GOLD Trading Predictions

1 Day Prediction

Target: July 11, 2025$3320

$3315

$3340

$3300

Description

The stock shows a slight bearish trend with recent lower highs. RSI indicates overbought conditions, suggesting a potential pullback. Volume has been decreasing, indicating weakening momentum. Expect a close around 3320.

Analysis

Over the past 3 months, GC=F has shown a mix of bullish and bearish trends, with significant resistance around 3400. Recent candlestick patterns indicate indecision, and the MACD is showing signs of a potential bearish crossover. Volume has been inconsistent, suggesting uncertainty.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish sentiment could push prices higher.

1 Week Prediction

Target: July 18, 2025$3305

$3310

$3350

$3280

Description

The stock is expected to stabilize around 3305 as it faces resistance at 3350. The recent bearish momentum may continue, but support at 3280 could hold. Watch for volume spikes that could indicate a reversal.

Analysis

GC=F has been fluctuating with a bearish bias recently. Key support at 3280 is critical, while resistance at 3350 remains strong. Technical indicators suggest a consolidation phase, with the possibility of a breakout or breakdown depending on market sentiment.

Confidence Level

Potential Risks

Potential for unexpected market news or economic data releases could alter the trend significantly.

1 Month Prediction

Target: August 10, 2025$3350

$3325

$3400

$3300

Description

Expect a gradual recovery towards 3350 as the market stabilizes. The RSI may normalize, and if bullish sentiment returns, we could see a test of the 3400 resistance level. Watch for volume increases as a confirmation signal.

Analysis

The stock has shown a bearish trend recently but may find support around 3300. Technical indicators suggest a potential reversal if bullish momentum builds. Volume patterns indicate a cautious market, with traders waiting for clearer signals.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could impact market sentiment and lead to volatility.

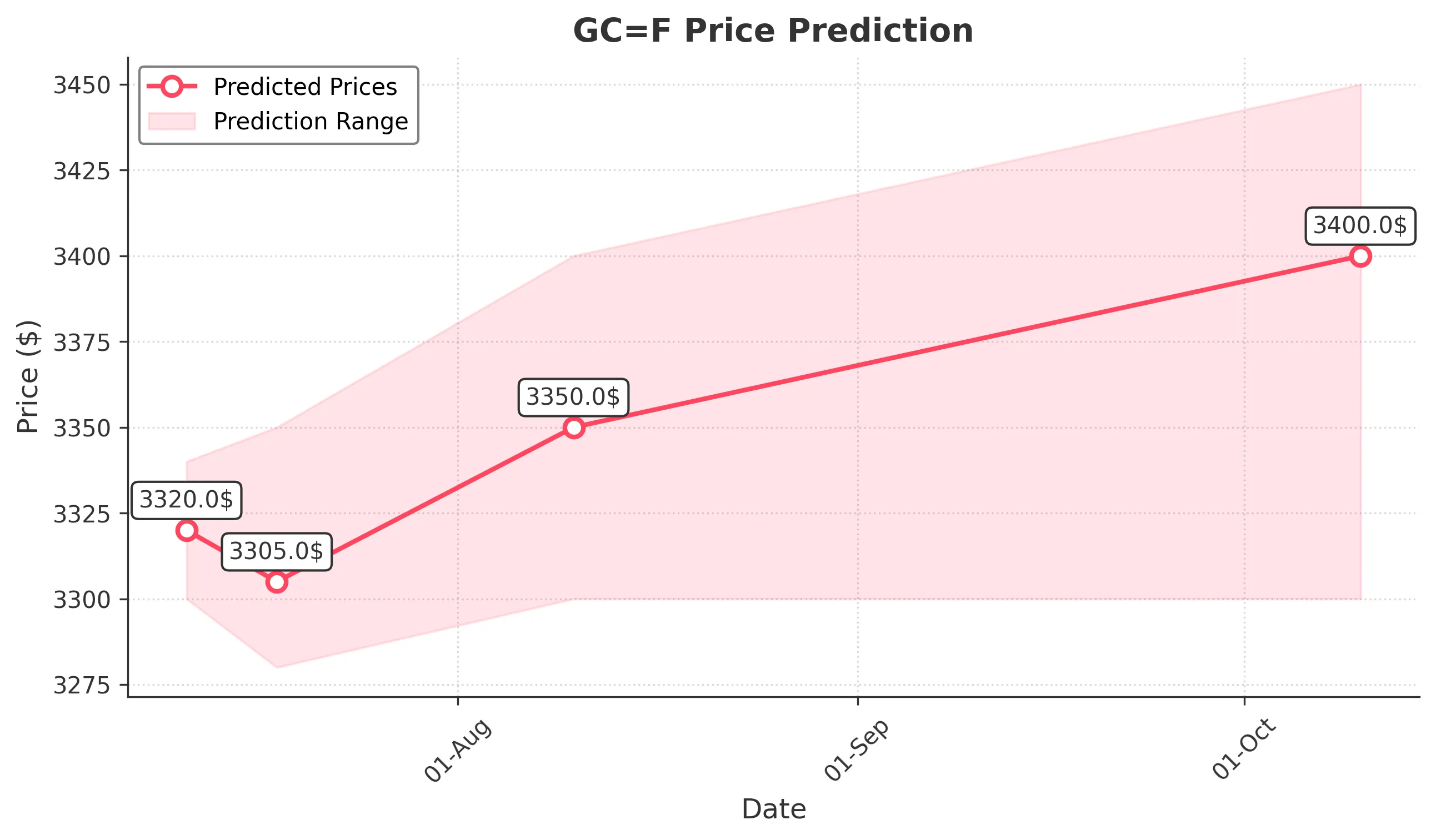

3 Months Prediction

Target: October 10, 2025$3400

$3350

$3450

$3300

Description

In three months, GC=F may reach 3400 if bullish momentum continues. The market could react positively to macroeconomic developments, but resistance at 3450 remains a challenge. Monitor for any shifts in sentiment.

Analysis

GC=F has experienced volatility with a recent bearish trend. Key resistance at 3450 and support at 3300 will be crucial in determining future price movements. Technical indicators suggest a cautious outlook, with potential for recovery if market conditions improve.

Confidence Level

Potential Risks

Long-term predictions are subject to greater uncertainty due to potential market shifts and economic changes.