GOLD Trading Predictions

1 Day Prediction

Target: July 10, 2025$3305

$3300

$3320

$3290

Description

The stock shows a slight bullish trend with a recent Doji pattern indicating indecision. RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward movement. However, recent volatility may limit gains.

Analysis

Over the past 3 months, GC=F has shown a mix of bullish and bearish trends, with significant resistance around 3400 and support near 3200. The recent price action indicates a consolidation phase, with volume spikes suggesting potential reversals.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or economic data releases, which may impact trading volume and price direction.

1 Week Prediction

Target: July 17, 2025$3310

$3305

$3340

$3280

Description

The stock is expected to remain in a tight range as it approaches resistance levels. The Bollinger Bands are narrowing, indicating reduced volatility. A potential breakout could occur if volume increases significantly.

Analysis

GC=F has been trading sideways with key support at 3200 and resistance at 3400. The RSI is hovering around 50, indicating a lack of momentum. Volume patterns suggest traders are waiting for clearer signals before committing.

Confidence Level

Potential Risks

Unforeseen market events or economic indicators could lead to increased volatility, impacting the predicted range.

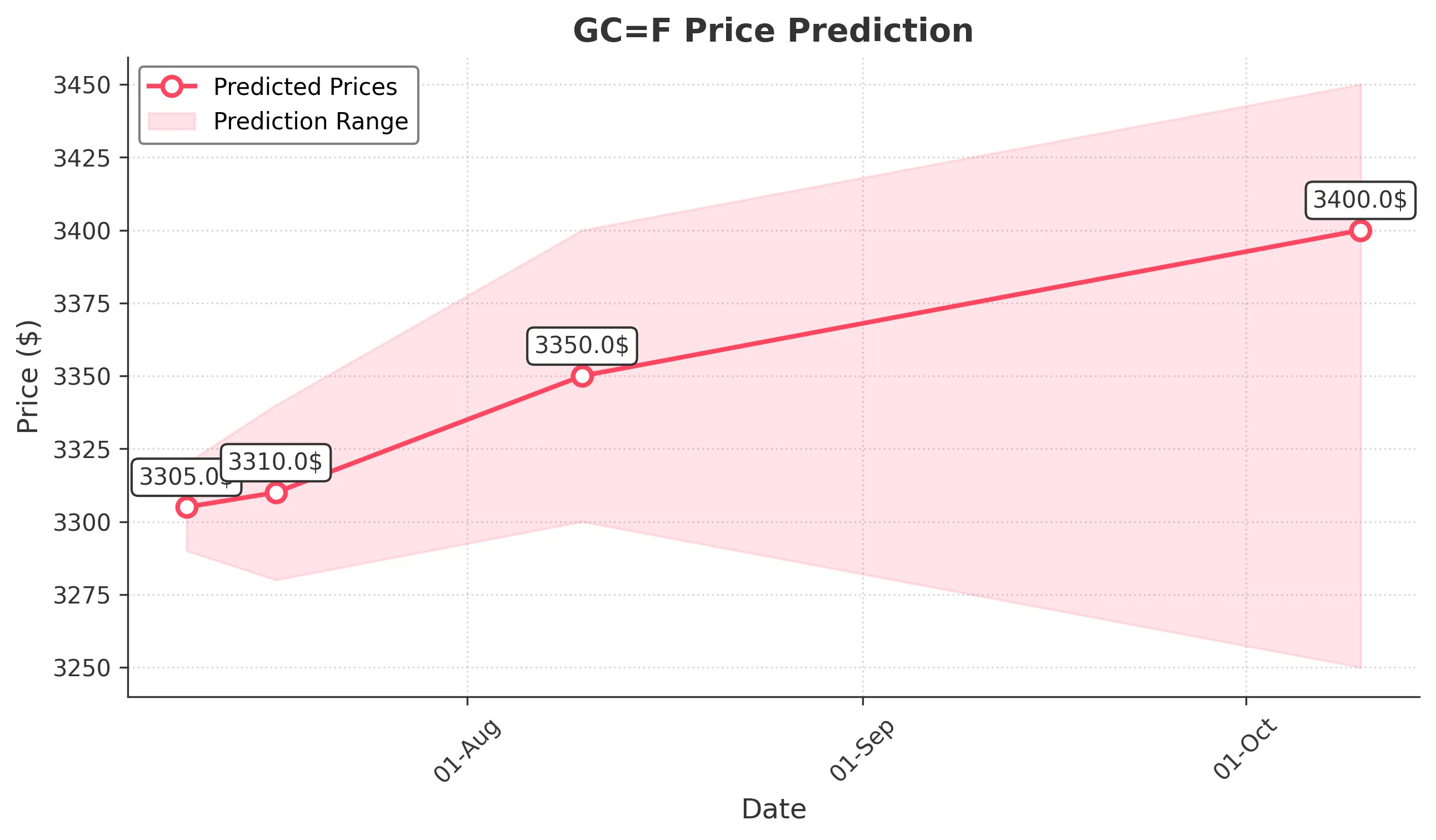

1 Month Prediction

Target: August 10, 2025$3350

$3315

$3400

$3300

Description

A gradual upward trend is anticipated as the stock approaches key Fibonacci retracement levels. The MACD shows bullish divergence, and if momentum builds, we could see a test of the 3400 resistance.

Analysis

The stock has shown resilience with a bullish bias, supported by recent price action. Key levels to watch are 3400 (resistance) and 3200 (support). The overall sentiment remains cautiously optimistic.

Confidence Level

Potential Risks

Economic data releases or geopolitical events could disrupt the upward momentum, leading to potential pullbacks.

3 Months Prediction

Target: October 10, 2025$3400

$3350

$3450

$3250

Description

Longer-term outlook suggests a potential breakout above 3400, driven by bullish market sentiment and improving economic indicators. However, caution is warranted as overbought conditions may lead to corrections.

Analysis

GC=F has been in a bullish phase, with key support at 3200 and resistance at 3400. The overall trend is positive, but external factors could introduce volatility. Monitoring economic indicators will be crucial for future price movements.

Confidence Level

Potential Risks

Market corrections or negative news could lead to significant price fluctuations, impacting the overall trend.