GOLD Trading Predictions

1 Day Prediction

Target: July 19, 2025$3345

$3340

$3355

$3330

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, recent volatility may limit gains.

Analysis

Over the past 3 months, GC=F has shown a bearish trend with significant fluctuations. Key support at 3300 and resistance at 3400. Volume spikes on certain days indicate potential reversals. Technical indicators suggest mixed signals, with RSI hovering around neutral levels.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or economic data releases, impacting the prediction.

1 Week Prediction

Target: July 26, 2025$3350

$3345

$3365

$3320

Description

The stock is expected to stabilize around current levels, with potential for slight upward movement. The MACD indicates a bullish crossover, but the RSI suggests overbought conditions. Watch for volume trends to confirm direction.

Analysis

GC=F has been trading in a range with resistance at 3400 and support at 3300. The recent price action shows a consolidation phase. Technical indicators are mixed, with some bullish signals but also signs of exhaustion in upward momentum.

Confidence Level

Potential Risks

Potential for market corrections or negative news could lead to unexpected price movements.

1 Month Prediction

Target: August 19, 2025$3300

$3350

$3350

$3250

Description

Expect a pullback as the stock faces resistance at 3350. The RSI indicates potential overbought conditions, and recent bearish candlestick patterns suggest a correction may be imminent. Volume trends will be crucial to watch.

Analysis

The stock has shown volatility with a bearish bias recently. Key support at 3250 is critical. Technical indicators suggest a potential downturn, with the MACD showing bearish divergence. Volume patterns indicate uncertainty in market direction.

Confidence Level

Potential Risks

Economic indicators or geopolitical events could significantly impact market sentiment and stock performance.

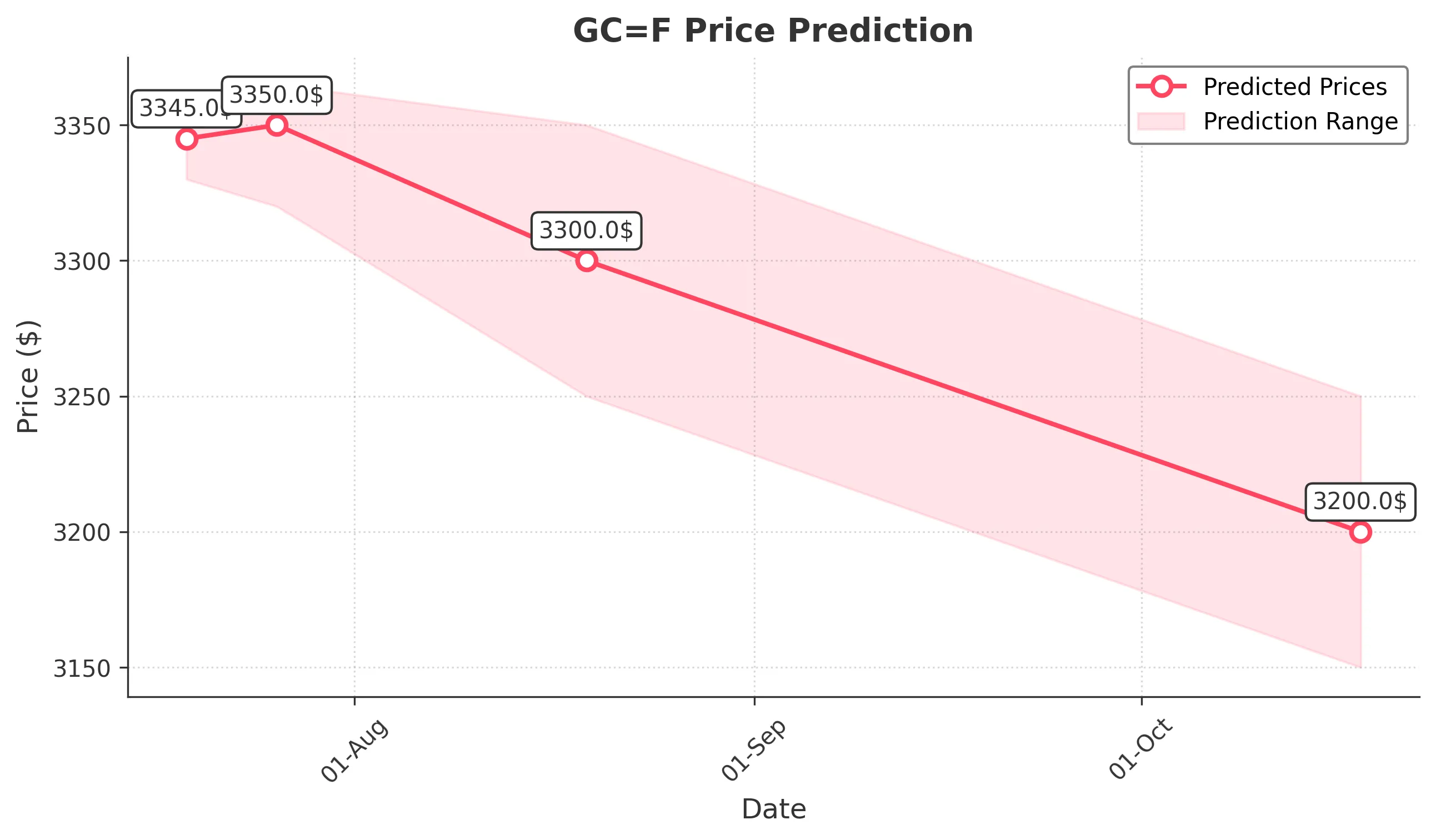

3 Months Prediction

Target: October 18, 2025$3200

$3250

$3250

$3150

Description

Longer-term outlook suggests continued bearish pressure, with potential for further declines. The stock may test lower support levels around 3150. Economic conditions and market sentiment will play a significant role in price action.

Analysis

GC=F has been in a bearish trend with significant resistance at 3350. The overall market sentiment is cautious, and technical indicators suggest a potential continuation of the downtrend. Volume analysis shows decreasing interest, indicating a lack of buying support.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or changes in market sentiment could lead to volatility and impact the accuracy of this prediction.