GOLD Trading Predictions

1 Day Prediction

Target: June 30, 2025$3310

$3300

$3335

$3290

Description

The market shows a slight bullish trend with a recent upward movement. RSI indicates overbought conditions, suggesting a potential pullback. However, support at 3300 may hold, leading to a close around 3310.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant resistance at 3400. Recent price action indicates a consolidation phase, with support around 3300. Technical indicators like MACD are bullish, but RSI suggests caution.

Confidence Level

Potential Risks

Potential volatility due to external market factors could lead to unexpected price movements.

1 Week Prediction

Target: July 7, 2025$3295

$3300

$3320

$3280

Description

Expect a slight decline as the market may correct after recent highs. The Bollinger Bands indicate potential for a pullback, and volume trends suggest reduced buying interest.

Analysis

The stock has been fluctuating around the 3300 mark, with resistance at 3400. The recent bearish candlestick patterns indicate potential weakness, and volume analysis shows decreasing interest, suggesting a possible downward trend.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to macroeconomic news, impacting the prediction.

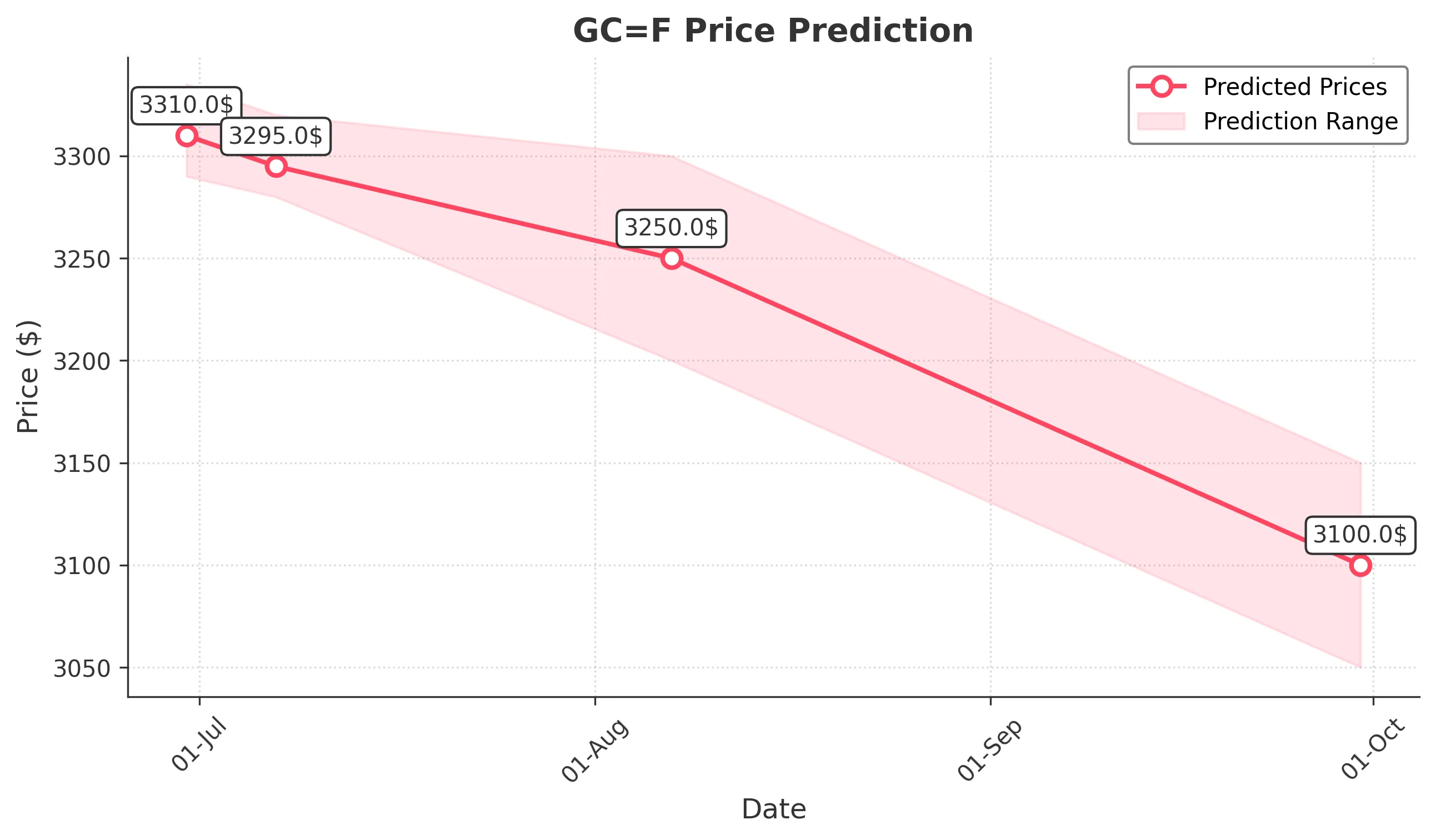

1 Month Prediction

Target: August 7, 2025$3250

$3280

$3300

$3200

Description

A bearish outlook is anticipated as the stock may continue to face selling pressure. Fibonacci retracement levels suggest a target around 3250, with potential support at 3200.

Analysis

The stock has shown signs of weakness, with lower highs and lower lows. Technical indicators like the ATR indicate increasing volatility, and the RSI is approaching oversold territory, suggesting a potential rebound but also risk of further declines.

Confidence Level

Potential Risks

Unforeseen economic events or changes in market sentiment could lead to volatility and affect the accuracy of this prediction.

3 Months Prediction

Target: September 30, 2025$3100

$3120

$3150

$3050

Description

A continued bearish trend is expected as the market may react to broader economic conditions. Support at 3100 is critical, and a break below could lead to further declines.

Analysis

The overall trend has been bearish, with significant resistance at 3200. The stock has been under pressure from macroeconomic factors, and technical indicators suggest a potential continuation of this trend. Volume patterns indicate a lack of strong buying interest.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could significantly impact market conditions, leading to unpredictable price movements.