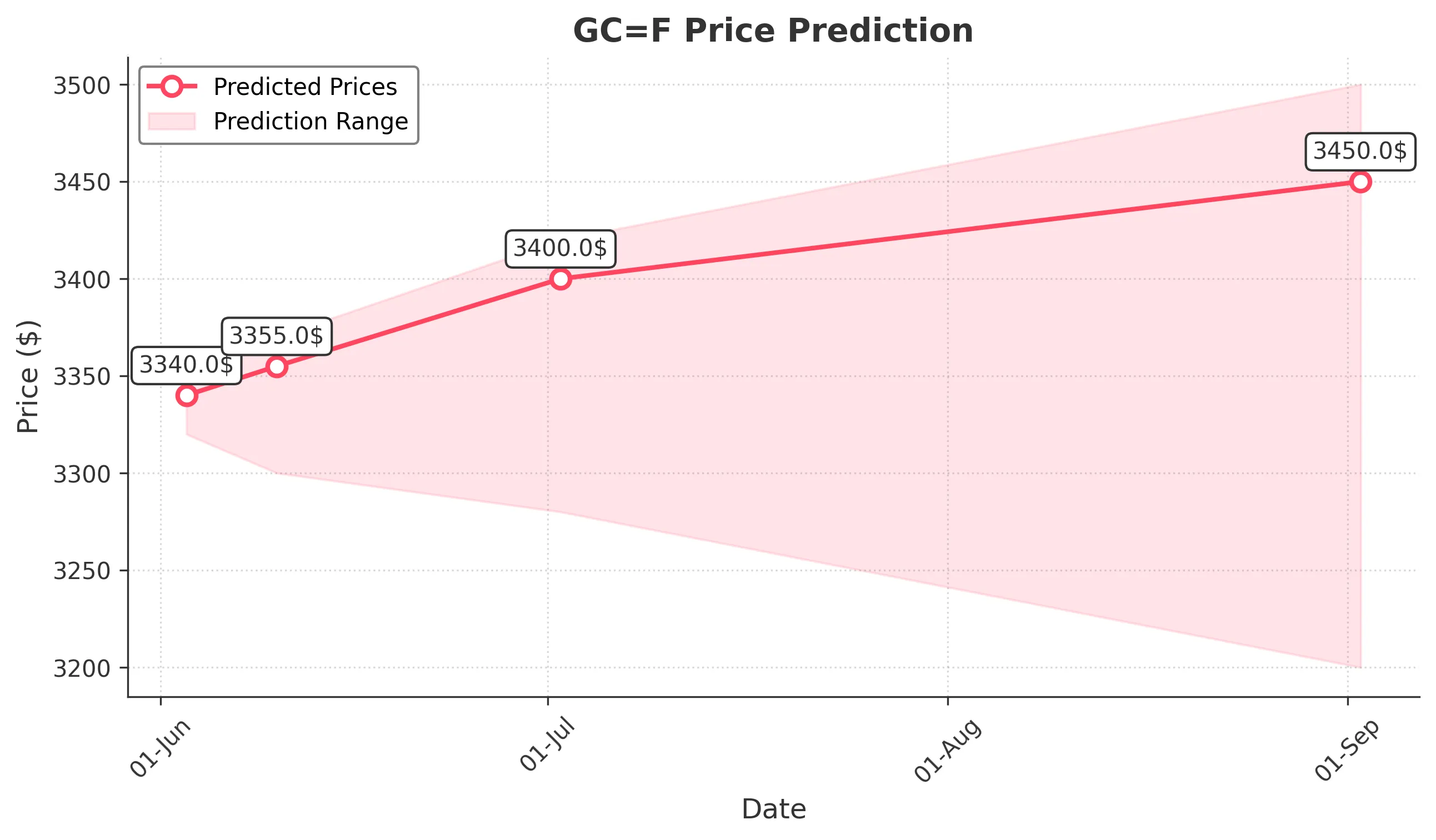

GOLD Trading Predictions

1 Day Prediction

Target: June 3, 2025$3340

$3335

$3355

$3320

Description

The stock shows a bullish trend with a recent upward movement. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong support at 3300 suggests a bounce back. Volume is expected to increase as traders react to recent highs.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant upward movements. Key resistance at 3350 and support at 3300. The MACD indicates bullish momentum, while volume spikes suggest strong interest. Recent candlestick patterns show bullish engulfing, reinforcing upward sentiment.

Confidence Level

Potential Risks

Potential for a short-term pullback due to overbought RSI conditions.

1 Week Prediction

Target: June 10, 2025$3355

$3340

$3370

$3300

Description

The stock is expected to maintain its bullish momentum, with a slight increase in price. The MACD remains positive, and the RSI is stabilizing. However, watch for potential resistance at 3370, which could limit upside movement.

Analysis

GC=F has been trending upward, with significant support at 3300. The recent price action shows bullish patterns, but the RSI indicates potential overbought conditions. Volume trends are strong, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market volatility and external economic factors could impact performance.

1 Month Prediction

Target: July 2, 2025$3400

$3355

$3420

$3280

Description

Expect continued bullish momentum, with the price potentially reaching 3400. The MACD remains bullish, and the stock is likely to find support at 3300. However, watch for any bearish divergence in RSI that could signal a reversal.

Analysis

The stock has shown a strong upward trend, with key support at 3300. The MACD and moving averages indicate bullish momentum, but the RSI suggests caution as it approaches overbought territory. Volume patterns are healthy, but external economic conditions may introduce risk.

Confidence Level

Potential Risks

Possible market corrections and economic data releases could affect price.

3 Months Prediction

Target: September 2, 2025$3450

$3400

$3500

$3200

Description

The stock is expected to trend higher, potentially reaching 3450. However, significant resistance at 3500 may limit gains. The market sentiment remains bullish, but macroeconomic factors could introduce volatility.

Analysis

GC=F has shown a strong bullish trend, but the market is facing potential headwinds from economic data and geopolitical events. Key support at 3200 and resistance at 3500 are critical levels to watch. The overall sentiment is cautiously optimistic, but risks remain.

Confidence Level

Potential Risks

Economic uncertainties and potential market corrections could impact predictions.