GOLD Trading Predictions

1 Day Prediction

Target: June 27, 2025$3355

$3350

$3365

$3340

Description

The stock shows a slight bullish trend with a recent close above the 50-day moving average. RSI indicates overbought conditions, suggesting a potential pullback. However, strong support at 3340 may hold, leading to a modest increase.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant resistance at 3400. Recent volume spikes indicate increased interest, but RSI suggests overbought conditions. Key support at 3340 may provide a buffer against declines.

Confidence Level

Potential Risks

Potential volatility due to market sentiment and external economic factors could impact the prediction.

1 Week Prediction

Target: July 4, 2025$3360

$3355

$3380

$3330

Description

The stock is expected to consolidate around current levels, with potential upward movement limited by resistance at 3400. The MACD shows a bearish crossover, indicating possible downward pressure in the near term.

Analysis

GC=F has been trading in a range with resistance at 3400 and support at 3340. The recent bearish MACD crossover and high RSI levels suggest a potential pullback, but strong support may prevent significant declines.

Confidence Level

Potential Risks

Market volatility and external economic news could lead to unexpected price movements.

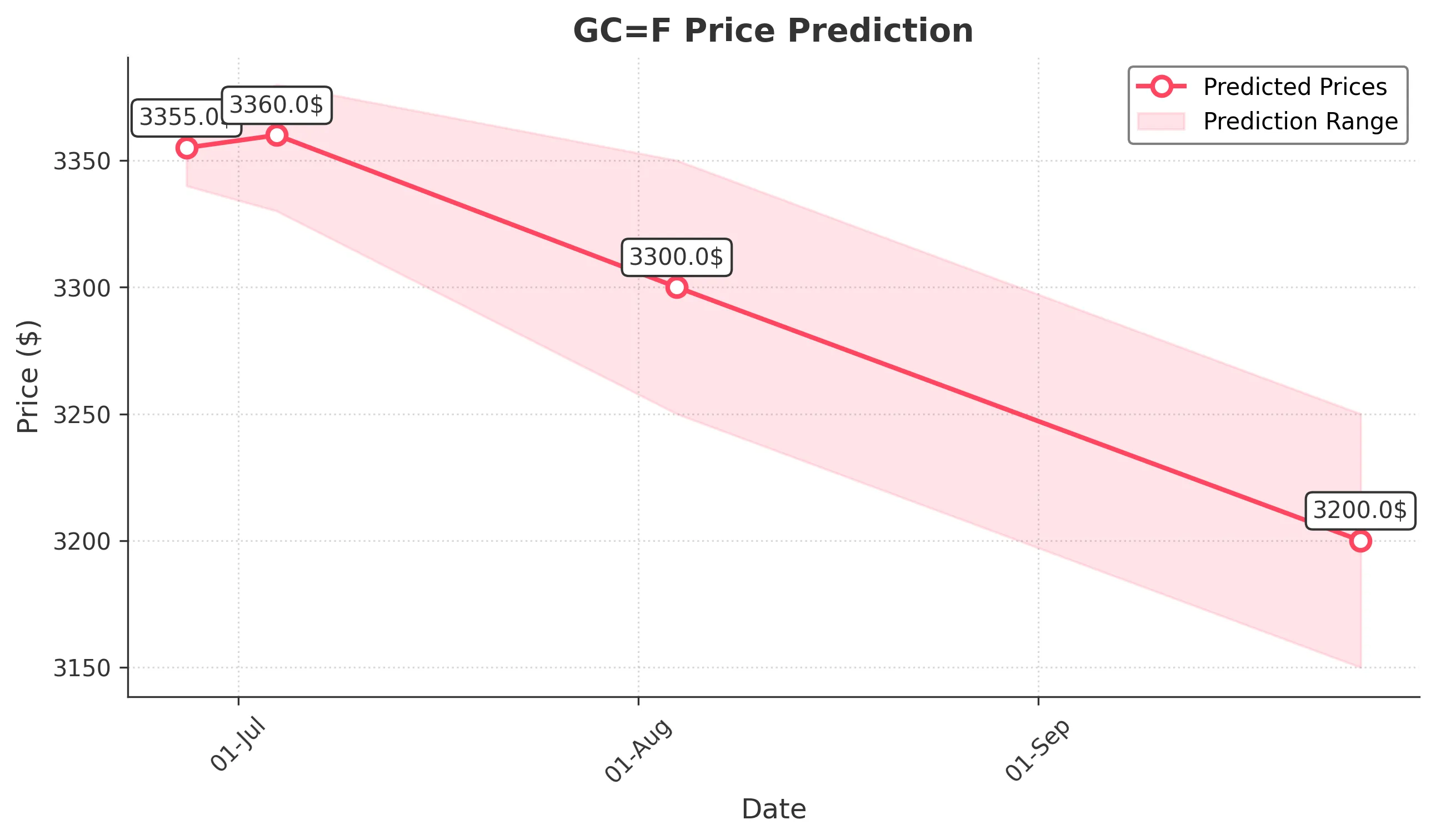

1 Month Prediction

Target: August 4, 2025$3300

$3350

$3350

$3250

Description

A bearish trend is anticipated as the stock approaches key resistance levels. The RSI indicates overbought conditions, and a potential correction could bring prices down towards support at 3250.

Analysis

The stock has shown a bullish trend but is now facing resistance at 3400. The RSI is high, indicating potential overbought conditions. A correction towards 3250 is possible, especially if market sentiment shifts.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or changes in market sentiment could significantly alter the outlook.

3 Months Prediction

Target: September 26, 2025$3200

$3250

$3250

$3150

Description

A bearish outlook is expected as the stock may continue to face selling pressure. The MACD indicates a bearish trend, and if support at 3200 fails, further declines could occur.

Analysis

GC=F has shown signs of weakening momentum with resistance at 3400. The MACD and RSI suggest bearish sentiment, and if support at 3200 is breached, further declines could be expected. Overall, the outlook is cautious.

Confidence Level

Potential Risks

Market volatility and economic indicators could lead to unexpected price movements, impacting the prediction.