GOLD Trading Predictions

1 Day Prediction

Target: June 17, 2025$3455

$3449.600098

$3470

$3440

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong support at 3440 and positive market sentiment suggest a slight increase in price.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant upward movements. Key support at 3440 and resistance at 3470. The MACD indicates bullish momentum, while volume spikes suggest strong buying interest. However, RSI nearing overbought levels could signal a pullback.

Confidence Level

Potential Risks

Potential reversal if market sentiment shifts or if external economic factors arise.

1 Week Prediction

Target: June 24, 2025$3475

$3455

$3500

$3430

Description

The bullish trend is expected to continue, with the stock likely to test resistance at 3500. The MACD remains positive, and the volume indicates strong buying pressure. However, watch for potential profit-taking as RSI approaches overbought territory.

Analysis

GC=F has maintained a bullish trend, with significant upward movements and strong support at 3440. The MACD and moving averages support further gains, but the RSI indicates potential overbought conditions. Volume patterns suggest sustained interest, but caution is warranted.

Confidence Level

Potential Risks

Market volatility and profit-taking could lead to unexpected price movements.

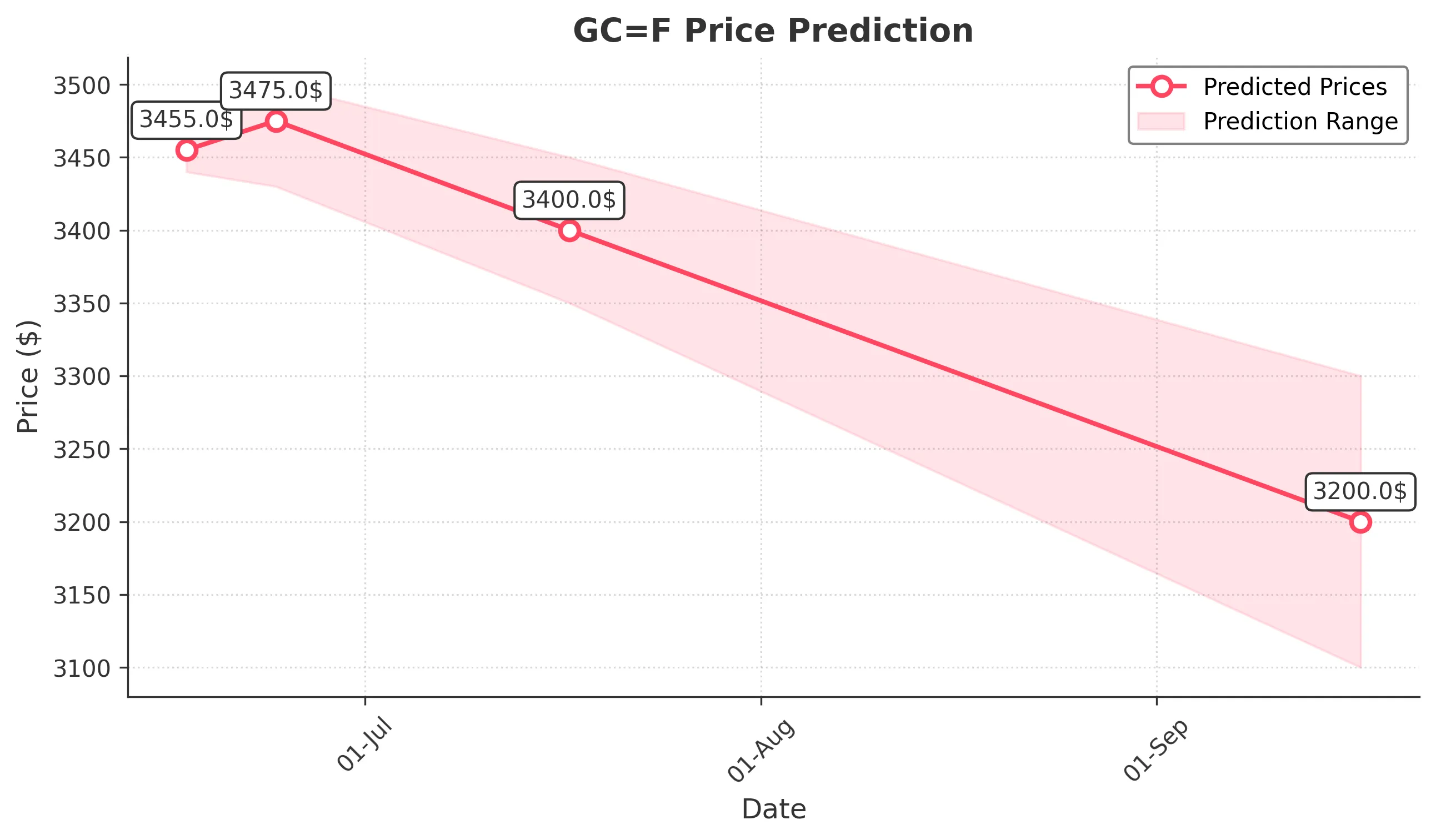

1 Month Prediction

Target: July 17, 2025$3400

$3475

$3450

$3350

Description

A potential correction is anticipated as the stock may face resistance at 3500. The RSI indicates overbought conditions, and profit-taking could lead to a decline. Support at 3350 will be critical in determining the next move.

Analysis

The stock has shown strong bullish momentum, but signs of overbought conditions suggest a possible correction. Key support at 3350 and resistance at 3500 will be crucial. Volume patterns indicate strong interest, but market sentiment could shift quickly.

Confidence Level

Potential Risks

Unforeseen market events or economic data releases could impact the stock's performance.

3 Months Prediction

Target: September 17, 2025$3200

$3400

$3300

$3100

Description

A bearish trend may develop as the stock faces significant resistance and potential profit-taking. The MACD may turn negative, and if support at 3100 fails, further declines could occur. Market sentiment will play a key role.

Analysis

GC=F has shown strong bullish trends, but potential bearish signals are emerging. Resistance at 3500 and support at 3100 are critical levels. The MACD may indicate a shift in momentum, and external factors could influence market sentiment significantly.

Confidence Level

Potential Risks

Economic conditions and geopolitical events could lead to increased volatility and impact predictions.