GOLD Trading Predictions

1 Day Prediction

Target: June 18, 2025$3410

$3405

$3430

$3390

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, the MACD remains positive, suggesting continued upward movement. Volume is expected to increase slightly.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant support at 3300 and resistance around 3440. The MACD indicates upward momentum, while the RSI is nearing overbought territory. Volume has been stable, with some spikes indicating strong buying interest.

Confidence Level

Potential Risks

Potential reversal if RSI exceeds overbought levels. Market sentiment could shift due to external factors.

1 Week Prediction

Target: June 25, 2025$3405

$3410

$3425

$3380

Description

The stock is expected to consolidate around current levels. The recent bullish trend may face resistance near 3440. The MACD remains positive, but the RSI indicates potential overbought conditions. Volume may increase as traders react to market sentiment.

Analysis

GC=F has been in a bullish phase, with key support at 3300 and resistance at 3440. The MACD supports upward movement, but the RSI suggests caution. Volume patterns indicate healthy trading activity, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market volatility and external news could impact price direction. A bearish reversal is possible if resistance holds.

1 Month Prediction

Target: July 25, 2025$3350

$3400

$3400

$3300

Description

A potential pullback is anticipated as the stock approaches resistance levels. The RSI may correct from overbought conditions, leading to a price decline. The MACD could also show signs of weakening momentum, suggesting a bearish shift.

Analysis

The stock has shown strong performance, but signs of a potential reversal are emerging. Key support at 3300 and resistance at 3440 are critical. The MACD is still positive, but the RSI indicates overbought conditions, suggesting a possible correction.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or shifts in market sentiment could lead to greater volatility and impact predictions.

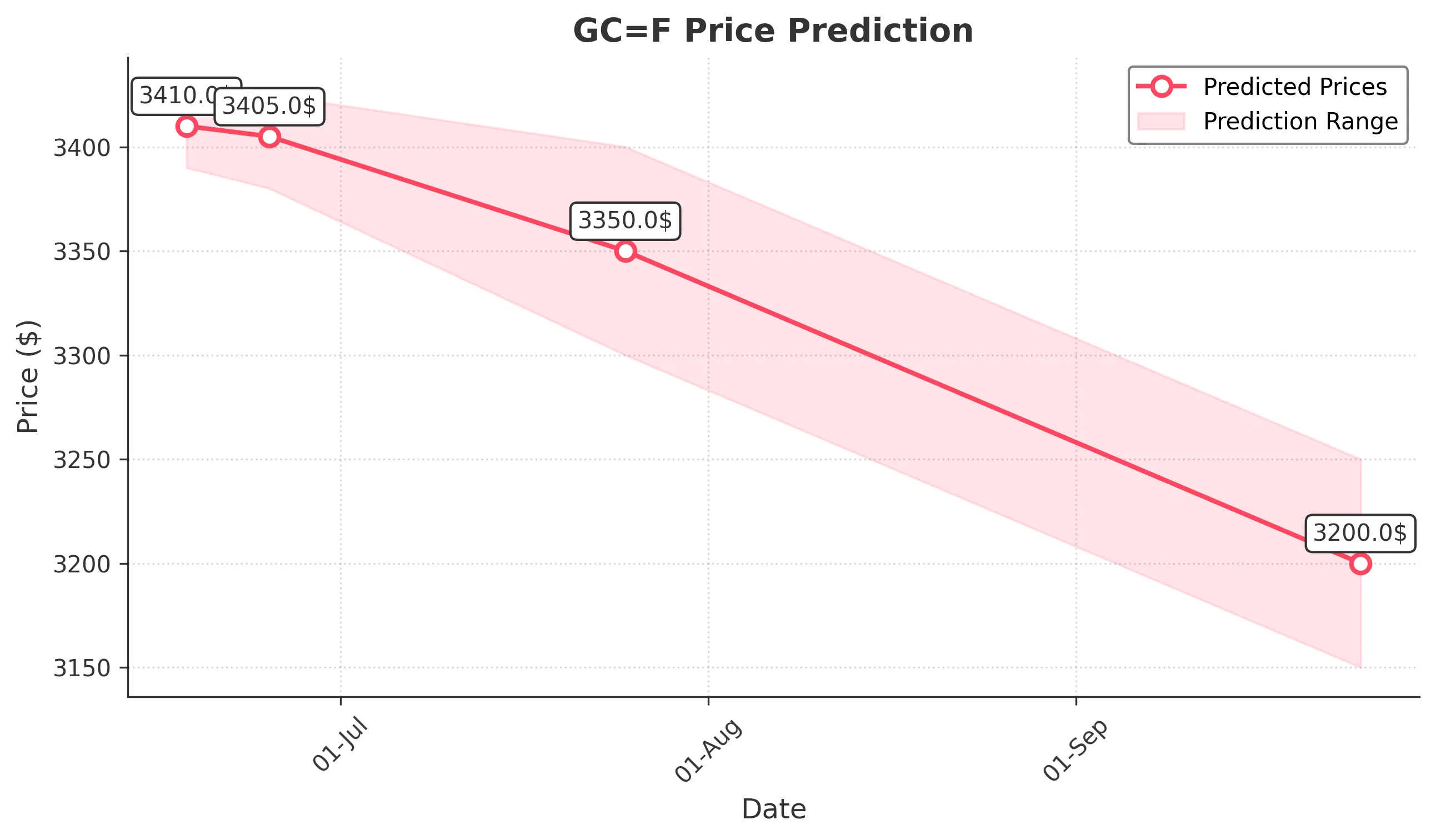

3 Months Prediction

Target: September 25, 2025$3200

$3250

$3250

$3150

Description

A bearish trend is expected as the stock may face significant resistance. The RSI is likely to remain in a corrective phase, and the MACD may turn negative. Volume could increase as traders react to market conditions.

Analysis

GC=F has shown volatility with a recent bullish trend, but signs of a potential downturn are emerging. Key support at 3150 and resistance at 3440 are critical. The MACD may indicate weakening momentum, and the RSI suggests a correction is due.

Confidence Level

Potential Risks

Market conditions are unpredictable, and external economic factors could lead to further declines or unexpected recoveries.