GOLD Trading Predictions

1 Day Prediction

Target: June 7, 2025$3395

$3390

$3405

$3380

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong buying volume suggests continued upward pressure. Watch for potential resistance at 3400.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant upward movements. Key support is around 3300, while resistance is at 3400. The MACD indicates bullish momentum, but the RSI suggests caution as it nears overbought territory.

Confidence Level

Potential Risks

Potential reversal if RSI exceeds overbought levels. Market sentiment could shift due to external factors.

1 Week Prediction

Target: June 14, 2025$3400

$3395

$3420

$3350

Description

The stock is expected to consolidate around the 3400 level. The recent bullish trend may face resistance, but strong volume indicates sustained interest. Watch for potential pullbacks to support levels around 3350.

Analysis

GC=F has maintained a bullish trend, with significant price increases. The MACD remains positive, but the RSI indicates potential overbought conditions. Volume patterns suggest strong interest, but caution is warranted as resistance levels are approached.

Confidence Level

Potential Risks

Market volatility and external economic news could impact price movements. A bearish reversal is possible if selling pressure increases.

1 Month Prediction

Target: July 6, 2025$3350

$3390

$3400

$3300

Description

Expect a slight pullback as the stock may face resistance at 3400. The RSI indicates overbought conditions, suggesting a correction. Volume may decrease as traders take profits, leading to a potential dip.

Analysis

The stock has shown strong bullish momentum, but recent price action suggests a potential correction. Key support is at 3300, while resistance remains at 3400. The ATR indicates increasing volatility, and market sentiment may shift if economic indicators are unfavorable.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to increased volatility. A stronger bearish trend could emerge if support levels are broken.

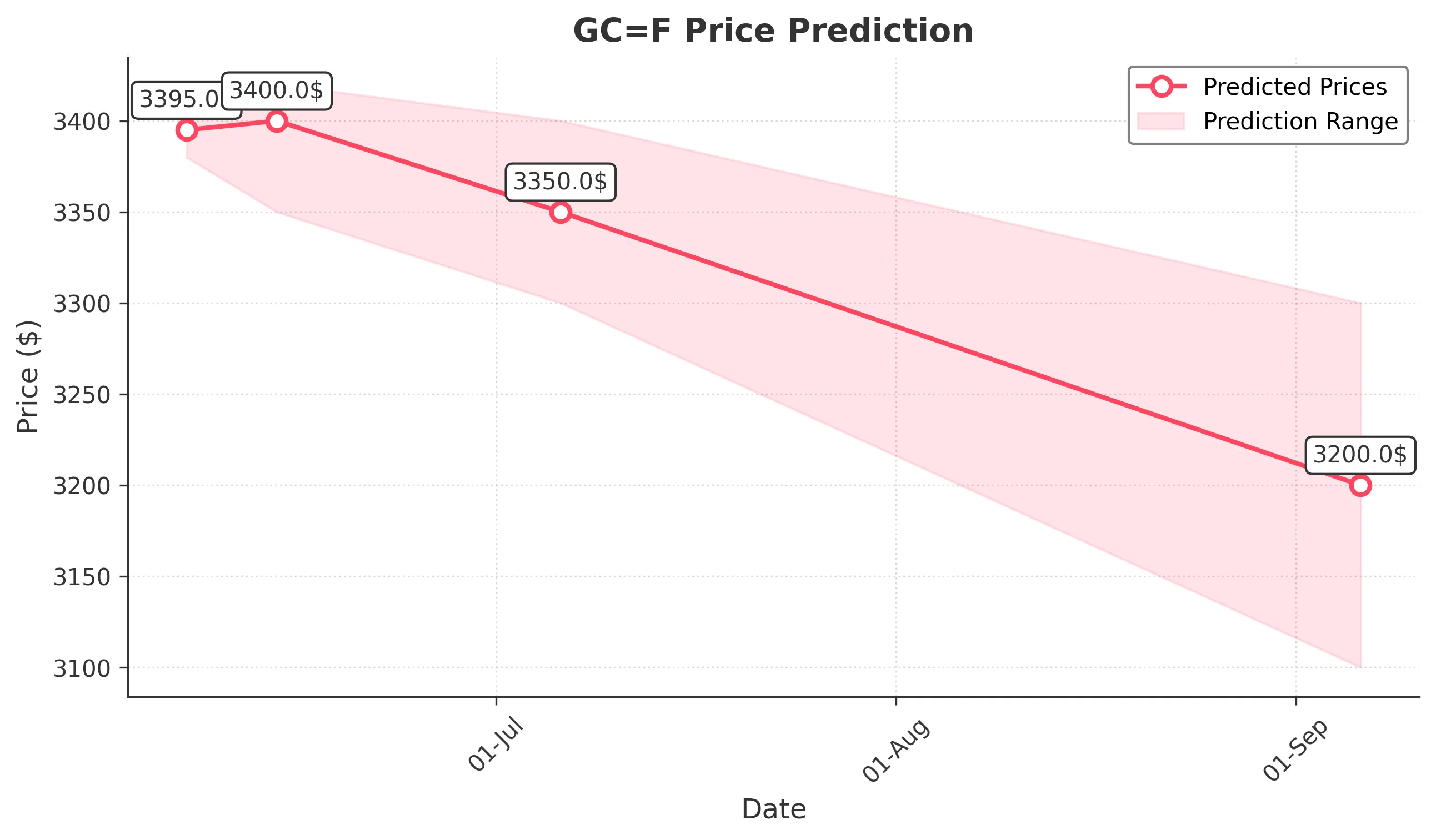

3 Months Prediction

Target: September 6, 2025$3200

$3250

$3300

$3100

Description

A bearish trend may develop as profit-taking occurs. The stock could test lower support levels around 3100. Market sentiment may shift due to economic uncertainties, impacting trading volume.

Analysis

GC=F has experienced significant volatility, with a recent bullish trend. However, the potential for a bearish reversal exists as profit-taking may occur. Key support is at 3100, and resistance is at 3300. The market's reaction to economic data will be crucial in determining future price movements.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could significantly impact market sentiment. A stronger bearish trend could emerge if key support levels are breached.