GOLD Trading Predictions

1 Day Prediction

Target: June 16, 2025$3470

$3460

$3485

$3450

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong support at 3450 suggests a bounce back. Volume remains stable, supporting the upward movement.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant upward movements. Key resistance is at 3485, while support is around 3450. The MACD indicates bullish momentum, but the RSI suggests caution as it nears overbought territory.

Confidence Level

Potential Risks

Potential market volatility and external economic factors could impact the prediction.

1 Week Prediction

Target: June 23, 2025$3500

$3480

$3520

$3440

Description

The upward trend is expected to continue, supported by recent bullish candlestick patterns. However, the RSI indicates potential overbought conditions, which may lead to a correction. Volume trends suggest sustained interest in the stock.

Analysis

GC=F has experienced a strong bullish phase, with significant price increases. The MACD remains positive, and the Bollinger Bands indicate potential for further upward movement. However, caution is warranted as the stock approaches resistance levels.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news, affecting the stock's performance.

1 Month Prediction

Target: July 16, 2025$3550

$3520

$3600

$3400

Description

The stock is likely to continue its bullish trend, with strong support at 3400. The MACD and moving averages indicate a sustained upward momentum. However, the RSI suggests caution as it approaches overbought levels, indicating a possible pullback.

Analysis

GC=F has shown a consistent upward trend, with key support at 3400 and resistance at 3600. The ATR indicates increasing volatility, and recent volume spikes suggest heightened interest. The market sentiment remains bullish, but caution is advised.

Confidence Level

Potential Risks

Unforeseen market events or economic data releases could lead to volatility and impact the prediction.

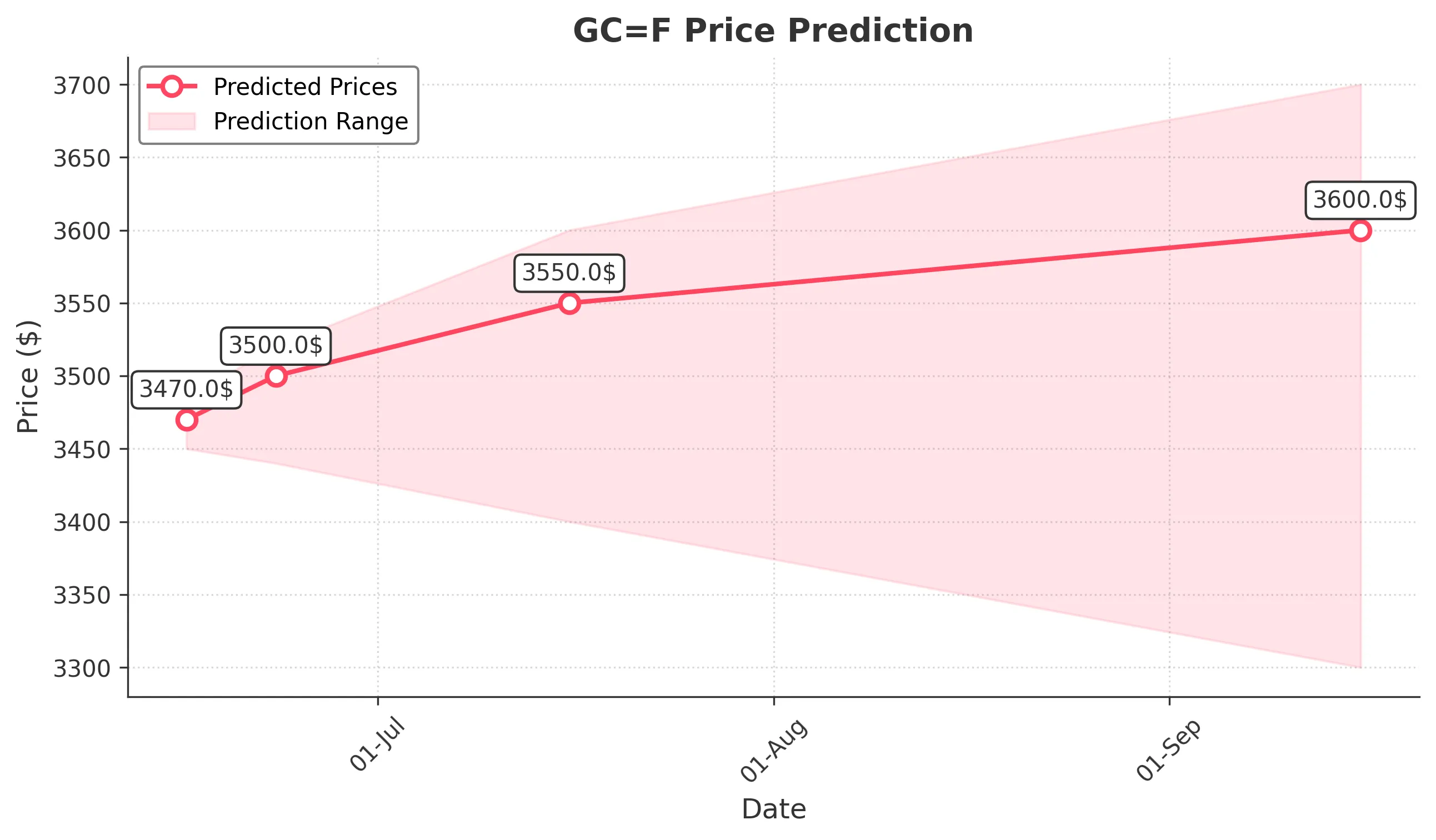

3 Months Prediction

Target: September 16, 2025$3600

$3550

$3700

$3300

Description

While the bullish trend is expected to persist, potential resistance at 3700 may lead to a correction. The RSI indicates overbought conditions, suggesting a possible pullback. Volume trends will be crucial in confirming the strength of the upward movement.

Analysis

GC=F has maintained a bullish trend, but recent price action shows signs of potential exhaustion. Key support is at 3300, while resistance is at 3700. The MACD remains positive, but the RSI indicates caution. Overall, the market sentiment is mixed, with potential for both upward and downward movements.

Confidence Level

Potential Risks

Market corrections and external economic factors could significantly impact the stock's trajectory.