GOLD Trading Predictions

1 Day Prediction

Target: June 23, 2025$3405

$3400

$3420

$3390

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong support at 3390 suggests a bounce back. Volume is expected to increase slightly.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant upward movements. Key resistance is at 3420, while support is around 3390. The MACD indicates bullish momentum, but the RSI suggests caution as it nears overbought territory.

Confidence Level

Potential Risks

Potential market volatility and external economic factors could impact the prediction.

1 Week Prediction

Target: June 30, 2025$3420

$3405

$3450

$3380

Description

The upward trend is expected to continue, supported by recent bullish candlestick patterns. However, the RSI indicates potential overbought conditions, which may lead to a correction. Volume is likely to remain steady.

Analysis

GC=F has maintained a bullish trend with strong support at 3390. The MACD remains positive, and recent candlestick patterns suggest continued upward movement. However, caution is warranted as the RSI approaches overbought levels.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news, affecting the price direction.

1 Month Prediction

Target: July 30, 2025$3350

$3400

$3400

$3300

Description

A potential correction is anticipated as the stock may face resistance at 3420. The RSI indicates overbought conditions, suggesting a pullback. Volume may increase as traders react to market sentiment.

Analysis

The stock has shown strong performance but is nearing resistance levels. The MACD indicates a potential slowdown in momentum, and the RSI suggests overbought conditions. A pullback to support levels around 3300 is possible.

Confidence Level

Potential Risks

Unforeseen economic events could lead to increased volatility and affect the accuracy of this prediction.

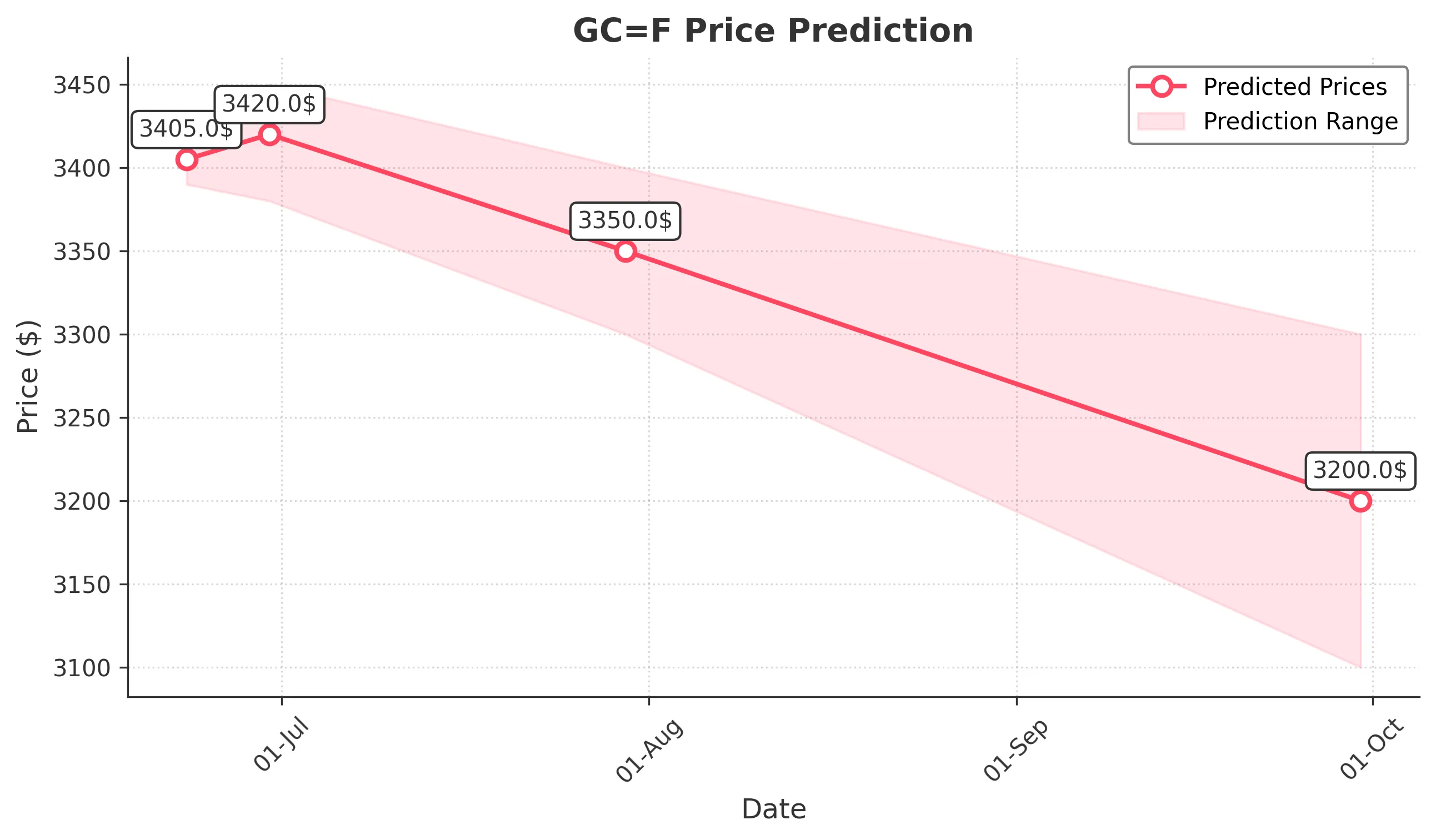

3 Months Prediction

Target: September 30, 2025$3200

$3250

$3300

$3100

Description

Long-term trends suggest a bearish outlook as the stock may face significant resistance. Economic factors and market sentiment could lead to a decline. Volume may increase as traders react to market conditions.

Analysis

GC=F has shown volatility with a recent bullish trend, but signs of a potential reversal are emerging. Key resistance at 3420 and support around 3100 indicate a possible downward trend. The MACD is flattening, and the RSI suggests caution.

Confidence Level

Potential Risks

Market conditions are unpredictable, and external economic factors could significantly impact the stock's performance.