GOLD Trading Predictions

1 Day Prediction

Target: June 6, 2025$3400

$3395

$3420

$3380

Description

The stock shows bullish momentum with a recent upward trend. The RSI is nearing overbought levels, indicating potential for a pullback. However, strong support at 3380 and resistance at 3420 suggest a range-bound movement. Volume is expected to increase as traders react to market sentiment.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant upward movements. Key support is at 3380, while resistance is at 3420. The MACD indicates bullish momentum, but the RSI suggests caution as it approaches overbought territory. Volume has been increasing, indicating strong interest.

Confidence Level

Potential Risks

Potential for a pullback if RSI continues to rise. Market sentiment could shift due to external factors.

1 Week Prediction

Target: June 13, 2025$3425

$3410

$3450

$3400

Description

The upward trend is expected to continue, with the stock testing resistance at 3450. The MACD remains bullish, and the recent candlestick patterns suggest continued buying pressure. However, the RSI indicates potential overbought conditions, which could lead to volatility.

Analysis

GC=F has maintained a bullish trend, with significant price increases. The MACD supports this trend, while the RSI indicates caution. Volume patterns show increased trading activity, suggesting strong interest. Key resistance at 3450 may be tested, but overbought conditions could lead to corrections.

Confidence Level

Potential Risks

Market volatility and potential profit-taking could lead to price corrections. Watch for external economic news.

1 Month Prediction

Target: July 5, 2025$3350

$3400

$3400

$3300

Description

Expect a pullback as the stock approaches overbought levels. The RSI indicates a potential correction, and the MACD may show bearish divergence. Support at 3300 is critical, and if broken, further declines could occur. Volume may spike as traders react to market shifts.

Analysis

The past three months show a strong bullish trend, but recent indicators suggest a potential correction. Key support at 3300 is crucial, and the RSI indicates overbought conditions. Volume patterns suggest traders are cautious, and external factors could lead to increased volatility.

Confidence Level

Potential Risks

Market sentiment could shift rapidly, and external economic factors may influence price movements. Watch for news that could impact trading.

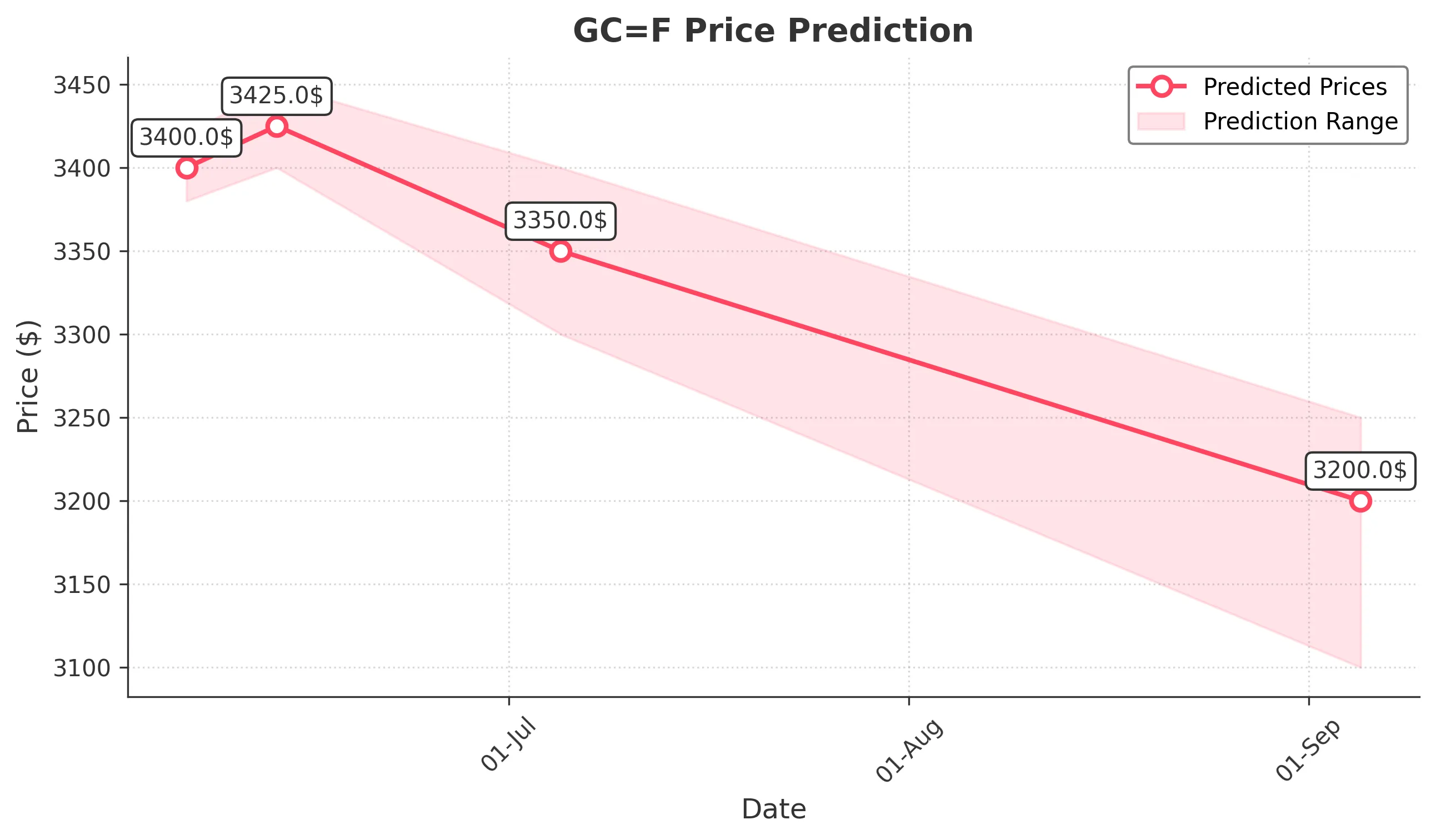

3 Months Prediction

Target: September 5, 2025$3200

$3150

$3250

$3100

Description

A bearish trend may develop as the stock faces resistance and potential profit-taking. The MACD may turn bearish, and the RSI could indicate oversold conditions. Key support at 3100 will be critical to watch. Volume may increase as traders react to market sentiment.

Analysis

GC=F has shown strong bullish performance, but signs of a potential reversal are emerging. The MACD may indicate a bearish trend, and the RSI suggests caution. Key support at 3100 is critical, and external economic factors could lead to increased volatility and price corrections.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant price changes. Watch for external influences.