GOLD Trading Predictions

1 Day Prediction

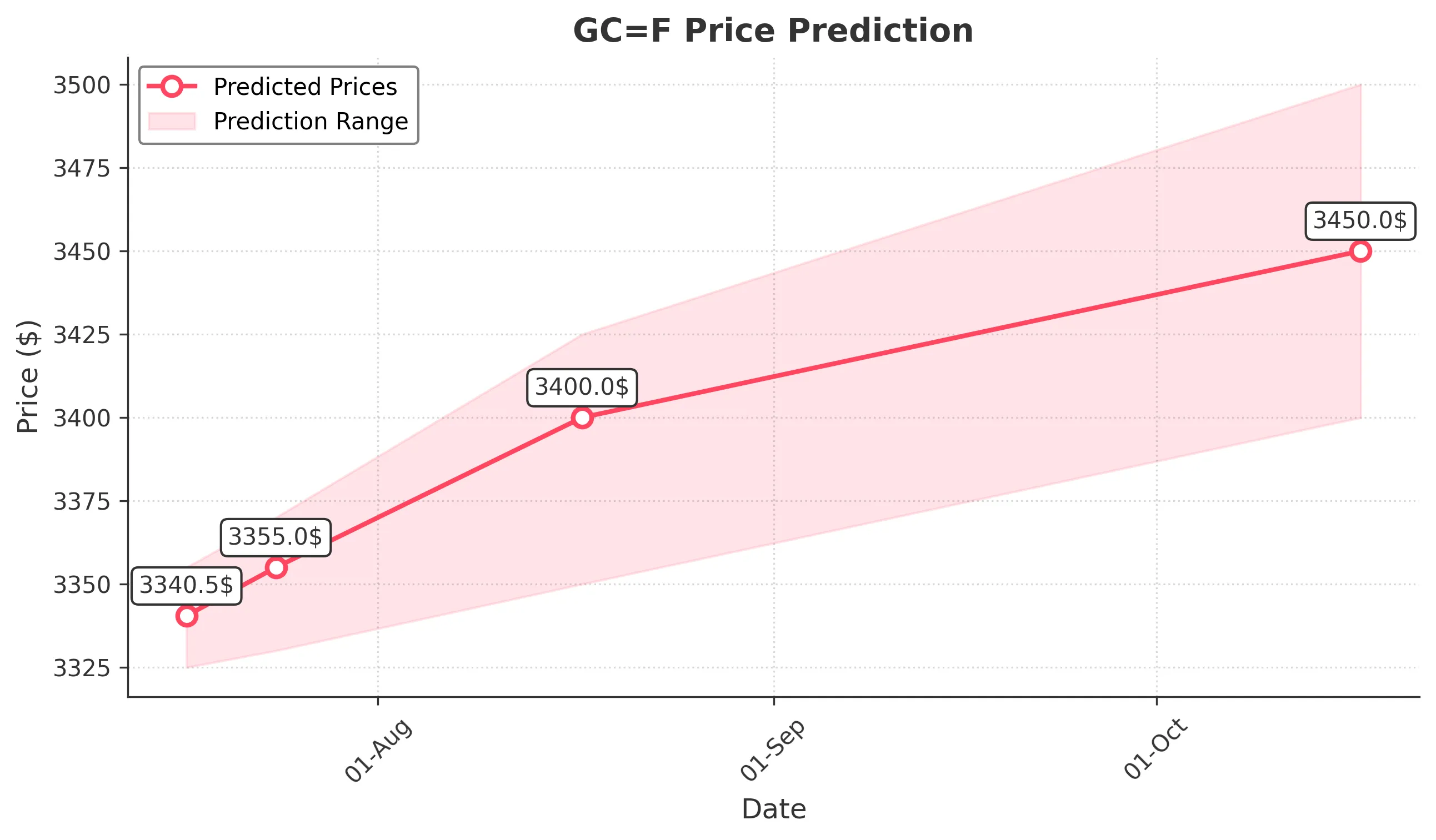

Target: July 17, 2025$3340.5

$3340

$3355

$3325

Description

The stock shows a slight bullish trend with a recent Doji pattern indicating indecision. The RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, volatility remains a concern.

Analysis

Over the past 3 months, GC=F has shown a bearish trend with significant fluctuations. Key support is around 3300, while resistance is near 3400. The RSI indicates neutral conditions, and volume has been inconsistent, suggesting uncertainty in market direction.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or economic data releases, which may impact the prediction.

1 Week Prediction

Target: July 24, 2025$3355

$3350

$3370

$3330

Description

The stock is expected to maintain a bullish trend as the MACD shows signs of a bullish crossover. The recent candlestick patterns suggest a potential reversal. However, the market remains sensitive to macroeconomic factors.

Analysis

GC=F has experienced a mix of bullish and bearish signals. The recent price action indicates a struggle to break above 3400, with support at 3300. The ATR suggests moderate volatility, and trading volume has been low, indicating cautious investor sentiment.

Confidence Level

Potential Risks

Potential market volatility and economic reports could lead to unexpected price movements, affecting the accuracy of this prediction.

1 Month Prediction

Target: August 17, 2025$3400

$3390

$3425

$3350

Description

A bullish outlook is anticipated as the stock approaches key Fibonacci retracement levels. The RSI is expected to trend upwards, indicating increasing buying pressure. However, external economic factors could pose risks.

Analysis

The stock has shown a recovery from recent lows, with a potential bullish reversal pattern forming. Key resistance is at 3400, while support remains at 3300. The volume has been increasing, indicating growing interest, but market conditions remain volatile.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could impact market sentiment and lead to price fluctuations.

3 Months Prediction

Target: October 17, 2025$3450

$3440

$3500

$3400

Description

The stock is projected to continue its upward trend, supported by bullish technical indicators and improving market sentiment. However, potential economic downturns could reverse this trend.

Analysis

GC=F has shown resilience with a gradual upward trend. Key resistance levels are at 3500, while support is at 3400. The MACD indicates bullish momentum, and the RSI is trending positively. However, external economic factors could introduce uncertainty.

Confidence Level

Potential Risks

Unforeseen economic events or changes in market sentiment could lead to volatility and affect the accuracy of this long-term prediction.