GOLD Trading Predictions

1 Day Prediction

Target: July 9, 2025$3345

$3340

$3360

$3320

Description

The stock shows a slight bullish trend with a recent upward movement. The RSI is neutral, indicating no overbought conditions. A potential Doji pattern suggests indecision, but overall sentiment remains positive.

Analysis

Over the past 3 months, GC=F has shown a bullish trend with significant resistance around 3400. Recent volume spikes indicate increased interest. However, the stock has also faced corrections, suggesting potential volatility ahead.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: July 16, 2025$3350

$3345

$3375

$3300

Description

The stock is expected to consolidate around current levels. The MACD shows a bearish crossover, indicating potential downward pressure. However, support at 3300 may hold, providing a buffer against declines.

Analysis

GC=F has experienced fluctuations with a recent peak at 3400. The RSI indicates a slight bearish divergence, suggesting potential weakness. Volume patterns show mixed signals, indicating uncertainty in market sentiment.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to sudden price movements.

1 Month Prediction

Target: August 8, 2025$3300

$3350

$3350

$3250

Description

Expect a gradual decline as bearish signals from the MACD and RSI suggest weakening momentum. The stock may test support levels around 3250, with potential for a bounce back if buying interest returns.

Analysis

The past three months show a bullish trend followed by recent corrections. Key support at 3300 is critical, while resistance remains at 3400. Volume analysis indicates a decrease in buying interest, raising concerns about sustainability.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to economic data releases or geopolitical events.

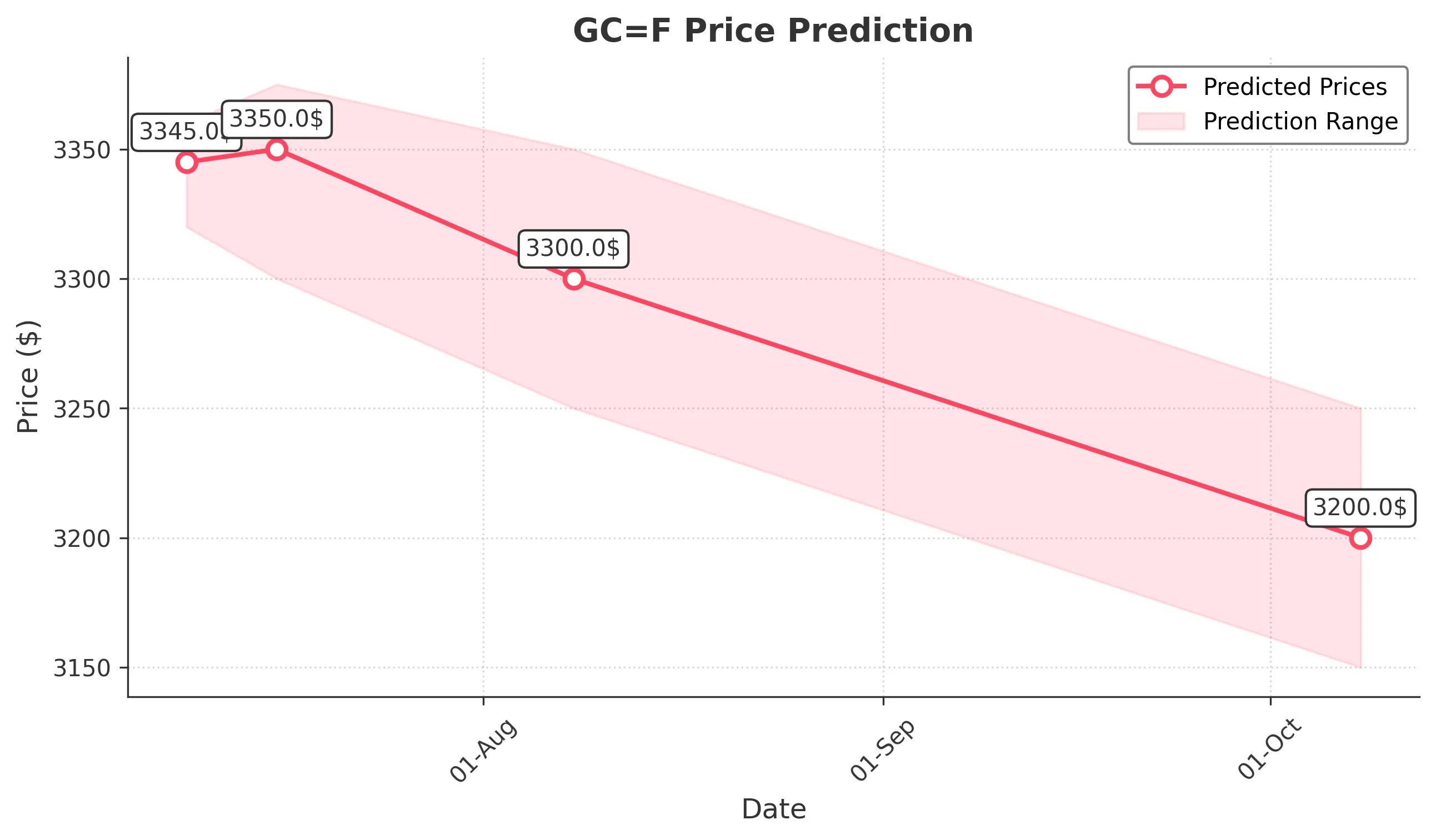

3 Months Prediction

Target: October 8, 2025$3200

$3250

$3250

$3150

Description

A bearish outlook is anticipated as the stock may continue to face selling pressure. The overall trend suggests a potential test of lower support levels, with macroeconomic factors likely influencing market dynamics.

Analysis

GC=F has shown a mix of bullish and bearish signals over the last three months. The stock is currently at a critical juncture, with support around 3200. The overall market sentiment remains cautious, influenced by external economic factors.

Confidence Level

Potential Risks

Economic indicators and market sentiment could lead to unexpected volatility.