GOLD Trading Predictions

1 Day Prediction

Target: June 26, 2025$3345

$3340

$3360

$3320

Description

The stock shows a slight bullish trend with a recent close above the 50-day moving average. RSI indicates neutrality, while MACD is showing a potential bullish crossover. Expect minor fluctuations due to low volume.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant support at 3300 and resistance around 3400. Recent volume spikes indicate increased interest, but the market sentiment remains cautious due to macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: July 3, 2025$3350

$3345

$3375

$3300

Description

The stock is expected to consolidate around current levels, with potential resistance at 3400. The Bollinger Bands suggest a tightening range, indicating possible volatility. Watch for any news that could sway market sentiment.

Analysis

GC=F has been trading sideways recently, with key support at 3300. Technical indicators show mixed signals, with RSI hovering around neutral. Volume patterns suggest cautious trading, reflecting uncertainty in the broader market.

Confidence Level

Potential Risks

Potential for bearish reversal if market sentiment shifts negatively.

1 Month Prediction

Target: August 3, 2025$3400

$3355

$3450

$3350

Description

Expect a gradual upward trend as the stock approaches resistance at 3400. The MACD indicates bullish momentum, while the RSI suggests room for growth. However, external economic factors could introduce volatility.

Analysis

The stock has shown resilience with a bullish trend over the past month. Key resistance at 3400 is being tested, while support remains strong at 3300. Volume analysis indicates healthy trading activity, but macroeconomic uncertainties loom.

Confidence Level

Potential Risks

Economic data releases could impact market sentiment and price direction.

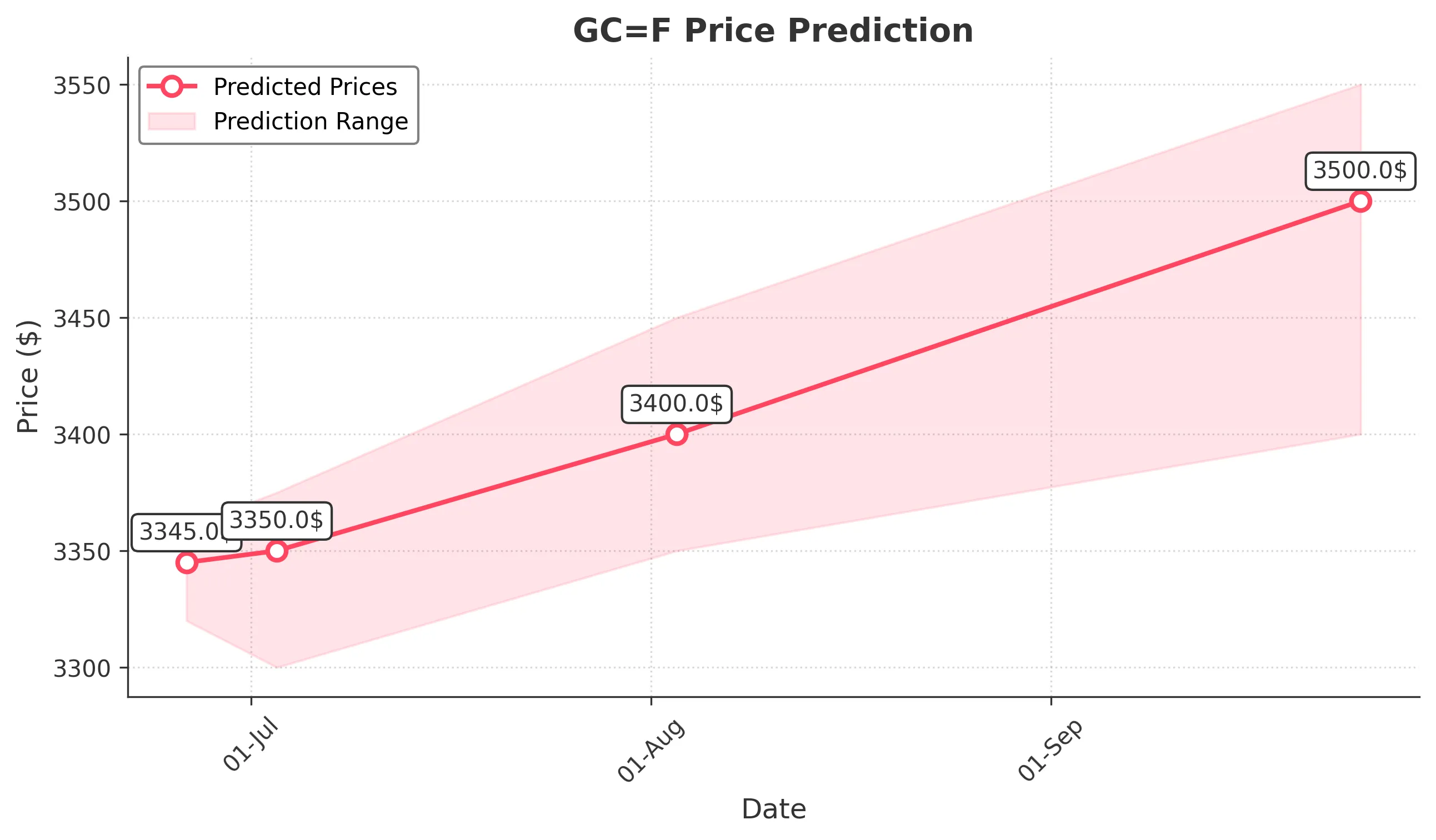

3 Months Prediction

Target: September 25, 2025$3500

$3425

$3550

$3400

Description

Long-term bullish outlook as the stock breaks through resistance levels. Technical indicators support upward momentum, but watch for potential corrections. Market sentiment may shift based on economic developments.

Analysis

GC=F has maintained a bullish trajectory, with significant support at 3400 and resistance at 3500. The overall market sentiment is cautiously optimistic, but external factors could introduce volatility. Technical indicators suggest a continuation of the upward trend.

Confidence Level

Potential Risks

Unforeseen geopolitical events or economic downturns could derail the bullish trend.