GOLD Trading Predictions

1 Day Prediction

Target: June 21, 2025$3365

$3370

$3380

$3350

Description

The stock shows a slight bullish trend with a recent upward movement. RSI indicates overbought conditions, suggesting a potential pullback. However, strong support at 3350 may hold. Volume spikes indicate increased interest.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant resistance at 3400. Recent candlestick patterns indicate indecision, and volume analysis shows spikes during upward movements. External factors like economic data releases may influence future performance.

Confidence Level

Potential Risks

Potential reversal due to overbought RSI and market volatility could impact the prediction.

1 Week Prediction

Target: June 28, 2025$3350

$3360

$3375

$3330

Description

The stock is expected to consolidate around current levels. The MACD shows a bearish crossover, indicating potential downward pressure. Support at 3330 is critical, and any breach could lead to further declines.

Analysis

GC=F has experienced fluctuations with a recent peak at 3400. The RSI is approaching neutral, suggesting a potential for sideways movement. Key support at 3330 and resistance at 3400 will be crucial in determining the next direction.

Confidence Level

Potential Risks

Market sentiment and macroeconomic events could lead to unexpected volatility, affecting the prediction.

1 Month Prediction

Target: July 20, 2025$3300

$3320

$3350

$3280

Description

A bearish outlook is anticipated as the stock may retrace towards the Fibonacci level of 3300. The recent downtrend and bearish candlestick patterns suggest a continuation of selling pressure.

Analysis

The stock has shown a bearish trend recently, with significant resistance at 3400. The ATR indicates increasing volatility, and volume patterns suggest profit-taking. The market sentiment is cautious, influenced by macroeconomic factors.

Confidence Level

Potential Risks

Unexpected positive news or market shifts could alter the bearish trend.

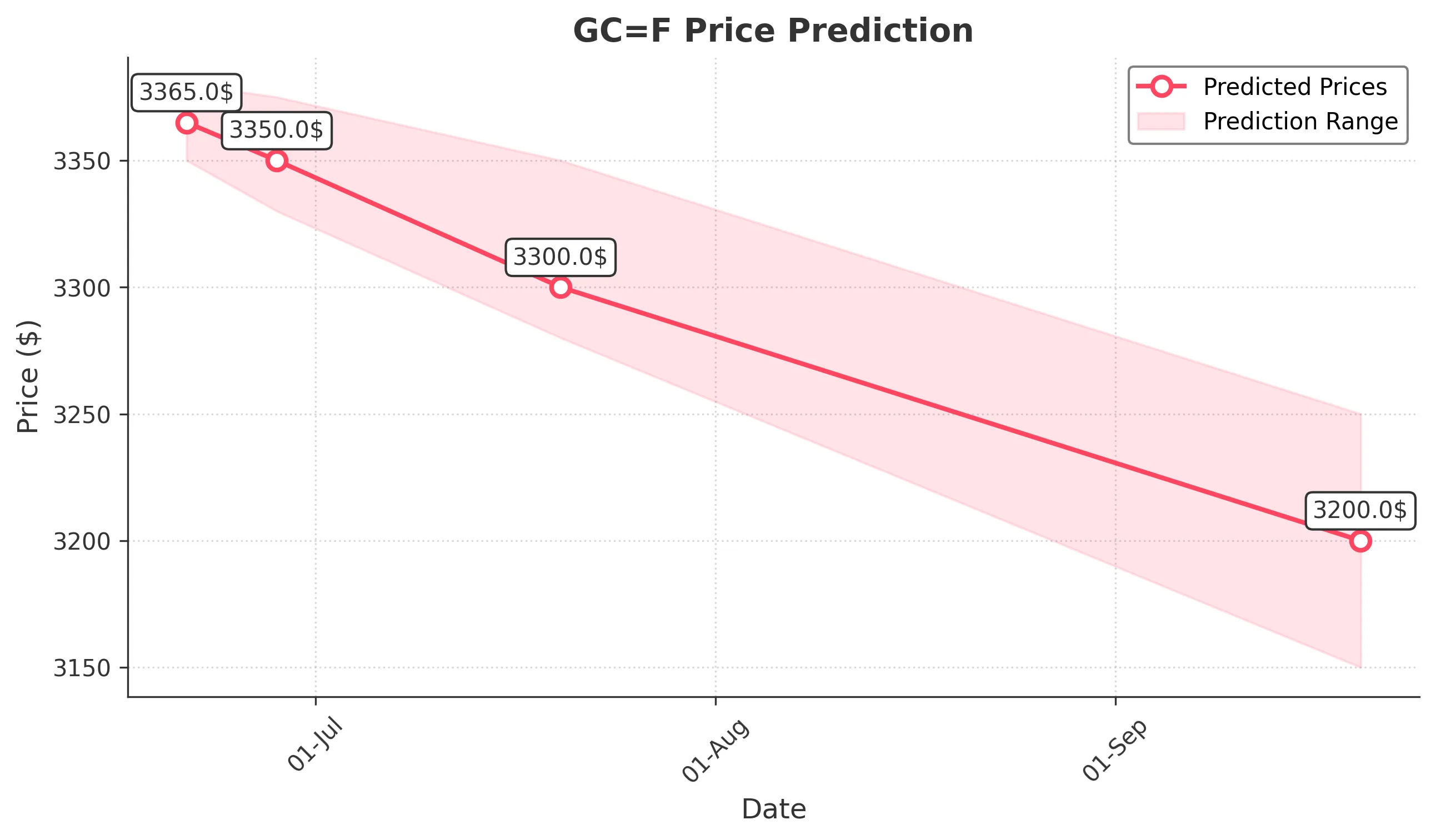

3 Months Prediction

Target: September 20, 2025$3200

$3180

$3250

$3150

Description

A bearish trend is expected to continue, with potential declines towards 3200. The stock's recent performance shows weakness, and external economic pressures may exacerbate this trend.

Analysis

GC=F has been in a downtrend, with key support at 3200. Technical indicators suggest bearish momentum, and volume analysis indicates selling pressure. Macroeconomic conditions and market sentiment will play a significant role in future performance.

Confidence Level

Potential Risks

Market recovery or unexpected bullish news could lead to a reversal.