GOLD Trading Predictions

1 Day Prediction

Target: July 18, 2025$3350

$3345

$3365

$3330

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is neutral, suggesting potential for upward movement. However, MACD is flattening, indicating possible resistance around 3365.

Analysis

Over the past 3 months, GC=F has shown a bearish trend with significant fluctuations. Key support is around 3300, while resistance is near 3365. Volume has been inconsistent, with spikes indicating potential reversals. Technical indicators suggest caution.

Confidence Level

Potential Risks

Market volatility and external news could impact the price. A bearish reversal is possible if the price fails to break above 3365.

1 Week Prediction

Target: July 25, 2025$3365

$3355

$3380

$3340

Description

The price is expected to rise slightly as the market sentiment improves. The MACD shows a bullish crossover, and the RSI is approaching overbought territory, indicating potential upward momentum. Watch for resistance at 3380.

Analysis

GC=F has been trading in a range with resistance at 3380 and support at 3300. Recent volume spikes suggest increased interest, but the overall trend remains cautious. Technical indicators show mixed signals, warranting close monitoring.

Confidence Level

Potential Risks

If market sentiment shifts negatively due to macroeconomic factors, the price could reverse. A failure to maintain above 3350 could lead to a bearish trend.

1 Month Prediction

Target: August 18, 2025$3400

$3365

$3425

$3350

Description

A gradual upward trend is anticipated as bullish sentiment builds. The 50-day moving average is trending upwards, and the RSI indicates a potential breakout. However, watch for resistance at 3425.

Analysis

The stock has shown resilience with a potential bullish reversal pattern forming. Key support at 3300 remains intact, while resistance at 3425 could pose challenges. Volume trends indicate cautious optimism.

Confidence Level

Potential Risks

Economic data releases or geopolitical events could disrupt this trend. A significant drop below 3350 would invalidate the bullish outlook.

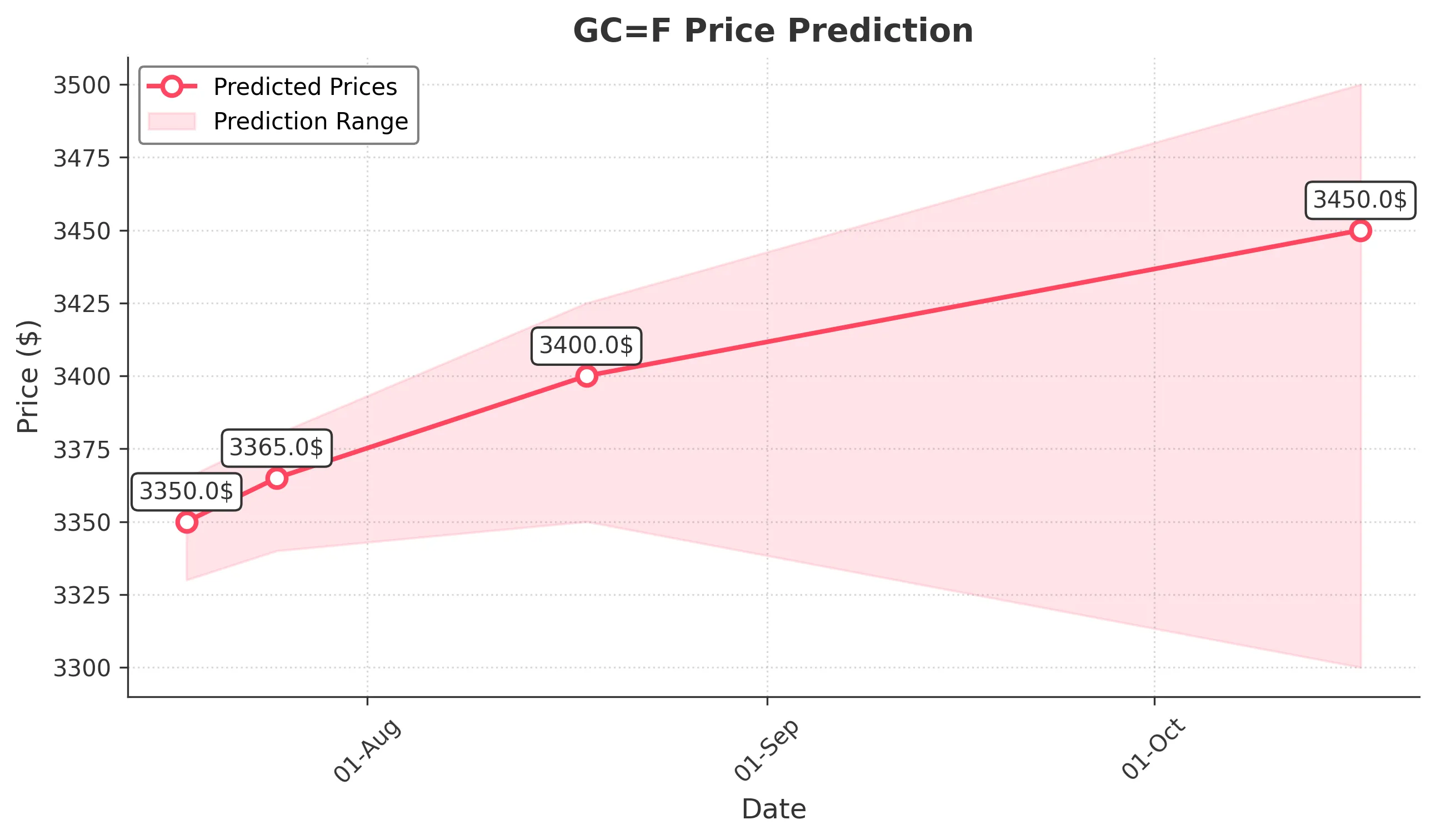

3 Months Prediction

Target: October 17, 2025$3450

$3400

$3500

$3300

Description

Long-term bullish sentiment is expected as the market stabilizes. The MACD indicates a strong bullish trend, and Fibonacci retracement levels suggest potential for growth towards 3500.

Analysis

GC=F has shown a mixed performance with a potential bullish trend forming. Key resistance levels are at 3500, while support remains at 3300. The overall market sentiment is cautiously optimistic, but external factors could influence outcomes.

Confidence Level

Potential Risks

Long-term predictions are subject to macroeconomic changes and market sentiment shifts. A downturn in economic indicators could lead to a significant price drop.